Are you in the market for a new car? Many people need to look at trading in their current vehicle or purchasing a new one, but they don’t have that kind of cash lying around. This is why it is so important to know what lenders like the AAA auto loan review have to offer.

AAA auto loans can be used on most makers and models of new and used cars, but cars older than ten years must be reviewed manually. They offer the option to add a co-borrower, flexible repayment terms up to 84 months, no prepayment penalties, and competitive interest rates.

Shopping around for a new auto loan is important so that you can ensure you get the best deal. Here are a few places you can start shopping.

AAA Auto Loan Review: What Kind of Loans Do They Issue?

AAA offers loans through their Auto Club Trust, FSB, a federally chartered and FDIC insured bank that is owned entirely by The Auto Club Group. They offer loans in almost every state, but they may not offer loans for every vehicle. Understanding the types of loans that they are likely to issue can be important before you get too far in the car-buying process.

Most makes and models are going to be eligible for financing. You can choose between new and used cars, small trucks, SUVs, and even minivans. For most newer vehicles, receiving information on loan status is relatively quick.

Older cars may take a bit longer to process your information. Used cars that are over ten years old from the current model year must be reviewed manually before approval can be issued.

AAA only offers loans on personal vehicles and does not provide financing for commercial cars. You must purchase your car from a licensed dealership or refinance it from another financial institution. They do not offer loans for private party sales, auctions, or brokers.

You must also borrow at least their minimum loan amount of $5,000.

(check more flexible loans below)

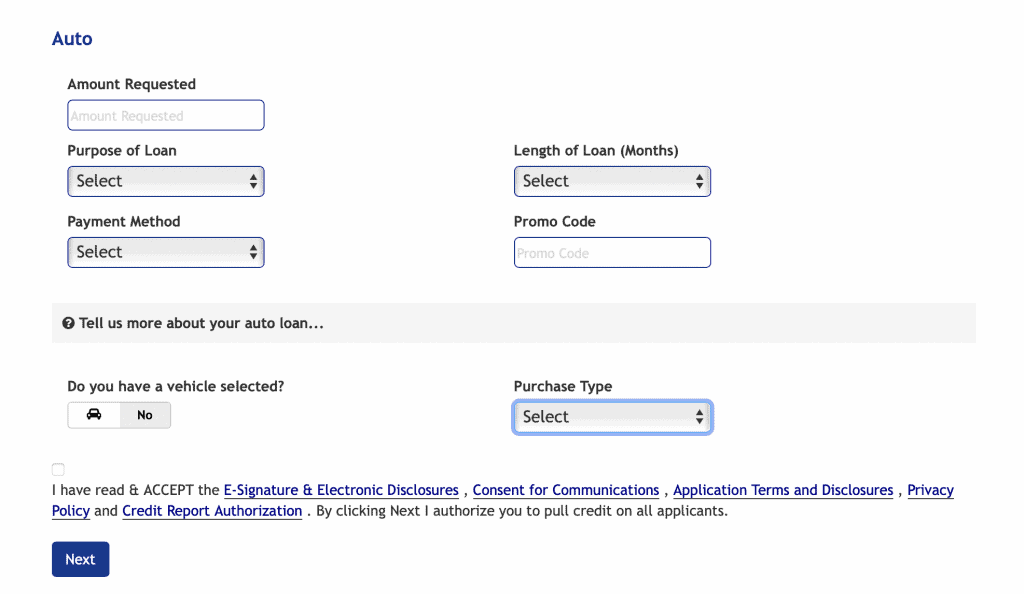

AAA Loan Application

Whether you are interested in financing a new car purchase or refinancing your existing vehicle, you should know about the AAA loan application. Every application is good for thirty days before it expires. This should give you plenty of time to shop around for the best deal on a new vehicle.

The loan application is relatively straightforward. You will start by filling in the details of the auto loan that you are interested in, including:

- Amount of financing requested

- Purpose of the loan (purchase or refinance)

- Payment method (monthly or autopay)

- Length of auto loan, up to 84 months

- Purchase type (new or used)

Once you have filled in the details about your pending purchase, you will have to fill out all of your personal information. This includes all of the information you might expect like social security number and contact information.

You will also be asked to fill out information related to your monthly income. They want to know the name of your employer, how long you have worked there, and the contact information.

If you have any other sources of income such as child support or alimony, there is also a section where you can add these details for the income to be considered in your application.

This is really the end of the AAA loan application. It will take you to a screen where you can review the details and then submit it for consideration. Decisions are usually available on the same business day. You will be notified via email when your loan application has been reviewed.

Benefits of AAA Auto Loan Review

There are a few benefits that should be mentioned when considering a AAA loan review. Before you make any decisions regarding financing, there are a few important details you should know.

The first thing is that you can add a co-borrower to your loan if you choose. This can be great if you have bad credit and have someone who is willing to co-sign on the loan with you so that you can qualify. Alternatively, you might need to add their income to qualify for the car of your dreams.

Another benefit that many people enjoy is the flexible repayment terms. You can borrow money for as few as twelve months or as long as seven years.

You can pay off your loan at any time with no prepayment penalties. If you opt for the longer 84-month loan term, paying the loan off early could save you hundreds or thousands of dollars in interest.

When you utilize their auto loans, they promise competitive rates and no car payments for the first ninety days. Loan rates start as low as 2.19 percent APR.

If you aren’t sure whether you can afford a new car, you can estimate your monthly payments before you get too far into the loan process. They have an auto loan calculator right on their homepage. While it may not be exact, it can give you a good idea of the cost for your new or new-to-you vehicle.

Pros:

Disadvantages to AAA Loan Review

While AAA does have some great benefits to consider, not everything about these loans is great. There is one distinct disadvantage that everyone with poor credit may want to consider.

AAA does not advertise a minimum required credit score to qualify for a loan, but they do check your credit.

According to their auto loan calculator, they offer financing to those with great, average, and fair credit. Most financial experts say that the minimum credit score required to be considered fair credit is 580. Anything lower than this score may not qualify according to AAA standards.

Cons:

Alternatives to AAA Auto Loans

If you do not think you will qualify for a AAA auto loan, then you might want to consider some of the alternatives. These three sites might be able to help you find a loan that better meets your needs and credit history.

PersonalLoans.com

PersonalLoans.com can connect you with a network of lenders who can issue loans as high as $35,000. All you have to do is fill out a simple online loan request form with information like how much you want to borrow, your credit type, and the reason for your loan.

The information it contains will be shared with lenders in their personal network, as well as other third-party lender networks to give you the best possible chance to qualify for a loan. If they feel that you might qualify, you will be invited to fill out a second application on their website.

If you qualify, the lender will send you a loan agreement for you to review. You can sign it online and they will send the funds to your bank account. Most funds are received in one to five business days so you can get a move on buying your new car quickly.

Personal Loans offers flexible repayment plans as well. Your lender may offer you anywhere from 90 days to 72 months to repay what you borrow. However, interest rates may be higher here than they would be with AAA. Many borrowers have interest rates ranging from 5.99 to 35.99 percent APR.

Pros:

Cons:

BadCreditLoans.com

BadCreditLoans.com is another option that allows you to purchase a car wherever you want. Unlike AAA auto loans, you can use these personal loans to purchase through private party sellers or auctions. Wherever you find the car of your dreams, these loans can help.

You can borrow between $500 and $10,000 for your new car.

Much like PersonalLoans.com, Bad Credit Loans will connect you with their network of lenders. They specialize in helping people with less-than-perfect credit receive the financing they need. However, you should know that you may face higher interest rates and less favorable terms if you have bad credit.

Everything can be handled digitally from the application to the receiving of funds. Money should be available as soon as the next business day.

Repayment terms will vary based on the lender and the specifics of what you qualified for. These installment loans can be paid back over time though.

Similar to CashUSA, they may present you with advertisements for credit repair services, debt relief, and other credit-related products if you do not qualify for a loan. They will not share your sensitive information with these services. Instead, they give them just your contact information so that they can reach out and follow up with you.

Pros:

Cons:

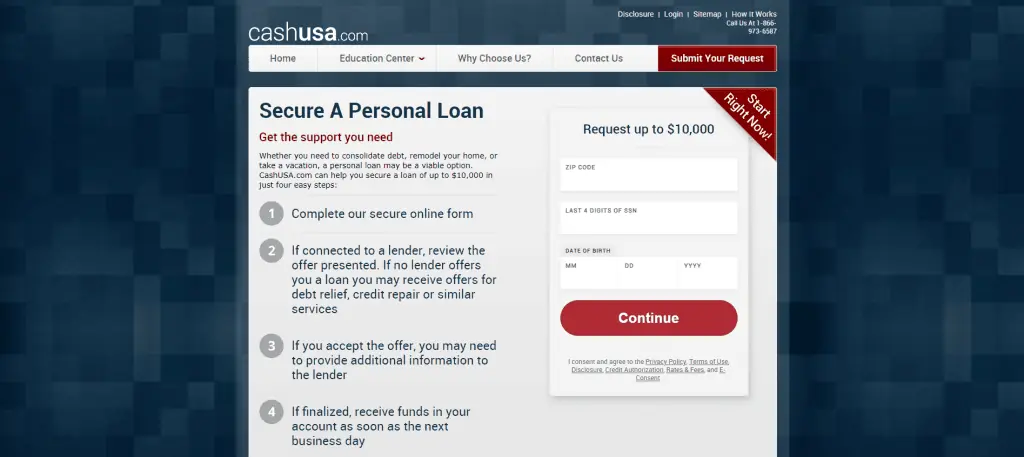

CashUSA.com

CashUSA.com makes it easier than ever before to connect with a lender and secure a loan up to $10,000. It all starts with a simple and secure online form that will send your information out to available lenders.

If you are connected to a lender, they will present you with an offer that you can choose to accept or refuse. The lender may require some additional information from you at this point. Once you submit everything you need and accept the offer, they will begin finalizing everything.

Funds can be received as soon as the next business day. Make sure to have your banking account information handy before starting the process to make everything go smoothly and quickly.

In order to qualify for a loan, here are the basic eligibility requirements:

- Must be 18 years old

- Must be a United States citizen or permanent resident

- Earn at least $1,000 per month after taxes

- Have a valid checking account in your name

- Have valid contact information including email and phone number

Sometimes, you may find that you still did not qualify for a loan. In this case, they will offer to connect you with other services that may help. These can include offers for debt relief, credit repair, and more.

Pros:

Cons:

AAA Auto Loan Review: Is it Worth It?

AAA offers a lot of benefits for those individuals who have credit scores high enough to qualify. You can benefit from competitively low interest rates, flexible repayment terms, and no prepayment penalties.

However, there are a lot of other options out there if this AAA auto loan review isn’t for you. Find a quality program that suits your needs and apply today to get your funds as soon as possible!