The Platinum Card from American Express is one of the premium cards offered by American Express. The card is a rewards credit card parked with excellent benefits, maximum rewards, and best offers for cardholders. The Amex Platinum Card is best suited for cardholders who frequently travel since most rewards and benefits are related to travel.

For example, the cardholder will obtain more Membership Rewards points for purchases made towards those who travel frequently over other purchases. Thus, the cardholder will enjoy amazing travel rewards, including statement credits for eligible purchases made through the Platinum Card.

The Amex Platinum Card is a premium, high-value reserved for those who can afford it. First, the Platinum Card carries a $695 annual fee which is quite steep and unaffordable for many. Also, the card requires cardholders to have a good to excellent credit score, starting at 690 to 850 during card application.

A good or excellent credit score will give the card applicant a better chance of having a successful application. However, American Express will require the cardholder to have more requirements to have a better chance of acquiring the Platinum Card.

Key Takeaways

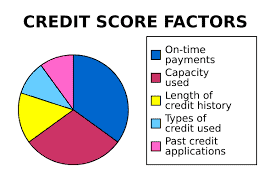

· There are about five credit score factors that make up an applicant’s credit score, necessary for a successful application

· The cardholder must have a credit score of above 700 to qualify for a successful credit card application

· American Express looks into more requirements, such as the applicant’s income during an application for the Platinum Card

Amex Platinum Card Benefits

The Platinum Card from American Express is one of the most luxurious cards, offering the best benefits in the market. The $695 annual fee is one of the highest among all credit cards, mainly maintaining the card’s exclusivity. The annual fee applies to the Amex Platinum Card and the Amex Business Platinum Card.

Amex Platinum cardholders must spend money to acquire the card’s many benefits and rewards. The more the cardholder spends, the more Membership Rewards points they earn, which are redeemed or transferred for more benefits during travel.

Aside from the zero foreign transaction fees, some of the extensive benefits offered by the card include the following:

· Cardholders earn 80,000 Membership Rewards points as a welcome bonus after spending $6,000 within six months of card membership. The once-in-a-lifetime welcome bonus is worth $800 when redeemed at a value of one cent per point after meeting the pre-set requirements. You can redeem the points for several benefits, including an airline ticket upgrade during flights.

· Cardholders will earn 5X Membership Rewards points for booking flights and prepaid hotels directly or through Amex Travel. Other eligible purchases made using the card will earn the cardholder one point per dollar spent.

· Cardholders receive a $200 statement credit for prepaid Fine Hotels Resorts or prepaid hotels booked through The Hotel Collection. A $100 statement credit is also given exclusively to cardholders of the Platinum Card for The Hotel Collection bookings. A minimum two-night stay is required for the cardholder to receive the statement credits and a room upgrade as a welcome gift.

· Cardholders will receive gold elite status for the Hilton and Marriott Hotels, with prior enrollment required to enjoy the benefit. Cardholders do not require a co-branded card to obtain elite status, although they must meet pre-set conditions with prior enrollment required.

· Cardholders receive annual statement credits worth $200 as an airline fee credit that includes incidental fees such as baggage fees. However, the airline fee credit is only available for one qualifying airline chosen by the cardholder every calendar year.

· The cardholder enjoys unlimited complimentary access to over 1300 airport lounges worldwide. The American Express Global Lounge Collection allows cardholders to have airport lounge access to exclusive lounges globally. For example, the cardholder has complimentary entry to the Centurion Lounge Network and Studio locations worldwide.

· Cardholders will receive complimentary insurance, including trip delay coverage, rental car insurance, baggage protection, and trip cancellation and interruption insurance. The New Hampshire Insurance Company underwrites the travel insurance plan, which oversees claims and reimbursements.

· Cardholders will receive statement credits for using airport security programs such as CLEAR, Global Entry, or TSA PreCheck.

· Cardholders can choose their preferred metal card design, which includes classic Platinum, Platinum x Kehinde Wiley, and Platinum x Julie Mehretu.

· Cardholders will also earn a $300 statement credit for eligible Equinox Club memberships, one of the most exclusive fitness clubs. Also, the statement credit covers membership for the fitness app, Equinox+, although there is prior enrollment required.

· The cardholder receives annual statement credits worth $200 for Uber Cash available to a Basic Card Member paying through their Platinum Card account. The cardholder receives automatic Uber VIP status, and the statement credit is divided into $20 monthly and up to $35 in December.

· The cardholder will receive a statement credit worth $155 for Walmart+, including the $12.59 monthly fee and applicable local sales tax. Walmart is a partnered retailer that accepts gift card redemption for Membership Rewards points, usually at 0.7 cents per dollar.

· The cardholder will receive a $100 statement credit for online or in-store purchases for Saks Fifth Avenue every calendar year. The statement is divided into $50 from January to June and another $50 from July to December.

· Cardholders will also receive a $240 annual statement credit for digital entertainment on select subscription services. Thus, cardholders will receive $20 monthly for streaming services such as Hulu, the Disney bundle, New York Times, and ESPN+.

Credit Score Factors

A credit score is a number starting at 300 to 850 used to calculate an individual’s credit behavior and creditworthiness. Credit issuers like banks or credit unions will look at your credit score to determine if you deserve credit. The higher the individual’s credit score, the better their chances of receiving credit. The total credit score is calculated based on the amount you owe, the amount of credit you have left, and the number of credit accounts.

Although you cannot calculate the credit score independently, you can monitor how well your score is doing across financial platforms.

Several factors make up an individual’s credit score, including their payment history. They are divided into how much they make up the credit score, depending on how they impact it. These factors will greatly influence your credit score to your credit behavior in different types of credit.

Since the Amex Platinum Card is not easy to obtain, the application process is very intense. Thus, American Express is at liberty to obtain all the necessary information regarding your credit score to qualify for the card.

The credit score factors remain the same whether applying for an Amex Platinum Card or an Amex Business Platinum Card. The following include the credit score factors that make up an individual’s credit score during credit card evaluation:

Payment History

Your payment history is typically your payment behavior and whether you have been paying your credit balance on time. The scoring model will ask about payment patterns during your credit score calculation. The scoring model will use the information found on your credit report to gauge how well or how late you have been paying the debt. A credit report consists of all open credit accounts, your credit mix, and information relating to your credit from other lenders.

Thus, even if you are applying for an American Express Platinum Card, American Express will consider other types of loans.

The payment history carries the highest percentage that makes up the credit score factors, standing at 35%. Therefore, an applicant’s payment history will take more time to build and improve. For example, a single late payment will hurt your credit score, but if you make more on-time payments, you will improve your credit score. Consecutive or multiple late payments will cause much damage to your credit score since your credit report shows a negative payment history.

Also, issues like bankruptcy, foreclosure, and repossession will greatly damage the individual’s credit score.

The American Express Platinum Card does not work like the traditional credit card since it was rolled out as a charge card. Therefore, the cardholder must pay the credit balance monthly to avoid penalties or reporting to the major credit bureaus. Thus, applicants should prove they can pay the balance on time through their credit report and credit score.

The application process will be longer than the application for other competing cards due to the many background checks conducted by American Express. The payment history will greatly affect the chances of an applicant applying for an Amex Platinum Card.

Credit Utilization

Credit utilization carries the second highest percentage of your credit score, carrying 30% of your total score. Credit utilization basically means how much credit you have used from your credit limit as provided by your credit card issuer. Many think maxing out your credit card will improve your credit score by fully utilizing your credit limit.

However, using a certain percentage of your credit limit will be best to improve your credit score. The best percentage to use for your credit limit is 30% or less for the overall health of your credit score.

The American Express Platinum Card is considered to work as a charge card without any pre-set spending limit. However, there is a spending limit based on the categories in which the cardholder spends more often. Therefore, the spending limit set on the category will be used to determine the cardholder’s credit utilization.

Also, other credit card accounts and pending loans will be considered to determine credit utilization. Avoid leaving balances on your credit card even as you lower your credit utilization for a better credit score.

The Average Age of Accounts

The average age of accounts is the aggregate of the total number of open credit accounts, which determines 15% of the total credit score. Already, the three main factors take up 80% of the total credit score since they are considered the main factors. The average age of accounts will determine how long you have had your credit accounts open.

The credit card issuer will check all your credit accounts through your credit report. The average age of accounts is calculated by adding all months in which your accounts were open and dividing them by the account open.

The longer the applicant has their credit accounts open, the better the chance of receiving an American Express Platinum Card. Thus, a higher average age of accounts shows that the applicant has a long experience with credit. However, the applicant’s credit report should have a positive trend for better chances of receiving the Amex Platinum Card.

If the cardholder is applying for an Amex Business Platinum Card, then other forms of credit will also be considered during the application.

New Credit

The new credit factor takes up 10% of the total factors influencing an individual’s credit score. New credit simply means the number of new credit accounts you have recently opened that impact your credit score. Opening new accounts frequently will lower the average age of your accounts, meaning you will be seen as an unreliable client.

Many new credit accounts will show your credit issuer that you cannot keep up with your credit payments.

When you take new credit, your lender will conduct a credit check, resulting in a hard inquiry. Hard inquiries will take a hit on your credit score, especially when you open too many recent accounts. Soft inquiries will not affect your overall score since they work as a self-check method to determine if you qualify for credit.

Only open new credit accounts when it is necessary and when you are sure you can have a successful application instead of rejection. Alternatively, ask another reliable individual to help lengthen your average age of accounts instead of taking new credit.

Credit Mix

Credit mix is the different types of credit accounts that make up your credit report, including mortgages, student loans, and car loans. A credit mix makes up 10% of your credit score, showing other forms of credit you can access. Your credit report will be diverse as you have different types of loans, showing your lenders you can handle your loans properly.

However, you must ensure that your credit report and credit history remain positive. Otherwise, the lender will notice that you cannot keep up with the payments from your different lenders in your different loans.

Having another credit card from American Express will increase your chances of successfully applying for the Platinum Card. That way, American Express will see that you are a reliable client and will highly consider your Platinum Card application. Alternatively, open a credit-builder account that allows you to build credit without a prior credit history.

However, credit builder loans are expensive, and their interests are quite high compared to other forms of loans.

How to Check Your Credit Score

The major credit bureaus usually generate credit reports but do not show your credit score. Also, you may have different credit scores, especially when applying for different types of loans. For example, if you check your credit score online, it may be different from the one checked by your credit issuer. Just because they are different does not mean they are wrong, even though you may check them from the same source.

Your credit score will vary due to different sections checked on your credit report, depending on your lender.

Your credit reports will have a more constant flow and remain more stable than your credit score. Your credit reports may have some mistakes affecting your credit score; hence, it is important to keep reviewing your credit report. You can check your credit score in one of the following ways:

· Check through a free credit scoring site, although some may offer subscriptions for credit monitoring

· Check through credit card companies like American Express and other loan companies. You will see your credit score on your loan statements, or you can check the scores through your American Express account.

· Purchase your credit scores through the major credit bureaus or other scoring models such as FICO.

What Credit Score is Needed for the Amex Platinum Card?

The Platinum Card from American Express is not easy to apply for and receive even after an application. The applicant should have a higher-than-average credit score, positive credit reports, and impeccable credit history. On average, the minimum credit score most applicants usually have while applying for the American Express Platinum Card is 715.

Therefore, the applicant should have a good to excellent credit score whether applying for the Amex Platinum or Amex Business Platinum Card.

However, there are exceptions to the credit score since some applicants may have a lower score with an exemplary credit report. Therefore, you can consult American Express to check whether you can qualify for the card by taking a pre-qualification application. Also, you can check for your approval odds that compare your profile to applicants approved for the Platinum Card.

Outstanding approval odds do not guarantee a successful card approval since American Express will have the final decision.

Other Approval Considerations

Aside from the main credit score factors checked during card application, American Express will look into further considerations. The American Express Platinum Card is an exclusive card that not everyone can access after application. Therefore, the application process is crucial and intense since American Express needs to consider all factors before approving the card. Some of these considerations include the following:

Personal Income

An individual’s personal income will greatly influence their approval odds during card application. The American Express Platinum Card is a high-value card that requires the cardholder to spend more to earn more rewards. Also, the Platinum Card is a charge that requires the cardholder to pay the card balance on other purchases monthly.

Therefore, American Express shortlists applicants who earn more than $50,000 annually since they can afford the card. The more you earn, the higher your chance of receiving the card if all your other requirements are in check.

Length of Credit

The length of credit will determine an individual’s credit history, which includes how long an individual has had credit. The credit history will tell the lender or credit issuer how well the individual handles their credit. It will show if there are any bankruptcies, repossessions, and collections associated with the applicant during the duration of their credit.

The longer you have credit, the more likely it is to have a negative credit history, although the opposite may be true. A greater length of credit shows that the individual is more reliable in receiving an American Express Platinum Card.

How to Boost Your Credit Score

You can use several ways to improve your credit score, increasing your chances of receiving a Platinum Card from American Express. Anyone can use the following tips to establish or build credit for better chances of a successful credit card application:

· Make all your loan or credit payments on time, even before the due date allocated by your lender. That way, you will not carry any balance, which can attract late fees or penalties that hurt your credit score.

· Monitor your credit report to avoid mistakes that may occur, which greatly affect your credit score. That way, you can dispute the mistakes and restore your credit score as you continue building your credit.

· Apply for a starter credit card, which includes a secured credit card or one with a low credit limit. The more you use your starter card, the more you will build your credit, especially for those with no credit history.

· Avoid applying for several new credit accounts since your rejection chances are higher. Application rejections cause hard inquiries on your credit score, affecting your score for up to a year. Instead, take soft inquiries through pre-qualification tests that check whether you qualify for a card.

· Choose to be an authorized user that allows you to build credit using another cardholder’s card. However, ensure you choose a cardholder with a great credit history and credit report since they will affect your score. American Express Platinum Card allows cardholders to add up to three authorized users at $175 per card.

Conclusion

The American Express Platinum Card is the best credit card for frequent travelers with the best rewards. The cardholder will receive the best benefits for travel, including statement credits and complimentary lounge access. The card is also a rewards credit card that earns the cardholder Membership Rewards points, which they can redeem or transfer.

Therefore, the Platinum Card is a high-value premium card, not easy to achieve. Aside from the $695 annual fee, the card requires the applicants to have a good or excellent credit score.

Applicants must have a credit score ranging from 690 to 850 to stand a chance of having a successful application. However, the applicant should meet other requirements to receive the Platinum Card from American Express. For example, the applicant should have a positive credit history and a high source of income to afford the card.

The applicant can take a pre-qualification test to see whether they qualify for the Platinum Card before applying. Individuals can take several measures to improve their credit score, such as getting a starter credit card.

FAQs

How hard is it to get the Amex Platinum Card?

The Amex Platinum Card is an exclusive and luxurious card that is only available to those who can afford it. Therefore, getting the Platinum Card from American Express takes work since you must prove that you can afford the card. Also, applicants should achieve several requirements, including an impeccable credit report without blemish.

Thus, it would be best to avoid hard inquiries on your credit report that will negatively impact your credit score. The applicant’s credit score should be over 700 to have a better chance of approval after an application.

What are the alternative options for the Amex Platinum Card?

The American Express Platinum Card is a high-value card and quite expensive to maintain, starting with the high $695 annual fee. Also, the card is usually tied to travel, offering the best benefits and rewards to those who travel frequently. There are cheaper and better options from American Express, best suited for those who travel less with more daily spending.

For example, the Gold Card from American Express has a $250 annual fee with more reward categories. The Gold Card will offer Membership Rewards points for restaurants and dining, not seen in the Platinum Card.

What to do if the Amex Platinum Card request is denied?

Having a successful application for the Amex Platinum Card is more challenging than that for other cards. Therefore, most applicants will have their application denied, especially if they cannot meet the pre-set requirements. For example, several hard inquiries or a shorter average age of accounts will greatly affect your chances of a successful application.

Thus, the applicant should check their credit score factors and improve their credit score and credit reports. The applicant should take pre-qualification tests to avoid hard inquiries while applying for the Platinum Card again.