Who doesn’t love picking up a few new items? Splurging on a new piece of jewelry, a new set of kitchen knives or a fancy new gadget can feel rewarding. Unfortunately, many people do not have the money to spend right now. This is where buy now pay later no credit check instant approval websites come in handy.

| Website | Pros | Cons |

| BadCredit loans.com | You can use it to buy whatever you like, there is no limitation on what you can buy! Up to $10,000. Works with bad credit score. | Limited to $10,000 |

| FlexShopper | Up to $2,500 spending limit Weekly payments spread out over one year | Only those who reside in certain states will qualify |

| Fingerhut | Two programs to choose from May boost credit score after making on-time payments | Do not accept certain clients who are in bankruptcy, have foreclosures or liens, or are part of a credit counseling service |

| QVC | No interest charge on Easy Pay Monthly payments can be paid with QCard, credit card, or PayPal | May be subject to soft credit inquiry |

| Home Shopping Network (HSN) | Payments broken up into 5 equal monthly payments No interest, hidden fees, or extra charges | Not all items qualify |

| Afterpay | Shop at leading retailers Short application process | High late fees |

| Affirm | No late fees, prepayment fees, or annual fees Can improve credit with on-time payments | May be charged high interest rates |

| Zebit | Credit limits up to $2,500 Payments correspond with your pay day No hidden fees, interest, or penalties | Must validate identity and income |

| Stoneberry | Monthly payments as low as $5.99 No minimum credit score required | May require a down payment |

| Seventh Avenue | Credit limits up to $2,400 No fixed number of payments | May decline based on past payment history with Seventh Avenue, fraud alerts, or restrictions from credit bureaus |

| Leaseville | Rent to own for 100 days for same as cash Can return and cancel monthly contract at any time | Must have minimum monthly income of $1,200 |

If you are ready to start shopping, here is everything you need to know!

These websites are helpful for everyone who needs to do a little shopping but is short on funds. Whether you have bad credit or no credit, these stores allow you to make your purchase now and pay over time.

Keep in mind that this is not free money. You will eventually have to cover the cost of the products you purchased. However, for right now, the only thing you need to worry about is where to find the item you are looking for.

If you are ready to find some places to buy now and pay later with no credit check and instant approval, here are a few outlets.

BadCreditLoans.com

Because many people do not want to be limited on where they can shop, they often look for personal loans. BadCreditLoans.com can offer you a personal loan up to $10,000 to purchase whatever your heart desires. The best part of this program is the ability to shop wherever you want. You are not limited to one particular storefront or a network of retailers.

This website is not a lender itself, but it helps to connect you with lenders who are more likely to issue loans to those with bad credit. They have a large network of financial institutions who can help you out when you are in a financial bind.

In order to qualify, all you need is:

- Be at least 18 years old

- Have proof of citizenship (for example, a social security number)

- Have regular income

- Provide a work and home telephone number

- Have a checking account in your own name

- Provide a valid email address

They have plenty of lenders who are willing to issue loans even if you have poor credit. There are no minimum credit scores required to qualify.

Your repayment terms will vary based on the lender and the specific loan that you qualify for. This is an installment loan, so you will pay the money back over time.

& get a free quotation!

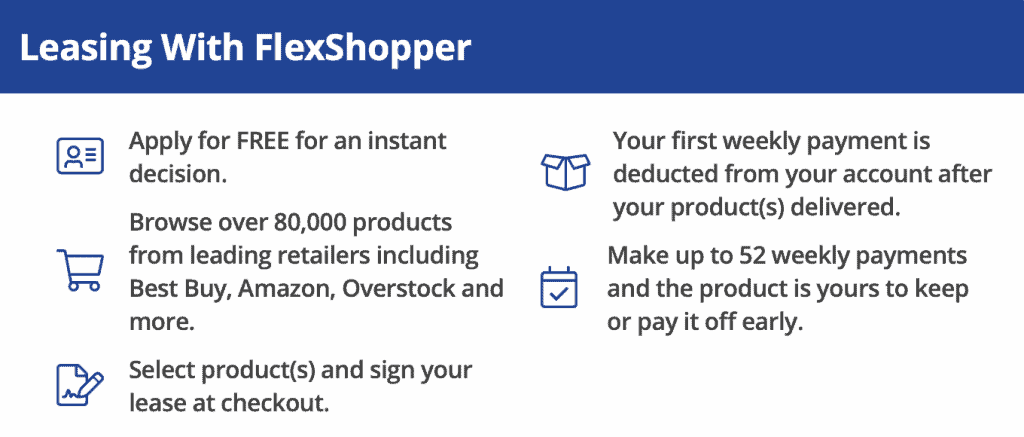

FlexShopper

FlexShopper makes it easy to look for high-value items that you don’t have to pay for upfront. They sell a variety of items ranging from electronics to furniture to appliances. Their storefront houses more than 85,000 products to choose from.

All you have to do is fill out their easy online application. It should take just mere minutes and you could be rewarded with an instant $2,500 spending limit.

Once you receive the products, you will be responsible for weekly payments for an entire year. If you make all of your payments, you will own the product at the end of your one-year lease agreement.

FlexShopper does approve individuals with bad credit, though it should be noted that not all applicants will qualify. They obtain a credit report from FactorTrust and Clarity Services as well as one of the major nationwide credit reporting agencies. However, this is not the only criteria they use to determine your approval.

To apply, you must:

- Be 18 years old (19 in AL and NE, and 21 in MS)

- Have a valid checking account in good standing

- Reside in the United States (with the exception of New Jersey, Minnesota, Wisconsin, and Wyoming)

- Have a valid social security number or ITIN, phone number, and address

- Have a current source of income

Fingerhut

Fingerhut allows you to shop on their site for all kinds of new items. They carry clothing, books, home goods, and even pet supplies. No matter what you are in the market for, there is a good chance you will find it in their storefront.

They have two distinct programs that you can use to buy now and pay later with no credit check and instant approval. The first is their FreshStart program. This is designed for people who are starting over or just starting out with their credit.

It is a one-time purchase program where you will make a small down payment. You will pay off the item in the timeframe given to you after your application. If you make all of the payments on time, then you will be upgraded to their more general credit account.

One of the main reasons people like Fingerhut is because it is a great tool to help build or improve credit. They report your payments to all three major credit bureaus. For those who make their payments on time, you should see a boost in your score after using this program for some time.

Keep in mind that not everyone will be approved. They do not accept clients who are:

- In active bankruptcy

- Have foreclosures, tax liens, or other marks against your credit

- A member of a credit counseling service

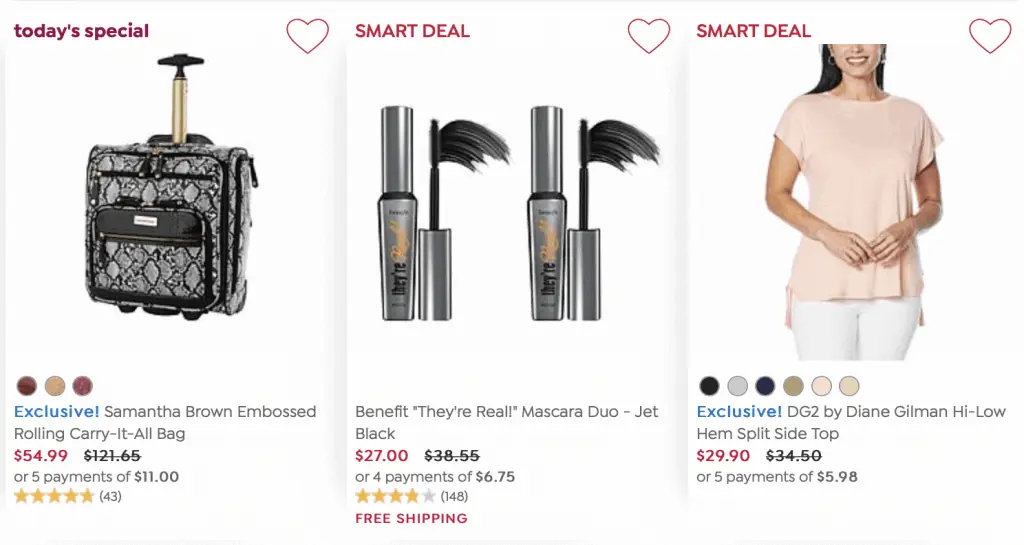

QVC

If you want to buy now and pay later with no credit check and instant approval, QVC might just be able to make your dreams come true. You are probably used to their late-night specials on television. Most people already know that they sell a little bit of everything from cosmetics to electronics.

Their Easy Pay program is rather unique. It allows you to purchase an item now and pay in monthly installments until the item is paid off. The monthly payments can be made with any QCard, major credit card, or PayPal account.

One of the main benefits of shopping through Easy Pay is that there are no interest charges or fees. Keep in mind that if you make the payments using a credit card, you may incur interest on those installments.

It is possible that they will do a soft inquiry of your credit before approving your Easy Pay account. This will not harm your credit score in any way. If you are not approved after this check, you will still have the option to purchase the item outright.

Home Shopping Network (HSN)

Much like QVC, many shoppers are already familiar with the Home Shopping Network or HSN. They offer a similar installment payment plan known as FlexPay.

If you select this payment option at checkout, you make the first payment plus taxes and shipping upfront. From here, the rest of the purchase will be divided into as many as five equal monthly payments.

Unfortunately, not all items are eligible for this installment plan. Items that are excluded from FlexPay include:

- Cellphones over $500

- Jewelry over $1,000

- Gaming over $1,000

- Coins over $500

- Televisions over $2,500

- Computers over $1,500

One of the benefits of this plan is that they do not charge interest, hidden fees, or extra charges.

Keep in mind that some FlexPay orders may be subject to credit verification. You can see if a credit report was requested and get the name of the agency who conducted the report by contacting their FlexPay Eligibility Department.

Afterpay

Unlike some of the other leading buy now and pay later sites, Afterpay partners with retailers to offer flexible payment plans. You can start by exploring their website. Once you pick an item or category that you like, they will direct you to the brand’s website where you can choose Afterpay as the payment method.

Those who are looking for instant approval will love the application process here. All you need is a few pieces of information and you are good to go:

- Phone number

- Address

- Date of birth

- Debit or credit card

You will make the first payment on the day that you place the order and make the rest of the payments over the course of six weeks. As you make on-time payments, your credit limit will increase and you can do more shopping.

When you make payments on time, there are no fees. Late payments can incur fees that cap out at 25 percent of the purchase price. You will definitely want to heed their reminders and make those payments on time!

Affirm

With only a soft credit check performed, you could qualify for a credit limit of thousands of dollars with options to pay over time through Affirm. Much like Afterpay, Affirm allows you to shop at your favorite stores instead of through their own website.

All you have to do is select Affirm as your payment method at the checkout. You’ll enter a few personal details and receive instant approval for your new financing.

Then, you can choose the payment schedule that works for you. Some customers will be given 0 percent APR while others may see rates that are much higher up to 30 percent APR. Interest rates depend on the size of the purchase and where you shop.

Signing up for an account with Affirm does not affect your credit, but these factors might:

- Making an official purchase

- Payment history

- Credit utilization

- Length of credit history with Affirm

If you are interested in buying now and paying later while also building up better credit, this might be a good option for you.

The other bonus to using Affirm is that they do not charge any fees. You will never incur late fees, prepayment fees, annual fees, or fees to open and close accounts.

Zebit

If you want to purchase top name brands with in-house financing, Zebit may be the right fit for you. This retailer can offer you a maximum credit line of $2,500 to go toward electronics, appliances, and more.

Registering for Zebit is incredibly easy and completely free. The application process is short and should issue you an approval within minutes. Keep in mind that they will validate your identity and income. You must be at least eighteen years old or of legal age to enter into a contract.

They will not pull your FICO credit score to determine eligibility. They do obtain information from specialty credit reporting agencies, but it will never affect your FICO score.

Unlike some buy now and pay later with no credit check and instant approval sites, Zebit is upfront with what they charge. The price you see is the price you will pay. They don’t believe in hidden fees, interest, or any sort of penalties.

One of the great things about Zebit is that they can coordinate your payments to correspond with your pay periods. This ensures that you always have money in your account on the day that your Zebit payment is due. You will have six months to pay for the product in full.

Stoneberry

Stoneberry is another great option for buying now and paying later. They sell items across a wide variety of categories including electronics.

They may make decisions based on your purchase history with Stoneberry as well as a credit evaluation from one of the three major credit bureaus. There is no stated minimum credit score and this is not the sole basis for their decision. Prequalifying will have no impact on your credit score.

To fill out an application, you will need simple personal information including your address, date of birth, social security number, and email address. It is a short application so it should take you no time at all to fill it out.

Subject to final credit approval, you may be looking at payments that are as low as $5.99 per month.

If they are unable to approve your credit account, they will give you an opportunity to still make the purchase by making a down payment. They will send a letter notifying you of what the required down payment will be based on your credit evaluation and the purchase price of the item you are interested in.

Seventh Avenue

Seventh Avenue is your one-stop shop for all your home needs. They have categories available for bed and bath, furniture, home goods, electronics, outdoor items, and more.

In order to take advantage of their buy now, pay later services, you will need to apply for a store credit card. Applying takes just a few minutes and approval is issued within the day. All you need to do is fill out the application and shop while you wait.

With this program, you can face monthly payments as low as $20 per month for purchases up to $200. You can borrow a maximum of $2,400 and face monthly payments of up to $80 per month.

You may face declined credit if you previously did not pay on a Seventh Avenue credit account. If you have a fraud alert or some other restriction from a credit bureau or no information returned from a credit bureau, you may also be declined.

Unlike some of the other buy now and pay later sites, Seventh Avenue credit is open-ended. This means that you will not have a fixed number of payments like you might have with other top competitors. It is a revolving line of credit so that the amount increases and decreases based on how much you purchased and how much you have paid down.

Leaseville

If you are in the market for some new electronics, Leaseville might be the best place to go. They carry computers and tablets, smartphones, smartwatches, cameras, televisions, and more. They also carry lawn and garden items, tools, musical instruments, and furniture.

You can rent to own items through Leaseville for 100 days, same as cash. All you have to do is fill out the online application at the end of checkout for an instant decision. You could be approved for up to $3,500.

Once you receive your order, you will make periodic rental payments. Once you make the final payment or buy out the contract early, you will own the item you purchase. The other alternative is to return and cancel the monthly contract at any time.

The benefit of going through Leaseville is that you do not need a FICO credit score or credit history to be approved. This is truly a no-credit-needed rent-to-own program. Instead, they rely heavily on verifying your monthly income over the last six months. You must earn at least $1,200 per month.

They also look to make sure you have an active checking account in good standing that has been open for at least three months.

Buy Now Pay Later No Credit Check Instant Approval

If you are ready to do some shopping but don’t have the cash, these websites can give you exactly what you’re looking for. Take some time to window shop and find the site that offers the deal you want. You can find anything from iPhones to cosmetics.

Most of these storefronts have a wide selection of items to choose from. With these buy now, pay later no credit check instant approval sites, you should be able to find exactly what you want and need.