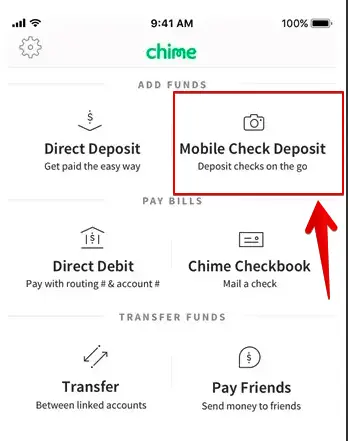

Chime is an app for saving, spending, sending, or receiving money. A significant benefit of using Chime is its mobile check deposit function, but is it instant? You’ll find out that it is through Direct Deposit in this article. Chime also has a fast mobile check deposit time, but more on that further down. In this article, we’ll also cover what time a chime mobile deposit does hit your account.

A Direct Deposit is the fastest situation in which a mobile check will clear. The money will move over instantaneously. Bank transfers through the Chime app or website can take up to five business days, and bank transfers from an external account can take up to three business days. Any returns on merchandise can take up to five days to clear as well. Finally, cash through Green Dot will be transferred within two hours.

Here is a fast break down of each different times based on the deposit methods:

- Direct Deposit – Instant

- Bank Transfer Through Chime App or Website – Up to five business days.

- Bank Transfer From External Account – Up to three business days.

- Cash Through Green Dot – Within two hours.

- Returns on Merchandise – Between three and five business days.

Is Chime mobile check deposit instant?

Yes, it can be instant if you use the ‘direct deposit‘ method to deposit your mobile check.

The other options vary, but the maximum time for the mobile check deposit to go through in Chime is 5 business days.

What Time Does Chime Mobile Deposit Hit?

If your employer is using the Direct Deposit method on the chime app, it’ll be in your spending account instantly.

Using other methods such as a normal bank transfer can take up to 5 business days.

Talk to your employer to find out what time they pay the check.

Now, if you’re depositing the money yourself and wonder ‘what time does chime mobile deposit hit your account,’ then simply use the direct deposit method and see the funds hit your account directly.

1. Direct Deposit – Time: Instant

Time from sent till received: Instant

As we covered in our guide to adding money to Chime accounts, a Direct Deposit is the easiest and quickest method. You can send and receive a Direct Deposit just by providing your account number and routing number.

This option holds the fastest Chime mobile check deposit time between the options we listed in this article.

In many cases, users prefer for their employers to pay them through this method into their Chime account.

However, the employer will need to fill out a Deposit form before this can happen. You’ll find this form in ”Move Money —> Email me a pre-filled direct deposit form to send the completed form to yourself.”

Regardless of who is paying you via Direct Deposit, it should be an instant process. As soon as the money has left the payer’s account, it should be in your Chime account.

If it isn’t, there’s a chance that the payer’s bank has flagged the transaction for some reason. This might happen in the first instance of a Direct Deposit since a transfer to Chime will be newest, and therefore most suspicious, on the payer’s account.

However, every time after that, the Direct Deposit should be instant.

2. Bank Transfer Through Chime App or Website – Time Up to 5 days

Time from sent till received: Up to five business days

When it comes to methods of Chime deposit that take a long time, this is one of the longest. It is also the most common method of depositing money into a Chime account though.

If you’re being sent money from a bank account that isn’t Chime or even from another online bank, the process is going to be slow.

While Chime says that it won’t take more than five business days, they can’t be more specific than that. It’s all to do with the internal processes behind the scenes at each bank.

It’s important to know that Federal Holidays are excluded from the five-business-day transfer period. If the transfer window includes a Federal Holiday, then it will take additional days to clear.

3. Bank Transfer From External Account – Time: Up to 3 Days

Time from sent till received: Up to three business days

External bank accounts won’t take quite as long as bank transfers. Chime says that they will take up to three business days instead of the five required for bank transfers.

Just how long the transfer takes is down to the bank that the transfer is coming from.

If the bank is usually quite fast, then the transfer should be just as fast. However, if you’re waiting for a notoriously slow bank, be prepared to wait the entire three days.

Once again, it’s important to bear Federal Holidays in mind. All banks will add additional days to transfer windows when a Federal Holiday is involved.

4. Cash Through Green Dot – Time: 2 hours

Time from sent till received: Within two hours

When you’re getting cash from Green Dot, it should come into your Chime account within two hours.

This is because Green Dot is another online bank, and the process of transferring money from one to the other is relatively quick and painless.

5. Returns on Merchandise – Time: 3 to 5 days

Time from sent till received: Between three and five business days

If you’re waiting for money to be returned to your account for some merchandise you’ve exchanged, you may be waiting for up to five business days. Officially Chime puts this time between three and five business days.

I’d say that most businesses will wait as long as they can before they have to return the money, though, so five days is a much safer bet.

Federal Holidays may not affect this type of deposit at all. Since the businesses you’ll probably be getting a return from will operate at weekends, their returns can likely be processed over the weekend as well.

FAQ:

Conclusion

Unfortunately, there’s a lot of variation between how long a check can take to deposit on your Chime mobile app.

The bank is incredible for so many different services. But speeding up deposits isn’t one of those services.

This is all because of the other banks that are involved in the process.

The fastest way for you to get money into your Chime account is with a Direct Deposit because it’s instant. Any other process of moving money could take up to five business days.

If that sounds like a long time, it’s not. This is the standard amount of time for cash to be moved between accounts, I’m afraid.

You’ll also find that Chime mobile check deposit is instant when using the correct method.