Getting a new washer and dryer is exciting but that excitement can quickly go away when the price tag rings up at the register. These appliances are expensive even with all the holiday sales. That’s why knowing the best way to finance your washer and dryer is important.

The best way to finance your washer and dryer is to finance through the company you are buying from. Because they want to sell you their product they are likely to offer the best financing rates through their credit cards. You can also finance through a lender outside of who you directly buy from.

Who Finances Washers and Dryers?

Major retailers that sell appliances for the home have financing options that lure customers in to buy directly from their stores. These are typically some of the best deals for those with fair credit.

Let’s take a look at some of the examples from popular retailers in the U.S.

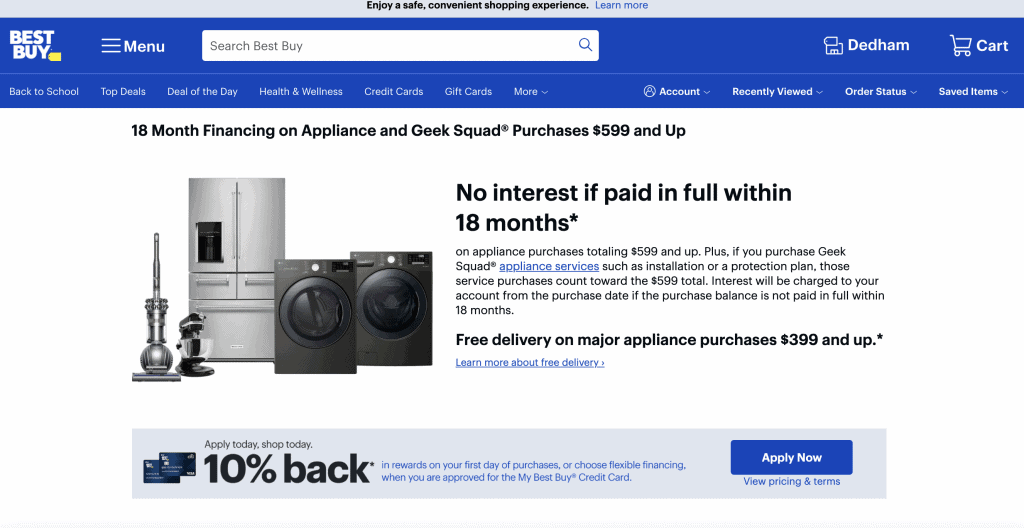

Best Buy – Credit Card

The Best Buy Credit Card offers no interest IF paid in full by 18 months. This is on purchases of $599 and up.

If it is not paid off in 18 months interest WILL be charged from the purchase date, not from the 18-month mark.

Home Depot Credit Card

With the Home Depot Consumer Credit Card, you can get up to 6-months of financing. Like Best Buy, Home Depot has backdating interest so you need to pay the balance in full by the date required. In order to qualify the purchase total must exceed $299 and you must have fair credit.

Home Depot wants their customers to know they offer appliance discounts with their credit card and one year of returns. This is four times longer than most stores.

Lowe’s

Lowe’s requires a bit better of a credit score (640) to apply for one of their credit cards. And Lowe’s offers a choice. You can take part in 12 months of special financing or you can get 5% off your purchase. Exclusions apply*

With the special financing, you can expect 12-months of interest fee purchases if paid in full. These apply to washer and dryer purchases of $299 and more.

Some users dislike the fact that you can’t take part in discounts and use the card like other stores. Lowe’s is still work looking at because of their other benefits.

What Credit Scores Do You Need To Finance a Washer and Dryer?

With the options listed above by going through a major retailer, you can expect to need fair to good credit. For the ones listed above, despite it being a case-by-case circumstance, you can count on needing a credit score of 640 or better.

For some, this simply doesn’t work as they need to boost their credit. That’s why the alternative of no credit check buy now, pay later sites are a great option.

Check out our guide on the best websites that offer no credit check buy now pay later options.

Work With a Lender

It’s possible to avoid opening up a credit card altogether. By choosing a lender you can get a loan with specific financing rates that will fit your needs. Let’s look at how it works and an example with Honest Loans or PersonalLoans.com

How Does Getting a Loan Work?

Getting a specific washer and dryer personal loan does exist. Something to keep in mind is that those with good credit can get zero percent interest or at most very low-interest rates. However, those with no great credit score can pay up to 25% in absolute worst-case scenarios.

Here are the necessary steps you should take into getting a personal loan.

- Search for Appliance Loans which is a specific personal loan.

- Search for terms and rates that fit your needs. This will be how long you need to pay it off, how much you need to borrow, and the interest rate tacked on.

- After finding one that works, start the application process (likely online).

- You’ll be given an estimated approval rate that will likely be confirmed in a few business days to a week.

Example: HonestLoans

HonestLoans runs through a quick and easy process just like the one described above. You will fill out their personal loan application first. The great thing about HonestLoans and that you will get a quick decision on whether you are approved or not for the loan you are requesting.

This is because HonestLoans is not the lender giving you the money but actually a third party that matches lenders to prospects. This helps speed up the process of finding a personal loan that actually fits the needs of the applier. It also makes sure that you get the best possible deal since they all have to compete.

As soon as the next business day you can have the money directly deposited into your bank account to purchase your washer and dryer. Because everything happens so fast you may be leary. But HonestLoans uses SSL encryption to keep all their customer’s information safe.

Quick Facts:

- HonestLoans does not check for credit scores but the lenders they work with might.

- They offer loans from $100-$50,000.

- HonestLoans does not charge any fees for submitting your application. The lender will present fees if any at the final signing.

Map Your Finances Out

The best way to finance a washer and dryer is either through opening up a credit card or taking on a personal loan. These two options are very different from one another and will fit the needs of different customers. One option requires a new credit card; the other doesn’t.

For those who find themselves loyal to a specific brand like Best Buy, Home Depot, of Lowe’s, it may make total sense to finance through them. With yearly benefits and discounts, you can have zero percent interest rates if you pay in full by the designated time.

Sometimes opening up a new credit card is not appealing or even an option with your credit score. That’s why checking out no credit check buy now, pay later options may work in your favor. Others are just more comfortable with a personal loan that fits their needs.

You’ll need to map your finances out to determine which road is the best one for you.