Cash App is currently testing a relatively new feature, loans. While this is commonplace with most banks, Cash App has only just started offering them because it’s still quite a new online financial service. However, since December 2020, the feature has been rolling out to users, and now most people have access to it. This guide will cover how to unlock and borrow money from Cash App using this loan feature in 2021. We’ll also dive into this feature’s details and what it could mean for you regarding costs and benefits.

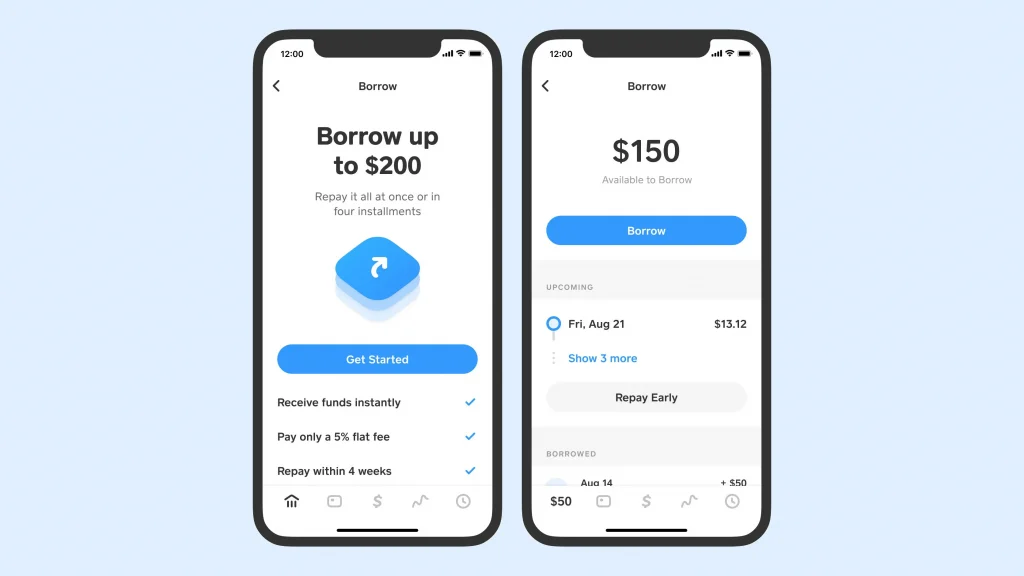

You can tell if you’re able to borrow money from Cash App because the option will be available to you on the main menu. All you need to do is tap the option, and you’ll be taken to a page where you can read exactly how the feature works and borrow money up to the limit of $200.

If you end up at the end-screen and notice that you’re not eligible to borrow as much as you were hoping, there are more places to turn to. Check out our editor’s choice below.

Below you’ll find a video explanation of how to borrow money from Cash app.

However, it’s not as simple as Cash App lending you the money to pay back whenever you want at no extra cost.

How To Get The Borrow Feature On Cash App?

To borrow money from Cash App, you need to be making regular deposits into your Cash App account. The more you regularly deposit, the more you can borrow from Cash App. For example, depositing $300 per month will allow you to borrow roughly $70.

To borrow a maximum of $200, you must deposit at least $1,000. As long as you deposit at least $1,000 per month, you can borrow up to $200 per month. It’s not a free service, though, and there are limits.

Cash App charges a flat fee of 5% on the amount you borrow. Over the course of 12 months, this adds up to 60% total, but that’s still less than you’d pay if you took out a payday loan.

You have four weeks to pay off your loan, then an additional one-week grace period before any further interest will be charged. After that, Cash App will add an extra 1.25% of non-compounding interest on top of what you owe them each week.

That’s a lot of data, so let’s look at what those interest rates might mean in practice.

Cash App Borrow Interest Examples

| Amount Borrowed | Cash App Fee (5%) | Additional Cost Per Week After 5 Weeks (1.25% per week) |

| $50 | $2.50 | $0.63 |

| $100 | $5 | $1.25 |

| $150 | $7.50 | $1.88 |

| $200 | $10 | $2.50 |

| $250 | $12.50 | $3.13 |

| $300 | $15 | $3.75 |

Cash App expects you to pay back what you have borrowed within four weeks or one month. If you don’t, there is a one-week grace period before they begin charging you additional interest.

The fee for borrowing money from Cash App is the same, no matter how much your loan is for. 5%. The additional cut that Cash App will charge every week after those five weeks of failing to pay the loan off is also flat at 1.25%.

While the costs don’t seem like much above, they can quickly add up. For example, if you borrowed $100 and failed to pay that off for an additional four weeks after the five-week grace period, Cash App would be charging you $11.25. You would then be paying an extra $1.25 for every month that you don’t pay the loan off.

Once again, this isn’t an extortionately high-interest rate on paper. Especially not compared with payday loan companies. However, it’s almost certainly worse than what your bank could offer you for the same amount over a long period of time.

Bank Loan vs. Cash App Borrow

The key difference between borrowing from Cash App and taking a loan with your bank is the financial viability of the money you borrow. A bank will assess your income and determine how much they can offer you based on your earnings and outgoings.

They’ll also structure a payment plan around those aspects of your life so that you don’t end up out of pocket because of the loan.

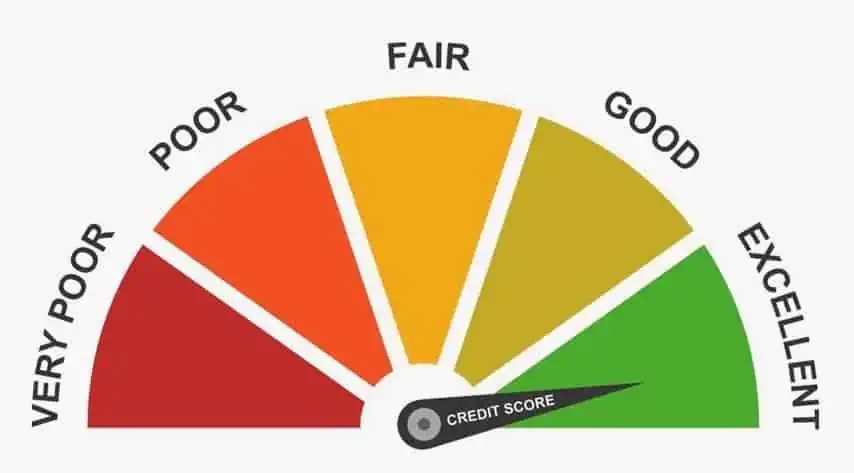

Cash App is different because they won’t be looking at your earnings and outgoings. While the company almost certainly checks your credit score, that’s probably all it does.

As long as your score is high enough to qualify, they’ll let you borrow money. This is dangerous if you can’t afford to pay the loan back and could land you in some serious debt over time.

However, Cash App does have certain requirements on regular deposits before you can borrow money from them. It could be argued that if you can afford to deposit $1,000, then you can afford to pay off a $200 loan. That’s what makes the service so accessible. It’s far easier than applying for a loan with a bank too.

Will Borrowing From Cash App Affect my Credit Score?

You can’t borrow money from a legitimate and responsible source such as a bank or Cash App without them running a credit check and looking at your credit score. If you borrow money from Cash App, they will check your credit score to see if you’re eligible for a loan of the amount you have requested.

However, unlike a bank, Cash App doesn’t take your current circumstances into account. Instead, the system will check your credit score is of a certain level.

As long as your credit score meets their requirements, the system will allow you to borrow the requested amount. While there is an additional barrier of having to deposit a particular amount before getting to the borrowing process, that doesn’t have anything to do with your credit score.

Some credit score checks will count against you and lower your score. Unfortunately, that’s part of how the system works. On the other hand, borrowing money and paying it off in a timely manner counts towards a better credit score.

So it’s in your interest to make use of features like short-term loans and credit cards because you raise your credit score with them.

This doesn’t mean that you should borrow from Cash App for the sake of it. Instead, you should only borrow money when you need to.

Why You Should Borrow From Cash App

Borrowing money from Cash App is no different from taking a small short-term loan. Just like a short-term loan, there are only certain circumstances in which you should choose to borrow money.

For example, if you need $100 to pay for food until your monthly paycheck is deposited in your account, borrowing from Cash App might be the best option for you. It’ll give you the chance to eat without having to dip into a credit card. You can also easily pay off the amount you’ve borrowed as soon as you get paid, thanks to speedy deposits.

If you need $200 extra to pay your rent for a month between jobs, that’s another excellent example of when you may need to borrow from Cash App. Again, when you’ve been paid for your new job, you can pay off the loan.

It’s essential to think about the long-term consequences of borrowing money in this way. You might think that borrowing $100 here and there won’t cost you too much, but the interest can add up to be crippling over time.

That’s why it’s so important to pay off each loan before you take out another one; luckily, this is a requirement for Cash app loans, more of that below.

Can I Borrow From Cash App if I Haven’t Paid Off What I Owe Them?

One of the most important restrictions with Cash App Borrow is the fact that you need to pay off what you’ve already borrowed before you can borrow more. In this way, Cash App protects users from getting into unmanageable amounts of debt. They’re also protecting themselves from having too much money loaned out at once that they may not see ever paid back.

Conclusion

That’s everything you need to know about how to borrow from Cash App. This fairly new feature can be handy for those in need. However, it can also be dangerous to those who don’t know how to manage their own money.

Suppose you’re a regular Cash App user who has most of their money deposited into their account each month. In that case, it’s a fantastic way to bridge the gap between financially tricky periods.

If there’s something that you think we’ve missed, please let us know in the comments.