Buy now pay later programs like PayPal’s Pay in 4 make shopping for expensive items more convenient. Instead of parting with all your cash in one fell swoop, you can split payments up over six weeks. Unfortunately, many people are not approved for this program. Why is your PayPal Pay in 4 denied?

Your PayPal Pay in 4 could be denied because of a lack of credit history or a low credit score. Unusual activity such as repeated attempts to fill out an application will also earn you a denial. If your balance is too high, you will need to pay it down before using the program again.

If you were turned down for this service, here are the reasons why and what you can do about them.

PayPal Pay in 4 Declined: Low Credit Score

One of the great things about the “Pay in 4 program” is that it does not affect your credit score in any way.

However, this sometimes misleads people to think that credit does not matter when it comes to getting approved or rejected. This is simply not true.

PayPal does perform a soft credit check when determining who is eligible for this type of account. A soft credit check does not negatively impact your credit score.

Instead, it gives PayPal access to essential aspects of your financial health, such as lines of credit, loans, and payment history.

One of the top reasons your PayPal Pay in 4 was denied is a lack of credit history or poor credit.

Not everyone has a credit history to pull. If you are relatively young, have no credit cards, and are responsible for a few bills, you may not have a credit score at all. PayPal could deem you too much of a risk for this buy now pay later program.

On the other hand, individuals who have poor credit scores and accounts that have fallen into collection may also face a denial.

If this is the case, you might still be able to purchase items on a buy now pay later program through loans with lenders like BadCreditLoans.com. They work with all types of lenders who can issue loans up to $10,000 for individuals with bad credit.

PayPal Pay in 4 Rejected: Application information tied to unusual activity

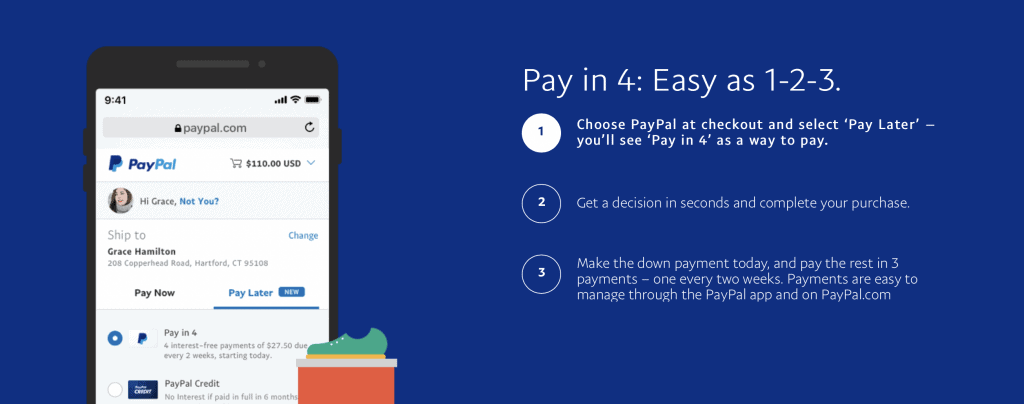

You add your items to the cart and head to the online checkout. When asked to select your payment method, you choose the Pay in 4 option and fill out the application.

Unfortunately, things don’t always go smoothly and you have to reprocess the application several times.

Be cautious when doing this as it can lead to an automatic denial due to “application information tied to unusual activity”.

PayPal tries to be cautious and protect you from fraud and scams. When it notices that your account has attempted to process payments multiple times, they shut it down to protect you from this supposed fraudulent activity.

Unfortunately, this can also lead to authorizations being placed on your account. If you try to pay with this method, it may still place an authorization on your account temporarily even if you don’t end up approved.

This can negatively impact your bank account balance and tie up some of your funds. In some cases, it leads to your account being overdrawn temporarily.

The best thing you can do is to contact the support directly and try to work this one out.

You may have to send in some documents proving that you are the rightful owner of the PayPal account.

PayPal Pay in 4 Not Approved: Balance Too High

Sometimes, you might want to purchase more than one item with this handy buy now pay later tool. The first transaction often goes through smoothly as you have no balance on your Pay in 4 account. However, the second may be denied if you are over the limit.

PayPal’s Pay in 4 program lets you finance purchases as low as $30 and as high as $1,500.

If you are buying high-ticket items like electronics, you might find that you max out your Pay in 4 account rather quickly. This is one of the main reasons why people have their PayPal Pay in 4 denied.

If you want to purchase more than one high-value item, you might need to pay down the balance on the first item before you can proceed. In this situation, your denial is likely to be temporary.

No matter how many items you want to purchase, you need to keep the balance below $1,500. The good news is that you must pay back the entirety of your credit in just a short six weeks.

Once the final payment has been processed, you should be eligible to make another purchase using this as your payment method.

Check Back Soon

If you discover that your Pay in 4 account was denied, you might notice that the payment option disappears when you head to the checkout. You may only be presented with the option to pay via traditional PayPal or with your credit or debit card.

Many people have been frustrated by this disappearance. This is especially true for individuals who have successfully used this program before their PayPal Pay in 4 was denied.

Customer service has been confronted about this issue by upset customers. There isn’t much they can do about the situation, though.

They recommend waiting five to ten days and then trying again. Some customers report seeing the option reappear as soon as 72 hours later, so be sure to check back regularly if you are determined to use this payment method.

Keep Trying

If your PayPal Pay in 4 is denied, give it a rest for a few days and then try again. This can help you avoid the unusual activity that often scores users a rejected status.

If it disappears as a valid payment option, wait a few days and then look again. Of course, if your credit was the issue, it may take longer to resolve and earn approval.