Cash App offers a debit card together with your online banking account. If you’re wondering where to find a Cash app ATM near me or where you can load your Cash app card for free, you’ve come to the right place. However, using ATM withdrawal with Cash app is different. We’ll cover what ATMs are free for Cash app and which fees could occur.

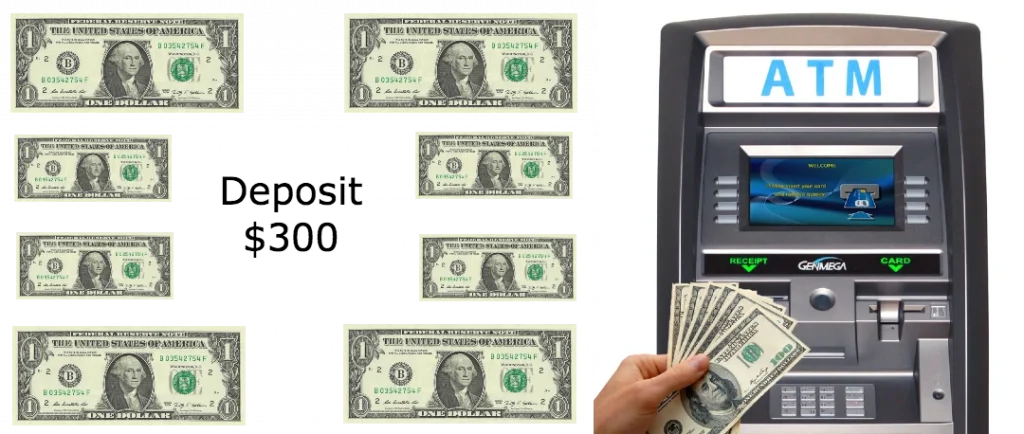

Cash App charges a $2 fee for all ATM transactions using your Cash App card, and Cash App works at any ATM. All fees charged by the ATM will be charged on top of this $2 fee. Cash App will refund three ATM fees for every 31 day period, up to $7 per fee, if you make a regular deposit of $300 into your account within that same period.

With all of those advantages, you’d expect a huge penalty on fees. That’s not the case at all, though. Cash App will reimburse any fees you incur from using your card.

You just need to be smart about how you use it. The following is our guide to where you can use your Cash App card for free.

What ATMs Are Free For Cash app

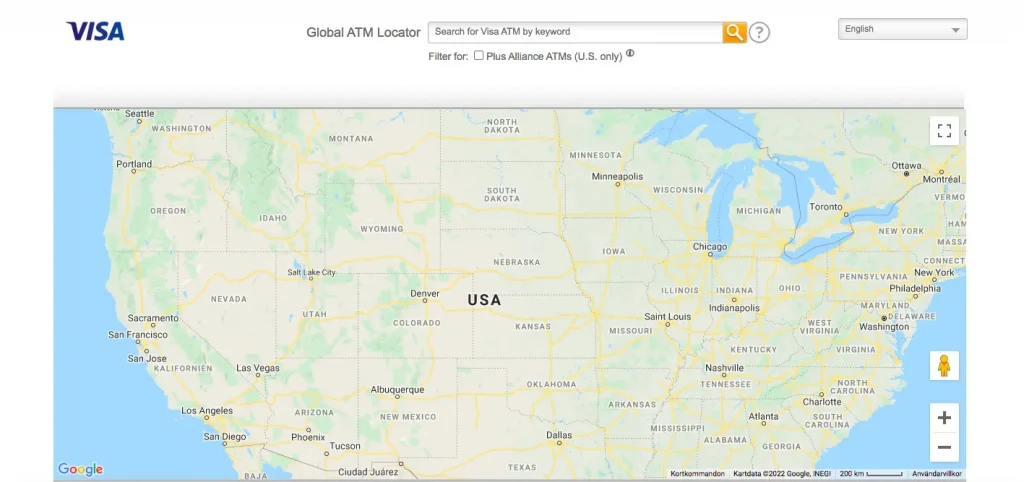

You can use your Cash App card for free at any ATM that accepts a Visa debit card.

Cash App isn’t interested in charging you lots of money to access your account. They want you to spend it. However, they do ask for one thing in return. Money.

Top up $300 every month and Cash App will repay any ATM fees you incur

The bottom line here is that you need to keep putting money into your Cash App account if you don’t want to pay any fees for withdrawing money.

That includes any charges that an ATM applies to your transactions, as well as fees from Cash App themselves.

Providing that you’ve topped up at least $300 in that month, all of those fees will be reimbursed. What is great about this is, all ATMs are free for the Cash app as long as this step is completed each month.

Cash App ATM Near Me (Free)

One way to avoid ATM fees is to search online for ATMs near you that don’t charge a fee. Often you’ll find that these are in supermarkets. There will always be one ATM nearby that is free for the Cash app card.

VISA’s free ATM locator is a good way to find a free Cash app ATM to withdraw funds.

Of course, if you’re not putting at least $300 into your Cash App account by direct deposit every month, you’ll be charged ATM fees by Cash App regardless.

There are some limitations to this, though, which we’ll go through now.

If you’re worried about how to make a direct deposit on Cash App, check out our handy guide here.

What are the Cash App ATM Fees?

You will also need to make sure that you have enough money in your account to cover the fee that the ATM charges as well. In most cases, this is a flat rate, but some ATMs will charge a percentage of the cash you withdraw.

For another example. If you are withdrawing $100, and the ATM charges $1.50, you will actually be taking $103.50 out of your account. This covers the $100 you need, the $2 fee for Cash App, and the $1.50 charge for the ATM.

Per Purchase Fee

Luckily, as a customer, you won’t pay any per-transaction fee. However, businesses that accept the card will be charged 2.75% per transaction.

So this might be a better option to avoid any ATM fees.

ATM Fees – $2 Per Transaction

Cash App has a single fee for all ATM transactions of $2. Regardless of how much you’re withdrawing, you’ll be charged this amount by the bank for the service. This fee will be added to the total amount that you’re taking out of the ATM.

While Cash App will reimburse fees you’re charged at ATMs, they’ll only do it for three charges in a 31 day period.

Those fees are limited to $7 each as well. So if you’re charged two $6 fees and one for $10, you’ll still have to pay $3 in ATM fees for that month.

Example: You may wish to withdraw $100 from an ATM. For this, you will be charged $102 because the Cash App fee also needs to be paid. If you don’t have enough funds in your account to cover the fee, then you will be forced to withdraw less cash so that you can also pay the fee.

You will also need to make sure that you have enough money in your account to cover the fee that the ATM charges as well. In most cases, this is a flat rate, but some ATMs will charge a percentage of the cash you withdraw.

Another Example: If you are withdrawing $100, and the ATM charges $1.50, you will actually be taking $103.50 out of your account. This covers the $100 you need, the $2 fee for Cash App, and the $1.50 charge for the ATM.

To avoid ATM fees, you need to make an initial direct deposit of $300 and make the same, or a larger, deposit every month.

If you don’t do this, Cash App will charge you $2 for every transaction at an ATM.

Where Can I Load My Cash App Card for free?

There are three different ways that you can load your Cash App account:

- Online, Debit card & Bank transfer is 100% free. (Credit Cards cost 3%).

- Ask a trustworthy friend to send you the money while giving the person physical cash in return.

- Load your Cash app account up in a store.

- Load you account with $300 monthly and get repaid all ATM fees

What ATMs are free for Cash app

- Walmart

- 7-Eleven Stores

- Target

- Walgreens

- Dollar Tree

- CVS

- Family Dollar

- Rite Aid

- Dollar General

Set an Alert to Direct Deposit $300 Every Month

If you want to make the most of Cash App and your Cash App card for free, then you need to be smart.

Set an alert on your mobile to deposit at least $300 on the same day each month.

If you’re worried about being able to afford food, don’t be. Without the risk of incurring an ATM charge, you can withdraw money using your Cash App card throughout the month.

You could even deposit your entire food budget for the month.

This will help you segment your money and stick to a budget without risking any charges on your Cash App card.

Balance

We understand that this is a lot to take on board. It’s also not possible for everyone to make a direct deposit of $300 into their Cash App account every month.

It’s all a matter of working within your means. If you can’t afford to make that kind of deposit each month, then don’t use your Cash App card at an ATM until you can.

You’re better off saving your money and being sensible with it. Instead, try opening a savings account to deposit what you can into each month.

Cash App is a great online bank for bringing all of your funds into one convenient place. You can spend those funds with ease using the Cash App card and deposit more when you need to. It’s also one of the best ways to send money to family and friends since there are no fees between users.

However, things are slightly different when it comes to using Cash App with an ATM.

Cash App Fee Refunds

As we mentioned above, Cash App will refund some fees when you meet particular criteria. That criteria are depositing at least $300 into your account over every 31 day period. As long as you are doing that, Cash App will refund up to three fees incurred at ATMs.

The refunds that Cash App provides cover more than just their $2 fee. They will refund three ATM fees of up to $7 each.

Let’s use our second example above. The one where you were charged $103.50. In this instance, Cash App would refund the $3.50 to your account that you were charged for using the ATM.

If you had three of this sort of fee in a 31 day period and deposited $301 in that same period. Then all of the fees would be refunded.

This is why so many users like Cash App. The fact that they can claim back ATM fees makes the bank worth using. Most people don’t need to use physical cash to buy anything these days.

A card or app is enough. When you have the option to withdraw cash and know you won’t incur any fees, it does nothing but gives you peace of mind about how you’re handling your money.

FAQs

The only way to withdraw money from your Cash App account through an ATM is by using your Cash App card. The process is the same as with any other card. Insert the card, enter your PIN, and follow the options to withdraw money.

Cash App cards can be used in any ATM. There are no restrictions on the type of ATM you can use unless the ATM is exclusively for a certain bank’s customers. The only difference between ATMs when it comes to your Cash App card is the fee that they will charge you for using them.

Find a VISA ATM near you following this link. That way you’ll find a free ATM for Cash app card

Conclusion

Cash App is an incredibly convenient bank, but they want you to make the most of their services. That’s why they’ll refund the $2 ATM fee they charge. Plus whatever fee the ATM has charged you, up to three times every month. All you need to do is deposit at least $300 every month, or make them your primary bank.

Now you know all about Cash Apps fees for ATMs. You might also be interested to learn about the fees for cashing checks at Walmart.

Having to consider that your bank will charge you a fee for doing something as simple as withdrawing cash can be quite taxing. That’s why we’re happy to have provided you with locations of free ATMs for Cash app.

However, the whole point of Cash App is that you can transfer money between accounts without a fee.

If you’re taking cash out at ATMs regularly to pay friends or family, why not get them to get a Cash App account so you can do it without incurring a charge?

This avoids the need for that $300 monthly deposit and makes life easier for everyone.