Many people see a charge on their balance and wonder what is Visa Provisioning Service is on my credit card and is it safe? This and everything you wonder about the transaction will be covered throughout this article.

What is Visa Provisioning Service on my credit card?

The Visa Provisioning Service charge should always show up as $0 on your bank statement and is considered safe. It is related to the tokenization process that many online retailers and digital wallet services are using to protect your sensitive account information. These charges typically fall off your transaction history within a week.

Before you panic about this unexpected transaction in your account history, you should take a few moments to understand why it is appearing now.

If you’d like to read more about whether the Visa provisioning service is safe and what you can do about it, you can read more about this further down in this article.

Here is everything you need to know about the new tokenization system and these charges.

What is Tokenization?

Before you can understand why you are seeing the Visa Provisioning Service charge, you must first understand another concept.

The Visa Token Service is a new security technology that helps to protect you from credit card fraud.

This new system is the reason that you are seeing these $0 charges pop up on your bank account.

The Visa Token Service aims to safeguard your most sensitive account information. In particular, it protects your account number from showing up when you make purchases.

In place of exposing your 16-digit account number, this security measure replaces it with another identifier known as a token.

This token allows merchants to process your payment without ever compromising your unique account details.

How Tokenization Works

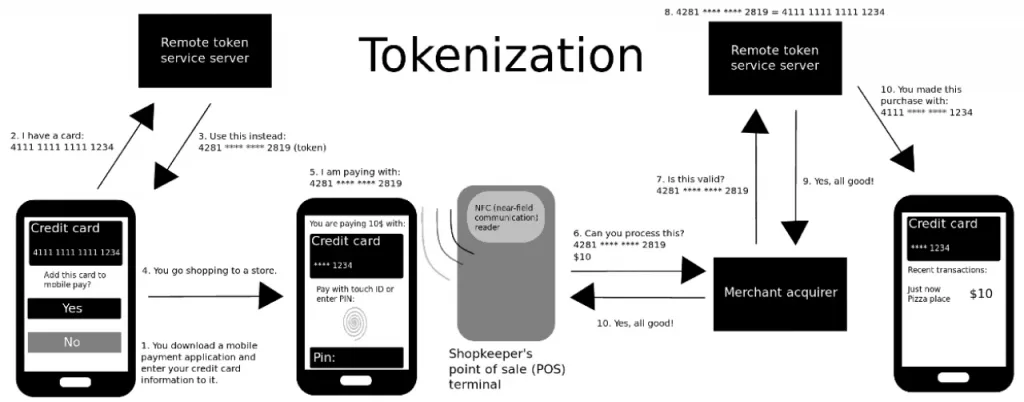

- You will enroll your Visa account with a digital payment service. This could mean through an online retailer or a digital wallet. When you do so, you will enter all of your information such as the account number, security code, and other pertinent details.

- The digital payment service provider will contact Visa to request a payment token for your registered account.

- Visa will share the token request with the account issuer. In this case, it likely refers to your bank.

- Once the account issuer or bank approves the request, Visa will replace your primary account number with the token. This is a completely unique identifier created just for you and your account.

- Tokens get assigned to your transaction, and Visa shares it with the token requestor (your online retailer or digital wallet service).

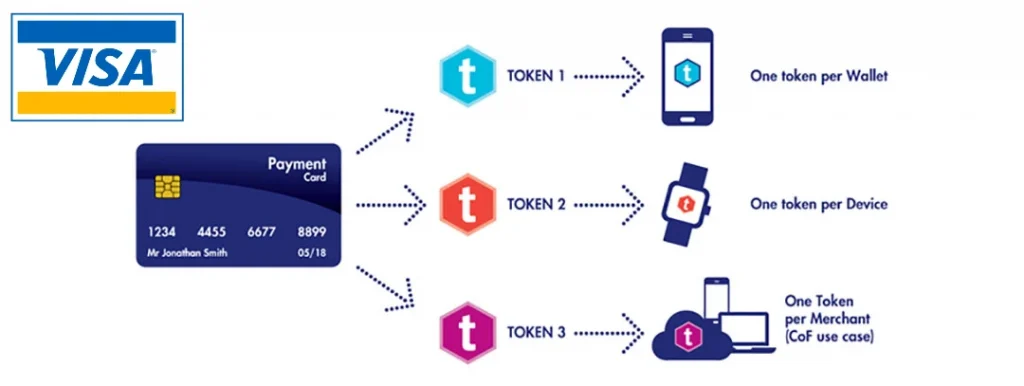

The unique token is assigned to you, but it may not last forever. Sometimes, it is limited to purchases and transactions made from your mobile device.

Other times, the token may be restricted to a specific online merchant.

It is also possible that the same token will apply to a limited number of purchases before it expires.

How Can You Use Tokens?

One of the things you must understand is how exactly tokens are used to process your payments.

They are great for protecting your account information, and you can use them in a variety of situations.

Tokenization gives retailers a more secure method of handling your payment in e-commerce transactions when paying with a Debit- or credit card.

You can also use it in-store if you use your mobile device to pay at the checkout. If you are given the option to pay with a Visa in an app, you might utilize tokenization.

In any of these situations, there is a likelihood that you will see the Visa Provisioning Service charge show up on your bank account.

In order to use the tokenization system, here is how it breaks down to get your payment information to the merchant.

You will initiate the payment, whether that means online or in-store.

The payment service provider (in this case, your digital wallet or merchant) will pass the token to the acquirer. This step is a large part of the authorization request.

The acquirer receives the token and routes it back to the Visa network so that the transaction can process.

Visa sends the token and card payment details over to the issuer (your bank) for authorization. From here, the bank will either accept or decline the transaction before sending it back to Visa.

Last, in the long chain of steps, the acquirer or merchant receives the payment and token.

You are able to process your payment without ever revealing your account number directly to the merchant.

This prevents them from needing to take security measures to protect it. It also gives peace of mind in knowing that nobody can steal this information from a transaction.

What is the Visa Provisioning Service Charge?

A lot of people worry when they see this Visa Provisioning Service charge show up on their bank account.

Even though it amounts to nothing, it can be concerning to come across a charge that you don’t recognize. You should always take things like this seriously, but this fee is relatively harmless.

You are likely to see this fee as a sort of preauthorization from a merchant. This is their way of telling whether the account is valid or not.

You might see this charge for a wide variety of situations, not just when you are doing some online or in-app shopping.

Some direct deposit companies will use the Visa Provisioning Service charge just to check that the account is valid before depositing your paycheck.

The same might be true if you write a check that has recently been cashed.

When you add a card to your mobile wallet, they may initially test your bank account which will lead to one of these charges.

For example, adding a debit card to your Apple Pay account often results in checking your account for active status.

Many online retailers are now going through the tokenization process instead of processing the payment with your account information.

Amazon is one such mega-retailer that is opting to take more caution with consumer payment details. Popular subscription services like Netflix are also starting to use this process.

In the end, the key takeaway is that this Visa Provisioning Service is just a way to ensure that your bank account is active.

Merchants want to ensure that your payment method is valid before approving your transaction. This is one such way for them to check in advance.

Is Visa Provisioning Service Safe and When Should You Be Concerned?

If you have registered your card with any online merchants or digital wallets, you could see a Visa Provisioning Service charge at any time.

For example, when Google converts their card records on file, all users may see this charge appear.

For the most part, this is nothing that you need to be concerned about. The line item may appear, but no direct charges come along with it.

It will not send your account into overdraft or withdraw funds without your knowledge.

Some people may feel better by contacting their bank for confirmation of this. However, you should see the $0 charge drop off your account history in about seven days.

If the charge is still there in a week, you could contact your service provider or bank to inquire about it.

When should you be concerned about this service fee popping up?

Individuals who have never registered their card with a merchant or digital wallet should be a bit concerned.

However, it is relatively rare to find someone who has never registered their card with any online retailers or payment providers.

A possibility always exists that someone stole your card information and registered it to one of these services. If you ever have any concerns regarding compromised card information, you should always reach out to your bank.

While you do so, you should place your card on hold to prevent any transactions from taking place.

You can often do this through the online portal of your bank or through the app. You can remove the hold on the card once the bank reassures you that your account details are safe.

Also check out: How to Activate a Mission Lane Credit Card |? Two Easy Ways

$0 Charges are Nothing to Worry About

The Visa Provisioning Service charge should always come to $0 on your account history. As long as this is the case, you likely have nothing to worry about.

The line item should drop from your transaction history within the week.

However, you can never be too careful. If you see this and do not remember making any recent transactions or saving your payment information, you should contact your bank.

This is the wave of the future, and it is ultimately in your best interest. Tokenization protects your account number from security breaches with online retailers, digital wallets, and more.

This Visa Provisioning Service charge is just a way of making sure that your account remains active.