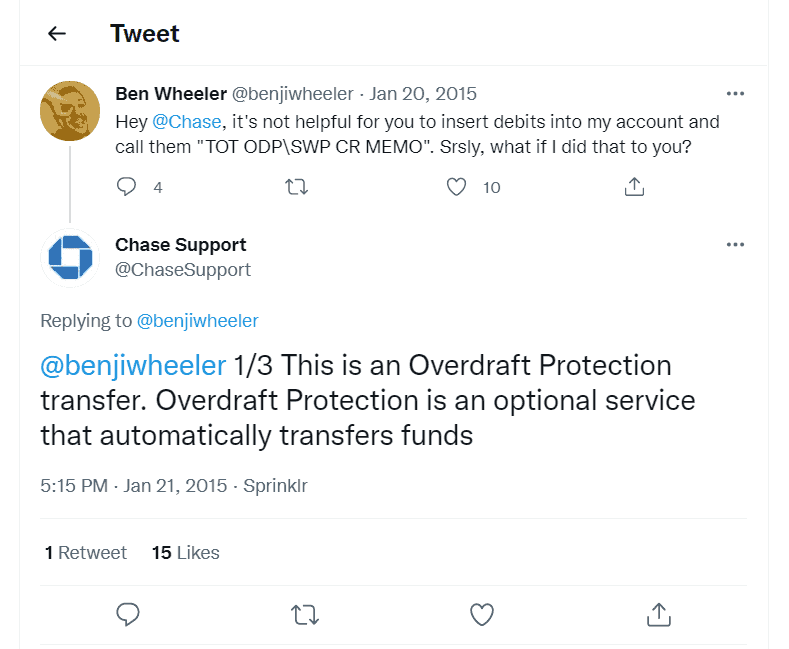

You are scanning your bank account statement and you come across a line item that you don’t recognize.

It reads with just a bunch of letters which makes it hard to pinpoint exactly where this charge is coming from. As a line item, it says TOT ODP/SWP CR MEMO. What does this really mean and what should you do about it?

The TOT ODP/SWP CR MEMO is the abbreviation for your bank letting you know that your account went into overdraft protection. It means they pulled money from your savings account to help cover the cost of going over your bank account balance.

If you need to learn more about what this means, limits, getting money back, or even preventing you from being forced to degrade your checking account. Here is the full breakdown you should know.

TOT ODP/SWP CR MEMO: What it Means

When you see this TOT ODP/SWP CR MEMO on your account, you might start to panic at first. Many people see that their bank account is in the negative when this charge occurs. That is because this line item on your account is for overdraft protection transfers.

In many cases, your deficit will be pulled from another account. This often means that the money you owe will be pulled from a savings account over to your checking account. However, you must have enough money in your savings account to cover the charge.

This makes the overdraft protection transfer a little bit less expensive. If you do not have enough money in your savings account to cover the cost of your purchase, then you will be charged the full overdraft coverage fee.

Some banks have a limit on how many ODP transfers you can make per month. For example, Chase only allows you to do this six times in any given month. If you surpass this amount, they will require you to switch to a different type of checking account.

To make things simpler, you need to pay close attention to how much money is in your bank account at any given time. When you know that you are going to run short on cash, you can sign up for cash advances on popular apps like MoneyLion or Brigit.

For more information on apps like MoneyLion, see our complete guide here.

Can You Get Rid of the Charge?

For those who have already overdrawn their bank account, they might be wondering if there is any way to get rid of the TOT ODP/SWP CR MEMO line item. The good news is that you may have a little bit of flexibility with this if it is your first time.

Reach out to your bank’s customer service department for assistance. Explain to them what happened and why you went over your bank account balance.

If you have not had one of these charges on your account in the past year or so, they may be flexible with you and reverse the charges. It all depends on your individual bank’s policies and how lenient they are willing to be with these charges.

Sometimes, customer service may still refuse to refund the fee back to you. When this is the case, you will simply have to accept that your account has been overdrawn and pay the consequences.

It is a good incentive to pay more attention to the balance of your bank account before making a purchase.

What to Do with Overdraft Protection Fees

TOT ODP/SWP CR MEMO seems like a bunch of random letters at first. It can be difficult to pinpoint exactly what you are paying for, but it is actually for overdraft protection. If you find yourself facing overdraft protection transfer fees, you should contact your bank. This will help you to see what you can do to reverse those charges.