For over a decade, eToro and XM have been competing to become the leading Forex and CFD broker. The battle has been very fierce because both brokers have a lot of exciting features and services to offer, but unfortunately, you can only pick one. This broker comparison is meant to help you choose wisely because we understand how important it is to find the best bro2ker.

Platform ease of use

This content is not intended for US users. eToro USA LLC does not offer CFDs, only real Crypto assets available.

All of your trading activity will take place over the trading platform, and it should be the highlight of any broker. For eToro, the platform is found online on its website or as an app for mobile devices. This company decided to focus on refining its web trader rather than make use of other popular trading platforms like MetaTrader. In fact, in the company’s own blog, it claimed that it found other software unable to match its own features. It is sufficiently powerful, no doubt about that, but some traders will probably feel a bit uncomfortable with the different design.

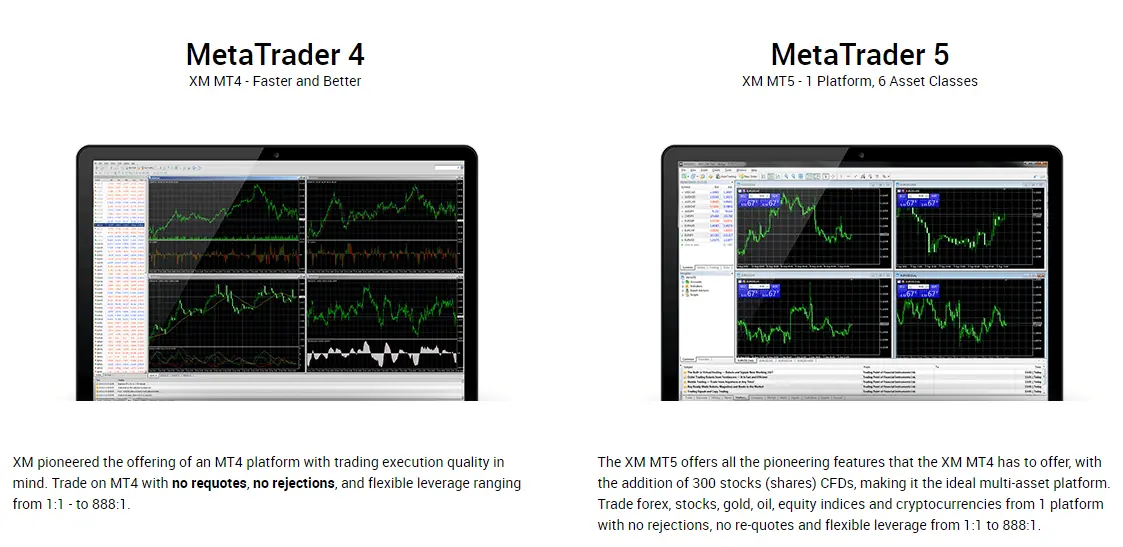

Meanwhile, XM went the way of MetaTrader, offering both MT4 and MT5 trading platforms. In addition, there is also the XM web trader for making trades right from your browser window. MT4 and MT5 are well known by traders globally because of their simplicity and power. Besides, the popularity of the platforms means that there are lots of custom technical indicators and algorithms that can be installed to help you analyze the markets.

Winner is clearly XM for including MT4 and MT5.

Fees

On eToro, trading fees are calculated by spread, and the spread is actually very competitive when compared to the overall market. The spread also applies to CFDs in other markets beyond FX such as stocks, ETFs, crypto, etc. For non-leveraged products including crypto, ETFs and stocks, trading is essentially free except for conversion and withdrawal fees. eToro charges a fixed withdrawal fee of $5 USD, Additionally, a conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted

XM also has a similar fee structure, except that spreads are a bit narrower when compared to eToro. Indeed, when compared to XM, trading fees and other transaction fees are lower across the board, meaning that it is cheaper to trade on XM than eToro.

Thus, the winner is XM for lowering fees.

Deposit methods

eToro

- Bank transfer

- Credit/debit card

- PayPal

- Skrill

- Neteller

XM

- Bank transfer

- Credit/debit card

- Skrill

- Neteller

- CashU

- UnionPay

- Bitcoin

Clearly, the winner is XM.

Interesting features

When comparing two brokers, sometimes the little things can make a difference to a trader. In the case of eToro, the company is very proud to have over 10 million clients from all over the world. This number was attained mainly from its social trading features that allow users to copy trades and read market analyses and discussions from other traders. The company has been very successful in the 12 years it has been around, and it is definitely worth considering.

XM has been around for a decade since being founded in 2009, and already it has over 2.5 million clients worldwide. It may not have as many clients, but XM is known for being very customer-focused. This can be seen in the many promotions offered by XM over the years, as well as the number of seminars hosted by the broker in over 120 cities around the world. We have also already seen how the company really tries to provide its clients with as many options as possible, which is a trademark of XM.

It is impossible to tell which of the two wins in this category as that is a personal preference, so we have a tie.