Trading the financial market and making a profit can be quite difficult. But having the right broker would make your chances much better, which is why it is so important to choose wisely. Two of the most highly recommended brokers around the world are eToro and XTB, but you can only choose one. To help you decide, we have put together this brief comparison of the most important aspects of any broker.

Platform ease of use

This content is not intended for US users. eToro USA LLC does not offer CFDs, only real Crypto assets available.

With eToro, all trading is performed on the web trader provided by the company on its website. To be fair, there is also a mobile app available for both Android and iOS, but trading on a PC is only done on the web trader. The platform is very good at executing trades and analysing the markets, and you shouldn’t have any problems there. In addition, it incorporates eToro’s social trading features, allowing you to find the market analyses and opinions about every asset you’re trading.

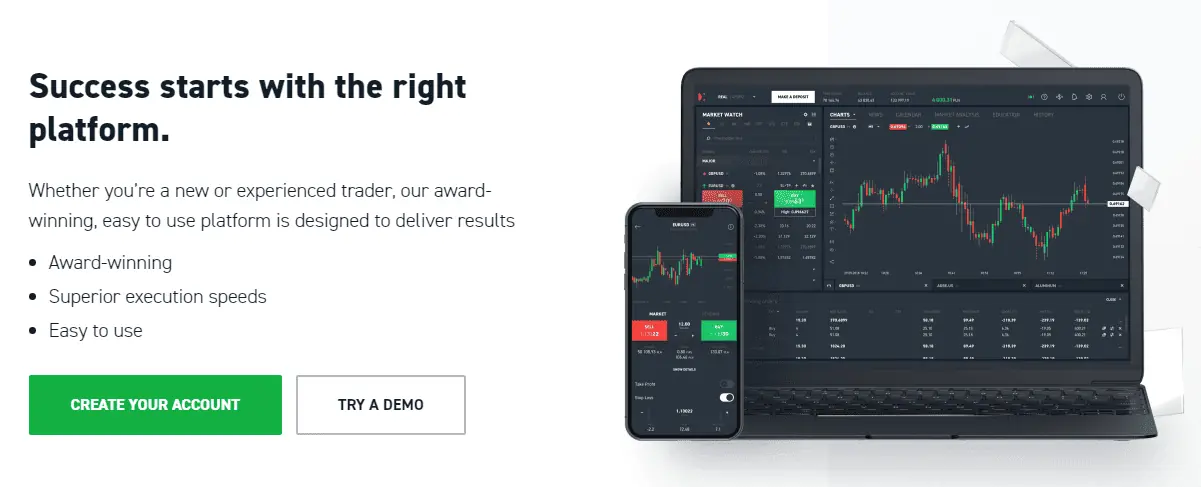

On XTB, there are two different trading platforms, MT4 and xStation 5. You’re probably already familiar with MT4 as it is the most popular trading platform while xStation 5 is XTB’s proprietary software. Both of these trading platforms are also available on mobile devices for traders on the go.

The choice on which trading platform is best is really a matter of personal preference. Some might prefer the familiarity of MT4 offered by XTB while others may favour the simplicity of eToro’s online platform. That being said, XTB comes out on top here because it gives traders an option between two platforms rather than forcing them to use the only thing available.

Trading fees

Brokers make their money by charging fees for various services. eToro charges a fixed withdrawal fee of $5 USD, Additionally, a conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted. The charges on transactions are made in the form of spreads when dealing with CFDs and leveraged products, for instance, trading currency pairs and stocks. As the company also provides real assets without leverage, these products are only charged conversion and withdrawal fees.

At XTB, the fee structure is similar for Basic and Standard accounts where trades are charged by a spread. PRO accounts, on the other hand, are subject to a commission that varies depending on the user’s base currency. Deposits are free for bank transfers and credit card provided they be based on the EUR or GBP. Other methods of deposit will be charged a small commission, and withdrawals below a certain amount will be charged too.

In the end, eToro charges lower fees and therefore takes this category.

Deposit methods

eToro

- Bank transfer

- Credit/debit card

- PayPal

- Skrill

- Neteller

XTB

- Bank transfer

- Credit/debit card

- PayPal

- Skrill

eToro wins by the number of deposit methods it allows.

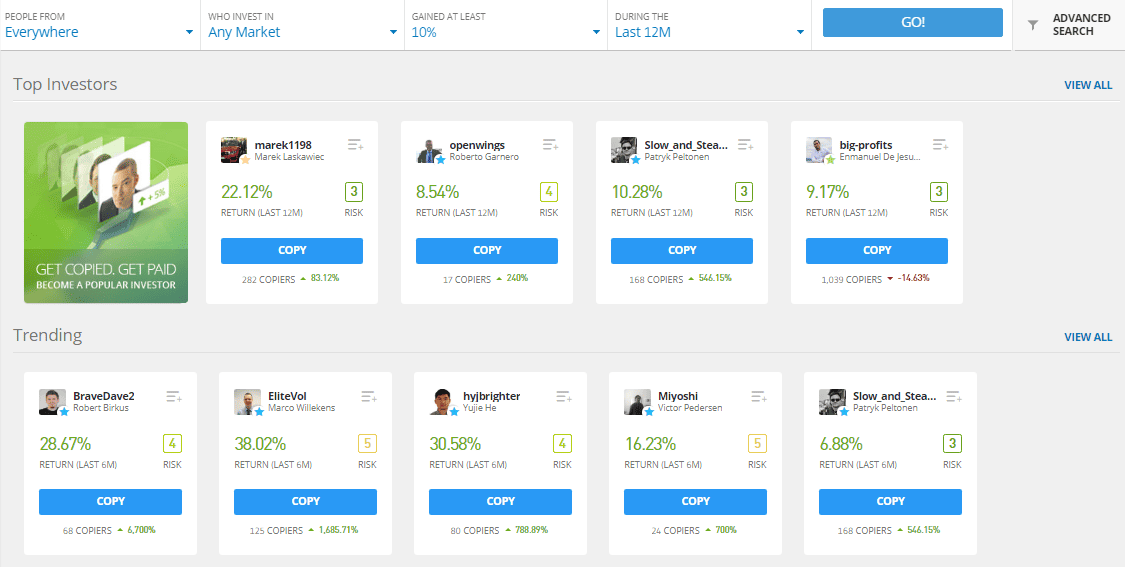

Interesting features

The most interesting thing about eToro is that you can use social trading and apply it in your own trades. This means that you can copy other people’s trades and participate in discussions about the financial markets. XTB doesn’t really have any outstanding features except for its cashback program, but the service is limited to only a few countries.

As a result, eToro is the winner in this category.

Assets available

Both eToro and XTB are primarily CFD brokers focusing on Forex pairs, stocks, indices, ETFs and crypto. They also both have an impressive list of assets available for trade, but XTB appears to have more assets in total – over 1,500 assets. Therefore, the winner in this category is XTB.