Every online broker has that niche they can hang their hat on and also for bragging rights. eToro and ZuluTrade each has a robust social trading program, and we saw it fit to compare the two head-to-head. Choosing a broker is never easy, but we hope this comparison will highlight the strengths of each broker to help you pick one that is best for you.

Platform ease of use

This content is not intended for US users. eToro USA LLC does not offer CFDs, only real Crypto assets available.

Every broker provides a trading platform from where its clients can access the markets. eToro chose to do it through a web trader that is accessible from a web browser on a computer. For the trader on the go, eToro further provided mobile apps that can be installed on either iOS or Android. A snapshot of the platform itself can be seen below, and it is clear that the platform has been made very simple to understand and use. Despite the simplicity, this web trader is still capable of handling all commands and market analysis so that you don’t lose out.

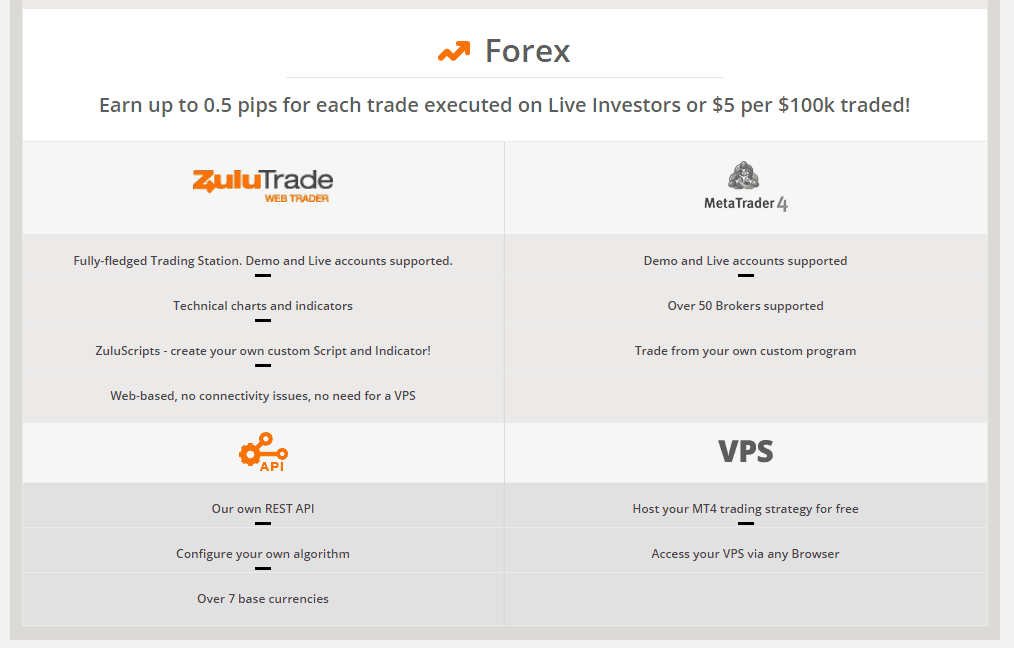

ZuluTrade also provides a web trader, a snapshot of which can be seen below. The platform is not as simplified as that of eToro, but it’s not too difficult to use either except for a short learning period. Fortunately, one doesn’t have to learn about ZuluTrade Plus if they don’t want to because MetaTrader 4 is also available for download on mobile devices and PC. MT4 is the most popular trading platform, and thus easier to understand for most traders.

Because of MT4 availability, ZuluTrade wins this round.

Fees

Trading fees on ZuluTrade become a bit complicated because there can be two types of accounts – trader account and investor account. With a trader account, you are broadcasting your trades to investors, for which you get compensated. Your trades will be charged by a spread that varies by market volatility, but you also earn a 20% performance fee every month from the profit you generated from your investors. Investors, on the other hand, get charged $30 subscription fee every month as well as a 25% performance fee. With this investor account, however, you can still make trades but get to enjoy a discount.

eToro fees are much simpler because there are no different account types. With the same account, you can become an investor who copies trades and a trader who broadcasts trading signals. You will need to pay only if the signal provider charges a subscription fee. As a result, trading charges remain the same across the board because there are no differences in account types. CFD trading is charged by a spread and real asset trading is free. Deposits are free but there is a $5 charge for all withdrawals. eToro charges a fixed withdrawal fee of $5 USD, Additionally, a conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted .

eToro is thus cheaper and wins this round

Deposit methods

eToro

- Bank transfer

- Credit Card (Visa, MasterCard, Diners Club, Maestro),

- PayPal

- Neteller

- Skrill

ZuluTrade

- Wire transfer

- Credit/debit card

- Skrill

- Neteller

- Giropay

- EPS

- Sofort

- iDeal

- Przelewy24

- QIWI

Although many of the above deposit methods are only available in Europe, it still means that ZuluTrade wins.

Available assets

eToro offers assets such as Forex pairs, stocks, indices, commodities, ETFs and cryptocurrencies. These are usually in the form of CFDs, but ETFs and stocks can also be available as real assets except that leverage is not applied. With ZuluTrade, the company only offers Forex pairs and indices. However, ZuluTrade partners with many other brokers and simply provides a platform for social trading. In so doing, you can create an account with just as many assets as eToro or more and use ZuluTrade to copy trades from other traders.

In this way, we can say that ZuluTrade technically has access to more financial assets and therefore wins in this category.

Special features

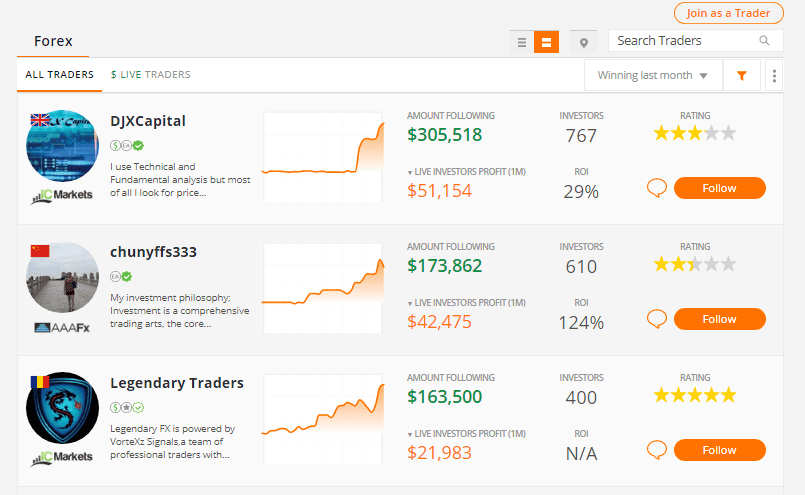

Both ZuluTrade and eToro are known as leaders of social trading in the world. Each of the brokers, however, has gone about it in a different way but a lot is still the same. One similarity is that with both brokers you can copy trades from individual traders. Below is a snapshot of what it looks like on the ZuluTrade window.

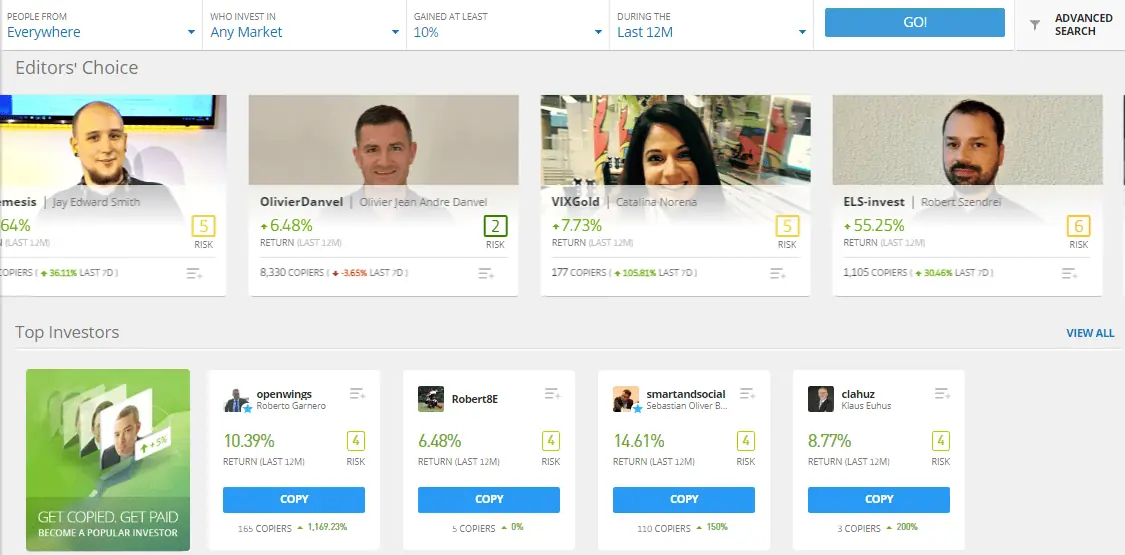

ZuluTrade will indicate a trader’s philosophy and their profitability so you can choose if you want to copy their trades. Below is a similar window from eToro with the only difference being the interface.

Despite the difference in looks, the services are similar. Another similarity is that they also both allow you to copy a combination of trades based on your risk appetite. eToro refers to the service as CopyPortfolios while ZuluTrade refers to it as Traders’ Combos, but really it’s the same thing.

Considering that the social trading features between these two companies are very similar, we have ourselves another tie.