Capital One is a world-renowned bank. Businesses and individuals around the world use the company because they meet everyone’s banking needs. For the most part, they are the perfect bank, providing you enjoy their services. However, sometimes the bank does things that make users question their motives. In this guide, we’ll be covering why Capital One might have closed my, yours, or anyone’s checking account for seemingly no reason. We’ll also be going through the next possible steps to take if your account has been affected.

There are two reasons that Capital One might close an account. The first is due to suspected fraudulent behavior. The second is inactivity. The most likely scenario is that Capital One would cancel a checking account due to suspected fraud, either on the part of the account owner or a third-party who they believe has acquired details for the account.

Next, we’ll explain the two core reasons that Capital One would close an account in a little more detail.

Why Has Capital One Closed my Checking Account?

If you’ve found that Capital One has closed your checking account for no reason, then it’s almost certainly because of suspected fraud. When users contact Capital One because their account has been closed, the most common reason given is fraud.

If you’ve found that Capital One has closed your checking account for no reason, then it’s almost certainly because of suspected fraud. When users contact Capital One because their account has been closed, the most common reason given is fraud.

Fraud

There are two types of fraud that would cause Capital One to close a checking account.

1. Third-party fraud

They might suspect that a third-party has gained access to your account details. They won’t be able to explain how they know this due to how fraud systems work. However, they will take all funds from the account and send them to your linked account.

The only reason Capital One will withhold your funds is if they suspect that they have been gained illegitimately or illegally. In most cases, the money will be released once an investigation into the suspected fraud has been completed.

2. Private fraud

The second reason that Capital One would close your checking account is that they believe that you have been committing fraud. In some cases, this is an automated response. Some users have reported that when they have been depositing funds from their Amazon business, it has triggered the bank to close their account.

All banks use similar software to track fraudulent activity. In some cases though, the system gets things wrong. This is when people’s accounts get closed for no reason.

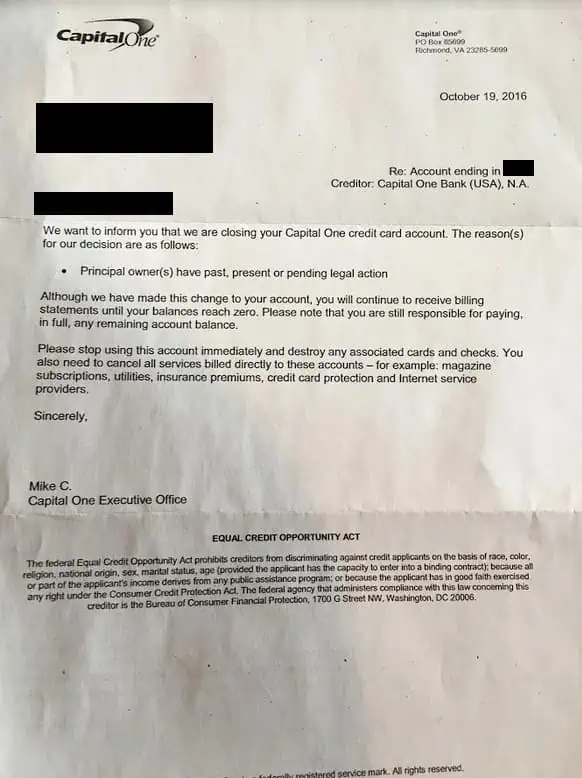

Why Has Capital One Closed my Credit Card Account?

Inactivity

The main reason that Capital One closes credit card accounts is inactivity. If you don’t use your credit card for a few months or a year, then Capital One will close it without warning. This prompts many users to panic and get in touch with the bank, but the closure is completely normal.

Unfortunately, this is simply an example of bad practice in terms of user experience. Many people hold onto their credit cards without using them so that they can use them in the future. For Capital One though, unused credit cards are an issue. They want their credit card customers to be spending money and paying interest. The bank will close inactive credit cards because they look bad on their financial results. They’d much rather have active credit cards on there which are earning them money.

Fraud

Of course, it’s still possible that Capital One will cancel your credit card account because of suspected fraud. If they believe that a third-party has accessed your card details, then closing it is safer not only for their users but also for them.

The issue with Capital One closing credit cards for no reason is that it will affect the owner’s credit score. If you suddenly lose a credit card, your available credit goes down. This, in turn, will lower your credit score because it looks like a bank has denied you credit. For this reason, it’s important to continue to use your credit cards, even if you only make a small purchase on them each month.

What to do if Capital One Closes Your Account

If you’ve found that Capital One has closed your account for no reason, then you need to get in touch with them straight away. You can do this in two different ways:

through the official website or by phoning them on 1-877-383-4802.

- Go to the Official Website – Here you’ll find simple FAQ answers and email contact information

- Phone them – You can call them directly at 1-877-383-4802

If you phone Capital One, then you will be able to speak to a staff member directly. In some ways, it’s easier to explain what you’re trying to find out on the phone. However, it’s just as easy to type out your query and use the live chat service on the bank’s website.

Why is the bank not giving clear answers?

Some users have reported that Capital One can act strangely when discussing account closures even if they’re speaking to the account owner. There are two reasons for this.

The first is that Capital One’s fraud software may have flagged the account. If this is the case, then the staff will be suspicious of you. They won’t want to provide too much information before their fraud investigation is complete. They may end up giving something away that will hinder it otherwise.

The second reason Capital One staff may act strangely is that they have closed your account for no reason. As we mentioned earlier, sometimes fraud detection software gets it wrong. As such, staff members have policies in place for what they can and can’t say to customers when an account has been incorrectly closed.

An example of this is the staff insisting that the account was closed for a good reason, but they can’t go into the details. They’ll then tell you that any money from the account will be sent out within a few working days at the time of closure. However, it’s often the case that the money fails to appear, and the staff members will keep pushing out how many working days it will take for the funds to clear.

Protect Yourself and Your Money

It goes without saying that you should always protect your card and account details. This will help you avoid a situation where your account is closed due to fraudulent behavior. However, it’s more important to hold a bank accountable when they’re in the wrong or owe you money.

In the case of Capital One, it’s best to phone them every day until the money from your closed account has come through. If you don’t, there’s a good chance that the bank has lost your details and will simply wait for you to stop contacting them before closing the case. The more you contact them, the sooner they’ll give you the money you’re entitled to.

However, if there has been a case of fraud, it’s better to leave the case well alone. Allow Capital One to conclude their investigation. This will see your money returned to you as soon as possible, and it won’t muddy the waters of the investigation either.

Conclusion

Unfortunately, sometimes Capital One close accounts, credit card, and checking, for no reason. Fraud-related issues almost always cause this, but sometimes it can be due to account inactivity as well. The best thing to do is get in touch with Capital One and identify the issue before doing anything else. Speaking to the bank directly will clear up any and all issues within moments.

If your account hasn’t been closed, but it’s been restricted, then check out our guide on why it might have been.