eToro and Binance are fundamentally different in that the latter is strictly a crypto exchange while the former handles that and much more. For the sake of this comparison, we shall look at eToro mainly for its crypto trading services just to make things fair. That being said, both of these companies have a global reach and excellent reputations, so we think it will be incredibly helpful to highlight each of their strengths and weaknesses.

Platform ease of use

This content is not intended for US users. eToro USA LLC does not offer CFDs, only real Crypto assets available.

All your trading activity happens over the platform, so it’s an essential part of the company’s services. Both of these companies have clearly put a lot of effort into the design of the trading platform, but you will notice a key difference. Below is a snapshot of the eToro trading platform.

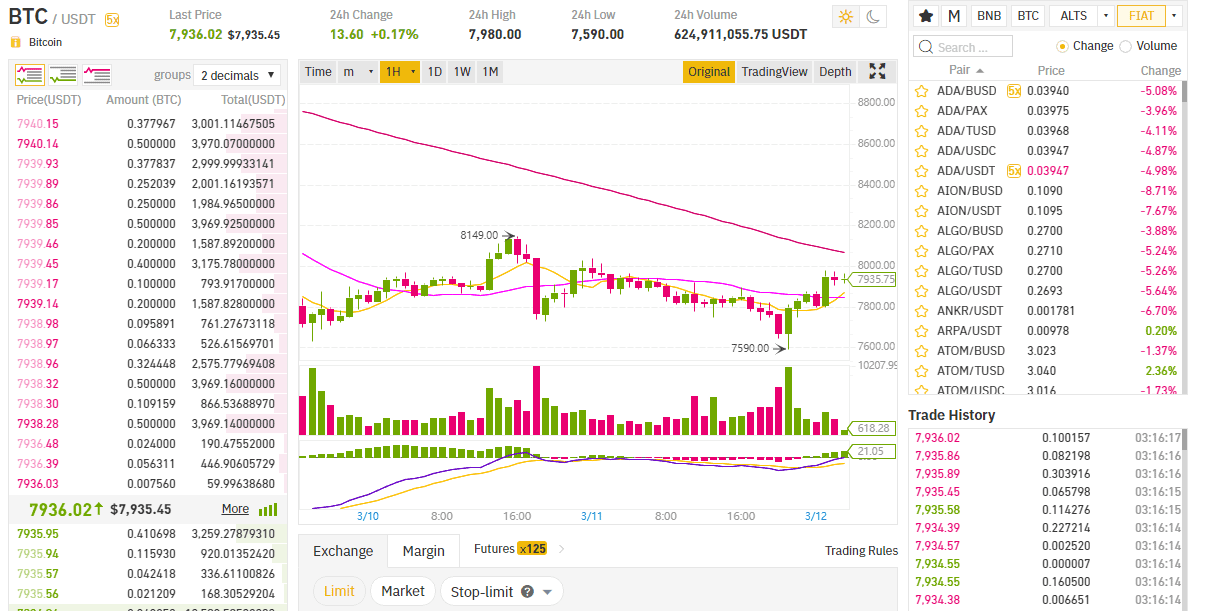

You can see that the window is divided into sections for different functions for easy navigation. Meanwhile, the screenshot below is of the Binance trading window. Can you spot the difference?

Clearly, the Binance trading window seems a lot more complicated. Believe it or not, that is the simplified version because a more complex one is also available.

This ease of use makes eToro a winner in this section.

Trading fees

How much you pay can mean the difference between keeping your profits or losing a huge part of it. eToro clients enjoy very low trading fees since the entire fee structure is based on a spread. For instance, trading Bitcoin incurs a spread of 0.75% on each trade since it is in the form of a CFD. This is much lower than the market average and thus makes it appealing to many traders around the world. Moreover, traders can trade actual coins by opting out of leverage. In that case, there are no spreads either, leaving only the cost for converting fiat to crypto and vice versa.

On Binance, a commission is charged for all trades, and the amount charged depends on whether you are making the market or taking away from it (maker/taker fees). At the lowest rung, maker/taker fees are tied at 0.1% and these can go as low as 0.02%/0.04%. More discounts are available when using Binance Coin (BNB) and other reward programmes.

As a result, Binance wins for lower trading fees.

Deposit methods

Making a deposit into your Binance account is only done by crypto or credit card. The platform offers over 150 different coins, and a deposit can be made into your wallet through any of these coins. Deposits by credit card are also possible, but one would have to verify their identity for AML/KYC policy adherence. On eToro, it’s possible to transfer money from the crypto wallet to the trading account and vice versa, which means you can deposit money using either crypto or any of the other methods available for non-crypto traders. These methods include credit card and e-wallets like PayPal and Skrill.

Technically speaking, Binance has a higher number of deposit methods, so it wins in this round, but only on a technicality.

Special features

eToro is most widely known for enabling social trading. It was one of the first companies to integrate the service, and today it has the largest social trading network in the world. That means traders who don’t even have the skill or knowledge about crypto markets can still trade profitably thanks to assistance from their peers. This is not possible on Binance, although the exchange is known for something different. Some unique features on Binance include the ability to stake coins and earn from that, as well as the presence of crypto futures and lending features on the platform.

This section is a tie because each company has a valuable and unique feature that would appeal to a different individual.

Available assets

If we were to count the number of cryptocurrencies offered by these two platforms, then Binance would be the obvious winner. But we did mention that eToro offers more than just crypto trading, and that gives it an edge over a crypto exchange like Binance. For crypto traders, Binance would be the obvious choice because of a wide selection and use of leverage. But general traders looking to diversify would certainly enjoy the variety of asset classes.

For this reason, it is once again a tie between these two platforms.