A quick search for the top online brokers today would probably bring up both eToro and Revolut. That’s a problem for you, which is why you’re reading this now, trying to decide the best among the two. To determine the true champion, you have to look at these two companies on different scales and judge the services separately. Only after doing this will you find the actual winner. Have a more extended read about which broker is the best between eToro vs Revolut, or check out our quick summary made for you below.

| eToro | Revolut | |

| Overall score | 4.9/5⭐ | 4.0/5 ⭐ |

| Trading platform | 5/5 | 2/5 |

| Fees | 4/5 | 4.5/5 |

| Markets and products | 5/5 | 3/5 |

| Pros | Extended products and unique products such as copy trading | Easy to use and perfect for day to day bank account use |

| Cons | Fee’s could be better. | Super limited functions. |

| License | CySEC | FCA |

Overall all verdict – Etoro is the winner.

This content is not intended for US users. eToro USA LLC does not offer CFDs, only real Crypto assets available.

Etoro is a clear winner here for investors and traders since they are not as limited as Revolut, but to make your own call feel free to read through the article below, where we go through everything in depth.

Platform ease of use

eToro has been in business for over a decade since being founded in 2007, so it would make sense that the company has refined its trading platform to point. Indeed it has, and the eToro trading platform is not only one of the easiest to use around but also one of the most powerful and loaded with technical tools to aid you in your market analysis and trading.

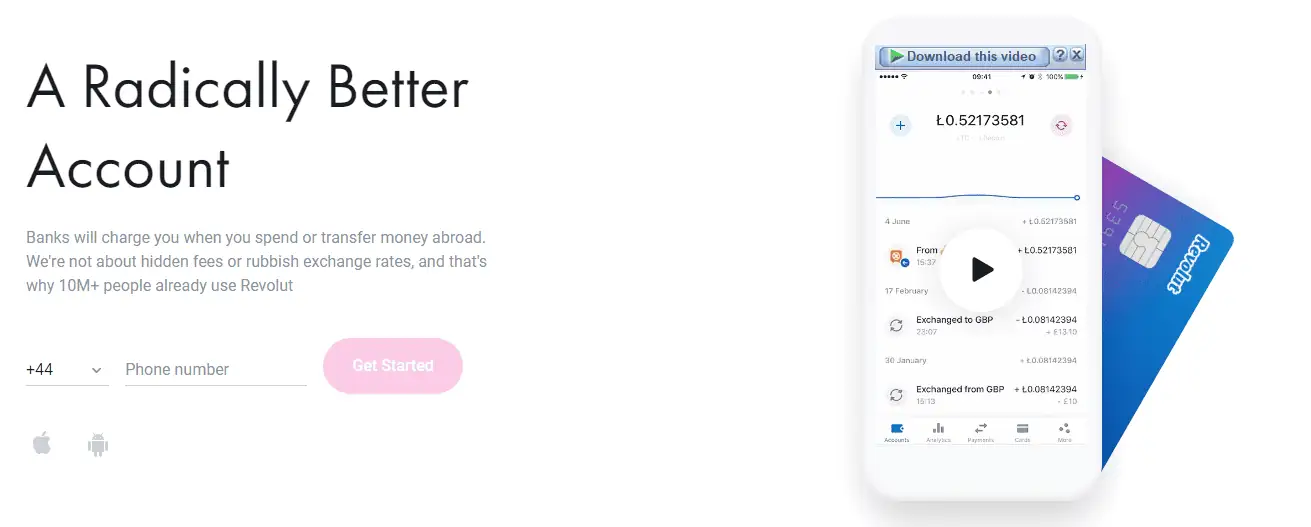

Revolut has a shorter history than eToro and has been active since 2015, but it has also created a very intuitive and easy-to-use app for iOS and Android. The only problem is that the company only offers the app but does not have a PC platform. Since the app is great at navigating different markets and placing orders, it still can’t give a trader extra precision to study the markets.

? The winner here is certainly eToro.

Fees

eToro charges a fixed withdrawal fee of $5 USD, Additionally, a conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted. Orders made on CFD trades will be charged a spread, while orders on non-leveraged products will be charged conversion fees only. This structure ensures traders don’t incur too many costs, especially when trading frequently.

On the other hand, Revolut has tried to make commission-free trading possible by eliminating most of the fees up to a point. A standard account with Revolut is free to open and run, but you only get 3 free trades a month, after which a commission is applied to every trade. Premium customers pay £6.99 a month, but in return, they get 8 free trades a month, and Metal members pay £12.99 a month to enjoy unlimited commission-free trades a month.

The winner has to be eToro for keeping fees low all around and not just favorable either for those who have funds to spare or don’t make a lot of trades.

? And the winner is once again eToro in the green corner.

Deposit methods

It would be no good to have a trading account if you can’t deposit money into it and do so in the most convenient way. eToro gets this and has subsequently made many deposit methods available to its customers. If you don’t mind waiting a few days to start trading, then bank transfers are allowed. But for those who prefer instant deposits, you can choose between credit/debit cards and e-wallets like PayPal and Skrill. Crypto deposits are also available in your eToro wallet for those who prefer.

On Revolut, your options are limited to bank transfer and crypto. Unfortunately, crypto transfers are only allowed from one Revolut address to another and not from external wallets. You can also link your credit card to your Revolut account and execute trades from it, which might be considered another deposit method.

? In the end, eToro takes the cake for most deposit methods.

Assets available

eToro has a variety of markets one can access, such as Forex pairs, stocks, bonds, ETFs, commodities, indices, crypto, and several others. In each category, there are also plenty of options to choose from, making the overall list of assets quite long. It would make sense considering how long the broker has been around, unlike Revolut.

With the latter, its goal was to make commission-free trading of stocks possible. Today the company provides access to over 450 US stocks and 5 cryptocurrencies. The number of stocks is impressive, but a limit on other markets drags down the trading experience.

? Thusly, eToro takes the win yet again.

Unique features

A unique feature of eToro is in social trading. No other broker in the world has such a vast network of traders allowing for the publishing and copying of trades. It not only helps new traders make money even without the necessary skills but also gives skilled traders a new way of earning money from their expertise. Revolut too, is unique in its own way in that it serves its clients by being a revolutionary digital bank offering free stock trading. A problem arises when certain users can’t enjoy the service because it is only available within Europe.

? As a result, we have to give eToro the trophy once again.

Although eToro came out as the winner on all tested metrics vs Revolut, we have to pinpoint that Revolut wasn’t far from taking home some of those, but so far, we are sure that eToro is the better trading platform between the two.