Mercury Bank is one of the most well-known names in the financial industry for startups, particularly when it comes to tech companies. They offer a wide variety of banking options for United States businesses who want to utilize an online bank. If you don’t need a bank with brick-and-mortar locations, you might want to get some more information from this Mercury Bank review.

Mercury Bank is a secure option for startups who need a basic checking and savings account. They have straightforward fees and free accounts at every level of funding. This San Francisco-based bank is ideal for businesses based in the United States, especially those in the tech industry. Mercury offers a great online platform, but they do not accept cash deposits.

Mercury Bank Review: Account Types

There are two different account types that you can choose from at Mercury. Most new startups begin with their standard account that has no minimum balance requirements. It supplies you with:

Tea Room is their more exclusive account type, built for startups that have generated quite a bit of capital. You must have $250,000 in deposits to qualify for this type of account. Once you hit this magical number, you still have access to the same features as the standard account, but you will have some additional perks.

For example, you will gain access to Mercury Treasury as part of your membership. Treasury is an automated cash management account where you can invest extra cash into government securities and money market funds. This allows your money to work harder for you by improving yield on cash that would otherwise just sit in your account.

There are no minimum balances for using Treasury, but you do have to be a Tea Room member. Funds invested in Treasury have a $500,000 SIPC insurance. This type of insurance does not cover the loss that may naturally happen when securities decline in price. However, it does protect you if the brokerage fails.

Opening a Mercury Account

You should know that only United States companies can bank with Mercury. As long as your business is based on United States soil, most businesses can open an account even if they personally reside in another country. There is a long list of countries where you cannot open an account, including:

If you want to bank with Mercury, you should be aware that they do not accept sole proprietors or trusts. You will need a federal employer identification number (EIN) to open an account. Apart from this exclusion, they accept most types of businesses even though they focus mainly on tech companies. There are a few types of businesses that they cannot accept as customers, including money services, adult entertainment, marijuana, and online gambling.

Keep in mind that this is an online bank which means it may not be a good fit if your business has a retail location that relies heavily on cash. They do not accept cash deposits as they have no physical locations for you to take them to. However, they are a great solution if you can handle all of your banking digitally.

You do have the option to withdraw cash at the ATM, though. Their debit card program is a part of the Allpoint ATM network that has more than 55,000 locations nationwide. When using an Allpoint ATM, you will not incur any additional fees. For out-of-network ATMs, Mercury does not charge any fees other than what the ATM fee is for that particular network.

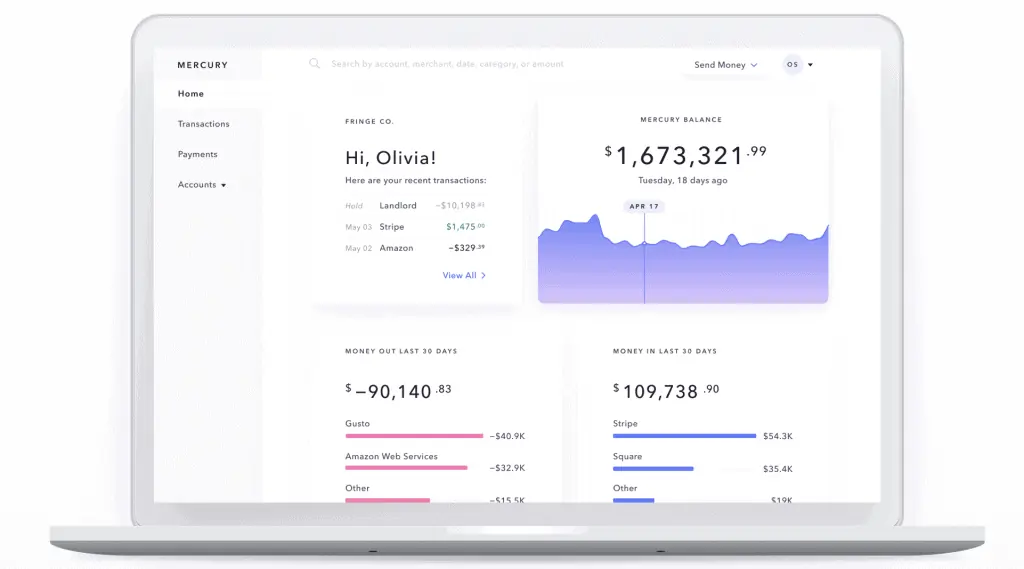

Online Tools

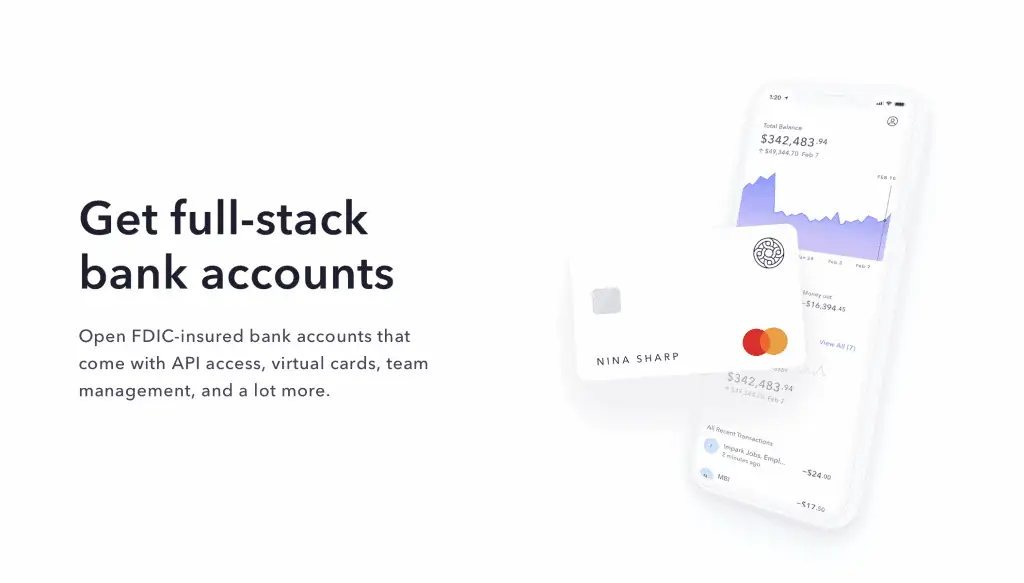

Mercury gives you access to digital tools that your business needs to function properly. With their online app, you can take care of virtually everything your company needs, including sending and receiving payments and tracking your transactions. Your new Mercury account can integrate with other popular third-party programs like QuickBooks, Xero, Shopify, and Stripe. Better yet, connecting them is a lot more intuitive than some integrations offered by other apps and programs.

You can create virtual debit cards for yourself or other users, as well as manage everything related to your physical debit card.

One of the main benefits of their digital platform is that it allows you to add users at two distinct levels. Admins can move money around and can receive their own unique debit cards for company purchases. On the other hand, bookkeepers can view your transaction history without the ability to spend company money.

Tech companies and startups love Mercury because it gives them API access with every account type. This gives you the ability to customize and automate your account in the ways that make the most sense for your business. You can create transfer rules, reconcile financial transactions, and even set up bulk payments. This access is granted for every user, not just those who qualify for the more advanced Tea Room accounts.

Mercury Bank Review on Security

Security is one of the top features that you should consider in any Mercury Bank review. They prioritize the safety of client information above all else. Banking with them ensures that you never have to worry about someone stealing your personal information or data. For starters, they always require HTTPS on each page of their website. Mercury only uses HSTS so that all browsers have to connect to their main system over a secure connection.

Once each year, they hire a third party to perform penetration testing to check for vulnerabilities. This helps to ensure that your money is kept safe from hackers.

Some companies store your passwords in a plaintext document, but Mercury never does. All stored passwords are encoded with a bcrypt algorithm for enhanced security. You may also be asked for time-based passwords designed for one-time use in order to maintain two-factor authentication. These secure codes are never sent via insecure channels like via text message.

Everything in their database, including images, is encrypted. Additionally, they utilize an extra layer of encryption for all sensitive data such as social security numbers and personal details. Debit card numbers are never stored on their servers.

Of course, it should go without saying that the money you place in Mercury Bank is also FDIC-insured. They work with and store your deposits with insured banks such as Evolve Bank & Trust. You can recover a maximum amount of $250,000 if your funds are stolen or if the bank fails. This is the protection afforded to you by the Federal Deposit Insurance Corporation (FDIC), an independent agency of the United States government.

Costs

No Mercury Bank review would be complete without mentioning the cost of signing up for one of their bank accounts. There is good news for all startups who want to find the perfect banking solution: Mercury accounts are completely free. This is excellent for startups who want to keep their monthly expenditures low because they are on a lean budget.

Mercury charges nothing for account opening fees or monthly fees, and there is no minimum account balance. You get access to all of their bells and whistles for free. Even sending money electronically through ACH to another account is free.

The only thing that you may pay for is outgoing wire transfers which cost $5 to domestic companies and $20 for international transfers. Tea Room customers pay nothing at all for wire transfers, and incoming wire transfers are always free for everyone.

How to Open an Account

Opening an account is a fairly straightforward process, although it is not completely self-service. To do so, you can fill an application out online here. The application will cover basic information about your business and will require your social security number. Also, Be sure to have information on your co-founders handy. Anyone with more than 25 percent ownership or those who have control of the finances must be included in the application.

For every person included on the application, you will need to submit proof of a government-issued ID. In addition, you will also need your EIN number from the IRS.

A customer service representative at Mercury Bank will review your application and get back to you. Once approved, you can start to transfer funds into your account. You can access your bank account through their mobile app (not yet available for Android users) and start to utilize all of their tools.

Mercury Bank Review: A Great Option for Startups

Overall, the Mercury Bank review is mostly positive. Once approved for an account, you have access to many features through their app and can start to automate your processes. They focus more on tech companies and startups, but anyone without cash deposits could benefit from one of their free accounts. Consider whether they might be a good fit for your company.