Cash App has been consistently topping the charts for the top free financial applications from Google Play to the Apple Store. By helping thousands of people who often come from underbanked, underserved, or overcharged communities, Cash App lets users access financial services with ease. In 2018, Cash App came up with an innovation that helps employers disperse payments to their employees safely and securely through its direct deposit feature.

What is a direct deposit?

A direct deposit is when funds are transferred electronically from one bank account to another. Direct deposit utilizes networks called an Automated Clearing House, which allows deposits to reflect automatically through bank apps, or e-wallets.

Before direct deposits, customers would have to go to a bank branch and provide physical money or paper checks to make a deposit. With innovations such as Cash App, users can send funds from anywhere in the United States with an internet connection.

Many Cash App users have jobs that make it difficult to go to traditional banks or live in areas where they can not easily access financial services. From paychecks to allowances, Cash App’s direct deposit feature lets depositors deposit money and give payees access to their funds remotely easily.

Five Steps to Direct Deposit on Cash App

Here are the five steps that you need to do for you to be able to fulfill a direct deposit on your App.

- Verify your Cash App

- Activate your Cash App Card

- Get your Bank Account and Routing Numbers

- Provide the Bank Account and Routing Number from Cash App

- Check if the Direct Deposit Was Successful

Here is how to direct deposit on Cash App in detail:

1. Verify your Cash App

Most Cash App users will already have their accounts linked to their bank accounts during their initial sign up process. While Cash App does not require its users to verify their identity, there are many benefits to doing so. One of them is to be able to use the Cash App direct deposit feature.

The following details will be requested by Cash App to verify your account:

- Your full name

- Date of birth

- The last four digitals of your SSN

- Your mailing address

Once you have these on hand, you can proceed to verify your Cash app through the following steps:

- Open Cash App

- Click on “Balance”

- Select ”Add Card”

- Type in the personal details above as instructed

- Provide your Social Security Number (SSN)

- Take a picture of any government-approved ID

- Take a selfie

Only users who are 18 years old and above will be verified and allowed the request for a Cash App Card. You will not be able to proceed with setting it up. With 24 hours, the confirmation for your Cash App account should arrive.

[irp]Now that your Cash app is verified, you can now activate your Cash App Card.

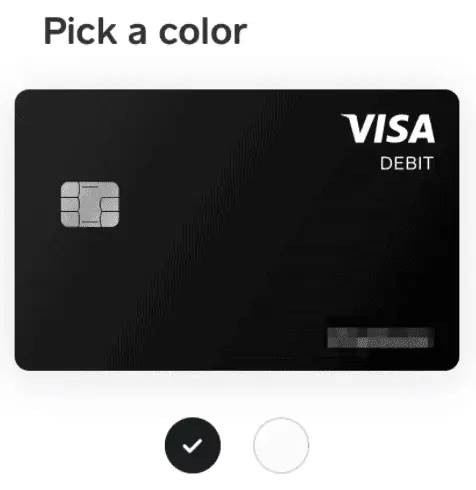

2. Activate Your Cash App Card

Before you can be allowed to direct deposit on Cash App, you must first set up your Cash App Card. Linked to your Cash App balance, the Cash App Card is a free and easy to use debit card.

To activate your Cash App Card, you must first request for one through your Cash App.

How to Request for a Cash App Card

While all verified Cash App accounts can have Cash App Cards, you will still have to request for it. The good news is, you can get your own Cash App Card through your Cash App. Here is how:

- Open Cash App

- Select “Cash Card” or the rectangular icon on the lower-left part of the screen

- Tap “Get Free Cash Card”

- Choose your desired color (black or white)

- Select “Tap To Customize”

- Write or draw your signature and select “Done”

- Enter your mailing address and tap “Next”

- Confirm your first and last name and tap “Next”

- Review the fees, terms, and conditions and tap “Continue”

It would take at least ten days for you to get your physical Cash App Card in the mail. You can now proceed to activate it.

Even if you have not received your Cash App Card yet, you will already be able to proceed with getting your bank account and routing numbers. Here is how to find them on your Cash App:

How to Activate your Cash App Card

Once you get your Cash App Card, there are two ways to activate it with and without a QR code. Activate your Cash App Card with QR code with the following steps:

QR Code method:

- Open Cash App

- Select “Cash Card” or the rectangular icon on the lower-left part of the screen

- Tap “Activate Cash Card”

- Scan the QR code using your mobile phone or device camera

If you prefer to activate your Cash App card without the QR code, you can also do the following:

- Open Cash App

- Select “Cash Card” or the rectangular icon on the lower-left part of the screen

- Tap “Activate Cash Card”

- Select “Missing QR code” and then select “Use CVV instead”

- Enter your CVV code and card expiration date on your Cash App Card

- Click “Confirm”

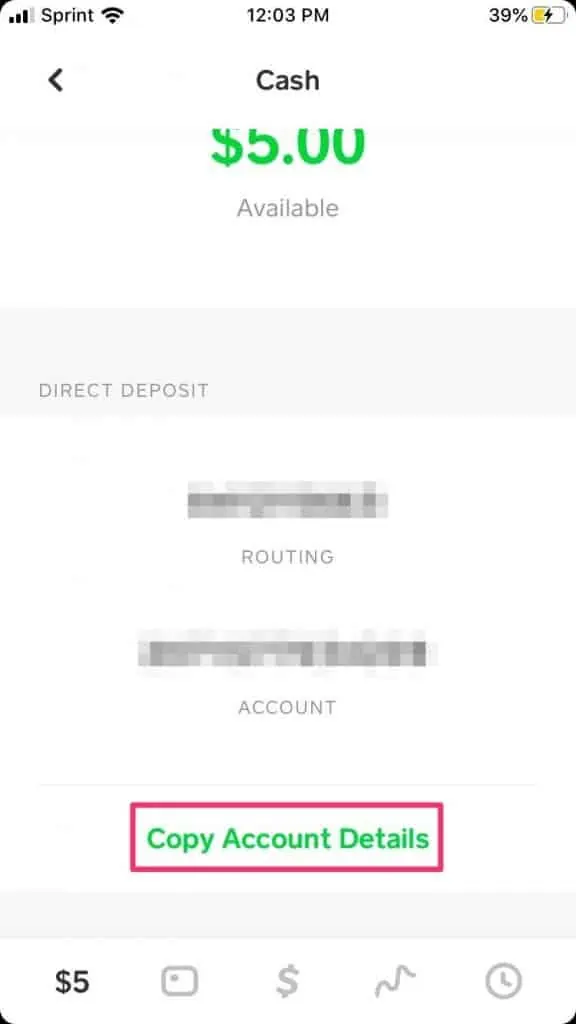

3. Get your Bank Account and Routing Numbers

Upon sign-up, Cash App will assign a bank account and routing number to your account. However, you must first enable it. To access your Cash App account number, follow these steps:

- Open the Cash App

- Tap on the “My Cash” tab next to the green $ sign on the lower-left corner of the screen

- Click “Cash”

- Scroll down and select “Direct Deposit”

- Tap “Get Account Number”

- On the pop-up screen, confirm by tapping “Enable Account”

- Click “Copy Account Details” and “Copy Routing Number”

- Take note of the Bank Account Number and Routing Number

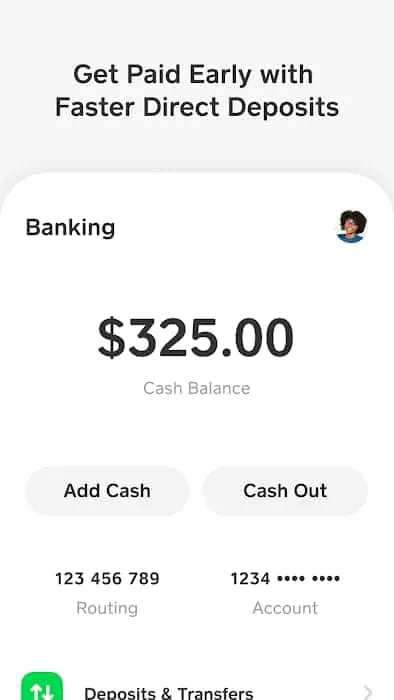

4. Provide the Cash App Bank Details to Your Depositor

Once you have a copy of your bank account and routing number, you will be able to send it to whoever will be making a direct deposit to you.

For the depositor to put funds into your account, all they have to do are the following:

- Open the Cash App

- Tap the “Banking” tab found at the lower left-most icon of the screen

- Select “Deposits & Transfers”

- Type in the provided Cash App Account Number and Routing Numbers to set up direct deposit

Direct deposits are free for direct depositors when using a debit or bank account through the standard transfer method. Should the depositor use their credit card for the transfer, Cash App will charge an additional 3% fee on top of the deposit amount

5. Check if the deposit was successful

Once your depositor has sent the funds, you will receive the money within 1-5 business days, or instantly if they chose to pay an additional fee. Cash App will notify you once the balance is updated.

To check your balance, all you have to do is check your Cash App home screen. Once the amount has is reflected in your Cash App balance, you can now proceed to make your transactions.

How does direct deposit on Cash App work?

While Cash App is not a bank, it works with some banks to give Cash App users the benefit of traditional banking features. Cash App’s partnership with Lincoln Savings Bank allows Cash App to generate bank account and routing numbers for its users that are necessary for direct deposits.

To be able to direct deposit on Cash App, you must have the following things:

- A Cash App account

- A verified Cash App Card

- Your Cash App bank account number

- Your Cash App routing number

There are many benefits to using Cash App’s direct deposit feature. Besides being absolutely free, the payee will also get a notification when the money is deposited to the Cash App account directly. In 1 – 5 business days after the deposit, payees can make purchases, transfer the funds, invest in cryptocurrencies, and even withdraw using their Cash App card.

If you are still a little confused on how to go about verifying your Cash App account or how to get your bank and routing numbers, do not worry. Just follow the steps above.

Benefits of Direct Deposit Cash App

Direct adding salary into Cash App is the perfect solution to the related fuss. It not only saves your time but also reduces the effort. In fact, by direct depositing cash, you make withdrawal steady and safe.

Here are some major benefits of using this cash app feature;

[irp]Conclusion

Since 2013, Cash App has continually been innovating their products, and services. Offering the option to direct deposit is yet another way to enable their users to take control of their finances. Cash App is increasingly becoming the go-to app for people with needs the traditional banking just don’t fill.

With multiple ways to cash-in, several retail partners, the Cash App card, and more, there’s no doubt that they will be around to innovate the mobile wallet experience in the years to come.

Frequently Asked Questions

No. All Cash App accounts require a linked bank account, so it is impossible to receive a direct deposit on your Cash App without it.

Cash App has a partnership with Lincoln Savings bank that enables them to generate these account details for their users. While Cash App also has a partnership with Sutton Bank for its Cash App Card features.

Cash App’s direct deposit feature has end to end encryption, making the process safe, secure, and private. Unless given explicit permission, and access to your account, no one else will be able to check your balance and take your funds without your consent.

However, the Cash app is not FDIC-insured. If you accidentally send money to the wrong person or have had your account details compromised, there are no insurance claims.

For depositors, the Cash App direct deposit is instant. In 1-5 business days, the Cash App account should reflect the deposited amount.

No, the Cash App direct deposit is instant and non-refundable. However, you can request for a Cash App refund if there is any failure in payment.

Most direct deposits go through to the recipient bank account within 1-5 business days. Should it take longer than this time frame, please contact the Cash App customer service for further assistance.