A TurboTax card is a pre-paid debit card that you can get when filing your taxes. It’s a method through which government bodies choose to send out tax returns when they’re due. Getting one is pretty easy. You just have to select it when given the option. However, not everyone files their taxes in the same way. That’s why in this guide, we’re going to cover exactly how you can pick up a TurboTax card for yourself.

To get your own TurboTax card, you need to first sign up for the card. The card will be delivered within 10 working days. Once you have your card, activate it online. The IRS will deposit your funds on the card once your tax return has been approved.

While that might seem quite simple to some readers, not everyone is as savvy when filing their taxes. Next, we’re going to walk you through each step of this process so that you know exactly how to get a TurboTax debit card.

Step 1 – Sign up for a Card

You can sign up for a TurboTax debit card in two ways. The first is by visiting the official website, and the second is by calling the company behind them, Intuit, on 888-285-4169. Online, you’ll need to provide quite a lot of tax information. Since the card will be issued to the primary filer on the tax return, be sure to apply with your own tax return details. This will help the company verify your identity.

Once your identity has been verified, the card will be sent out to you in the mail. This can take between 5 and 10 working days to get to you. If you have been waiting for more than 10 working days, call the company and tell them that you are still waiting to receive your card. They may need to issue a new one.

Step 2 – Activate Your TurboTax Card

As with most cards, you need to activate your TurboTax card before you can use it. The key difference with this type of card is that there won’t be any money on it when it arrives. It’s better to activate it as soon as possible though. Otherwise, you might forget to.

There are two ways in which you can activate your card. If you prefer to do things over the phone, you can call the company on the number above. A staff member will take you through the process of verifying your identity. They will then activate your card as soon as they have done so.

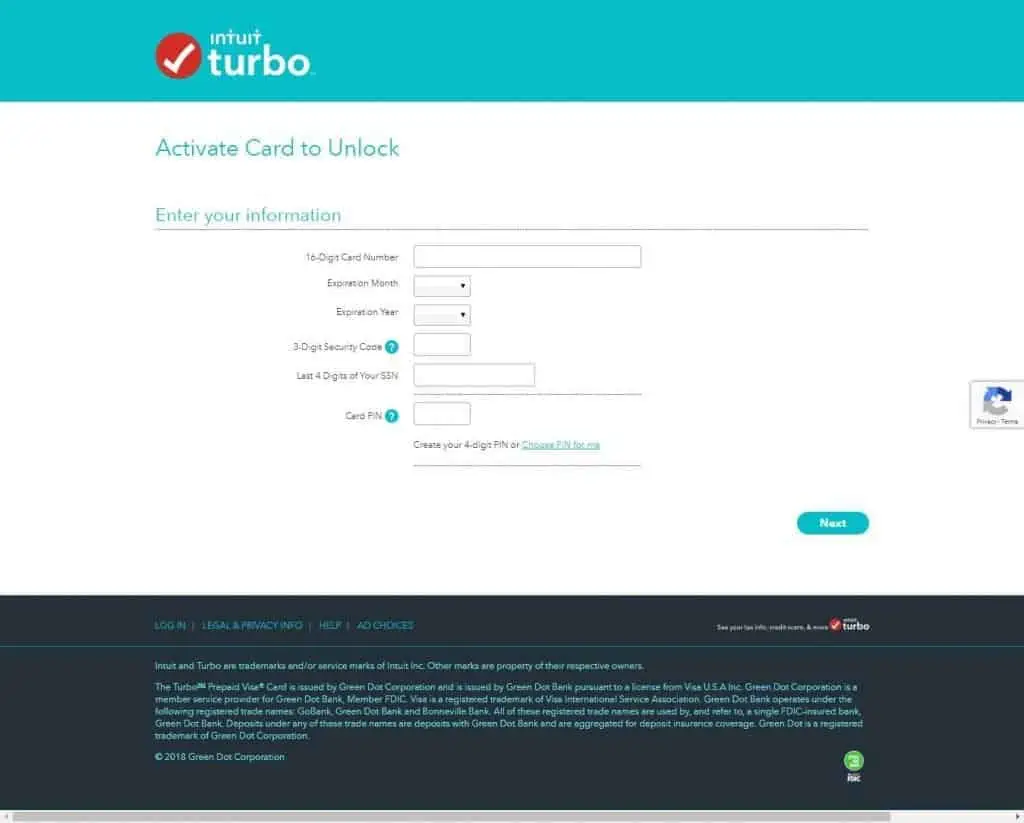

To activate your card online, all you need to do is to go to the official activation website. There is a button marked “Activate Card” which you need to click. You’ll then be taken through the short activation process.

For both activation avenues, you’ll need some personal details, such as your login information for TurboTax and your Social Security Number, and the details of the card itself. With this in mind, have your card with you while you are activating it.

Now that you have activated your card, all you need to do is wait.

Step 3 – Wait for Approval

After you’ve activated your card, you need to wait for the IRS to approve your tax return. They’ll then process the tax refund and apply it directly to your TurboTax debit card. This is why the name on your card must be the same as the one on your tax return. If it’s not, it could lead to delays in you getting your refund.

Conclusion

Getting a TurboTax card is easy. All you need to do is sign up on the official website. Even if you never get a tax refund sent to it, you’ll get a card in the mail. However, if you do have a tax refund issued by the IRS, then you’ll be able to access it easily and conveniently through your card.

If you’re experiencing issues with your TurboTax debit account, check out our guide on why that might be happening here.