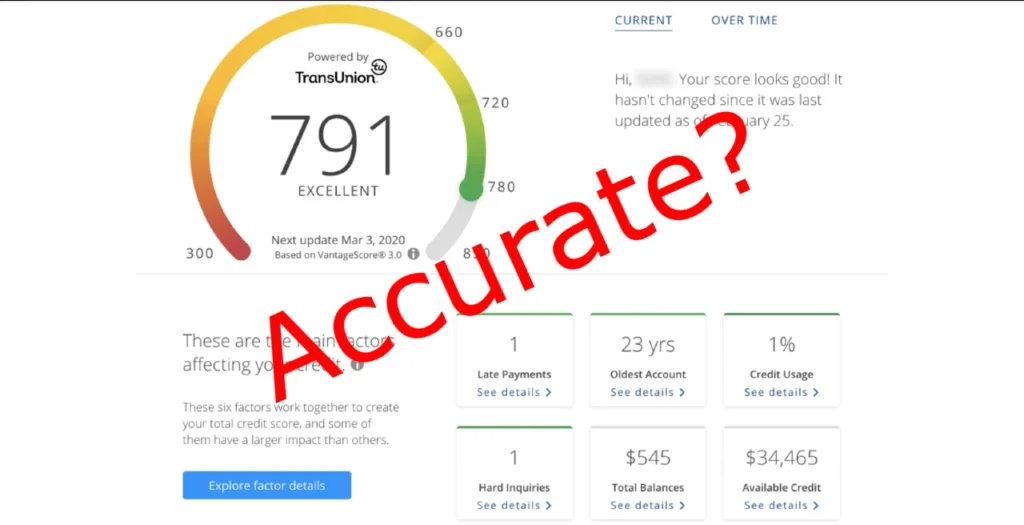

Checking your credit score is a great way to keep tabs on your financial health. Lenders will utilize this score to determine whether you are a responsible borrower and to issue approvals. Chase now offers credit scores to their members, but many people wonder whether the number they see is accurate. Can you trust it? Is Chase credit score accurate?

Chase uses the VantageScore 3.0 model, which is not the preferred score used by most lenders. However, it is often accurate and gives you good insight into your credit score. Some people report seeing errors in their credit report. Be sure to double check the report and file a dispute if necessary.

For more information on what you might see with the Chase credit score, here is everything you need to know.

What Credit Score Does Chase Use?

There are two major types of credit scores that lenders may use when considering an application. Most lenders use the FICO credit score model, but others use the VantageScore. When utilizing Chase Credit Journey, you will gain access to the VantageScore 3.0 which is the same model used by other free credit check sites like Credit Karma.

What is the difference between the two types of scores?

Both range from 300 to 850 with payment history being the most influential factor is determining your overall score. However, the actual categories used to determine these scores are a bit different. The categories are also weighted a bit differently.

In the FICO credit model, your score is determined based on:

- Payment history (35%)

- Amounts owed or credit utilization rate (30%)

- Length of credit history (15%)

- New credit (10%)

- Credit mixture (10%)

VantageScore does not give such a detailed breakdown. Instead, they are ranked by how influential each category is. Much like the FICO score, payment history is considered to be extremely influential. The rest of the categories are as follows:

- Type and duration of credit/credit utilization rate (highly influential)

- Total balances and debt (moderately influential)

- Available credit and recent inquiries (less influential)

Both scores are accurate and give a good indicator of your overall financial health. However, you can see that they may differ slightly from one another.

Because most lenders use the FICO model, you may not be seeing the same information that they see when you use Chase Credit Journey and your VantageScore. This doesn’t mean that you should ignore this data though. It can still be helpful for knowing where you stand and for understanding what you need to do to improve that number.

Is Chase Credit Score Accurate?

With the introduction of Chase Credit Journey, many people are suddenly alarmed to find that their credit score is lower than they thought. Sometimes, it registers too many late payments that are not actually on your credit report.

While the VantageScore model is considered to be accurate, you might find that Chase has some errors on the information they use to determine that score.

Chase used to use TransUnion for determining their credit score, but they have made the switch over to Experian. In the process, there has been some confusion from their users who are seeing different information that may not be accurate.

What do you do if you think that the information included in your Chase VantageScore is incorrect?

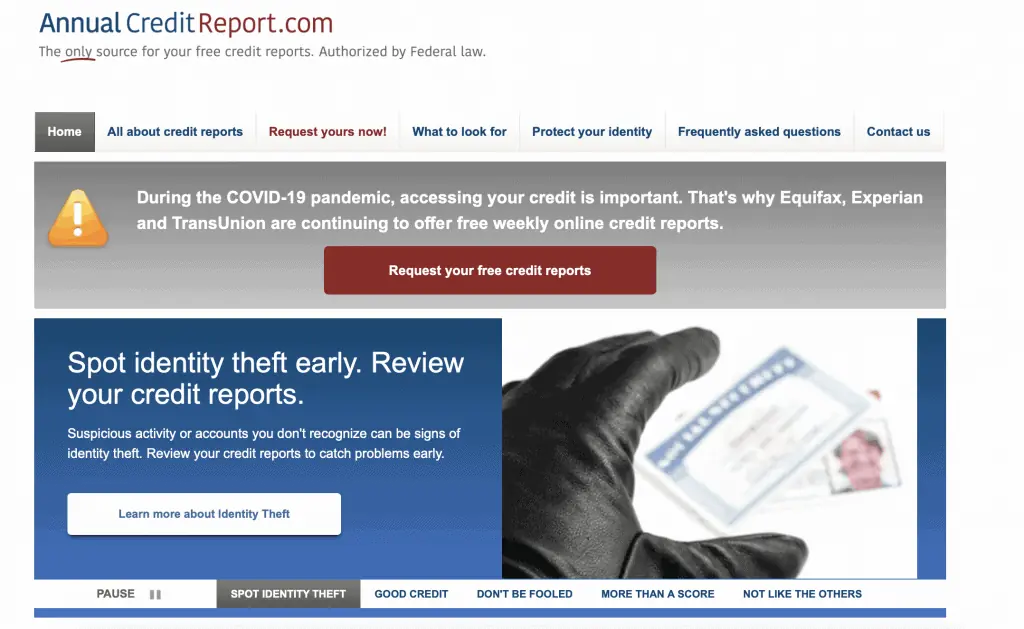

The best thing to do is to head straight to the source: your credit report. You are entitled to a free credit report from each of the three credit bureaus each year through the website AnnualCreditReport.com. Right now, the credit bureaus are offering weekly online credit reports for free due to the pandemic.

Be sure to look at the Experian report specifically, as this is the data used by Chase to determine your score.

Look for those late payments and errors that Chase is showing. Oftentimes, people find that it is a glitch in the Chase system and those late payments do not actually show up on their credit report. If you see that they are on your credit report but are inaccurate, you can file a dispute with the credit bureau to have them removed.

For more information on the Zelle weekly limit, you can see our complete guide here!

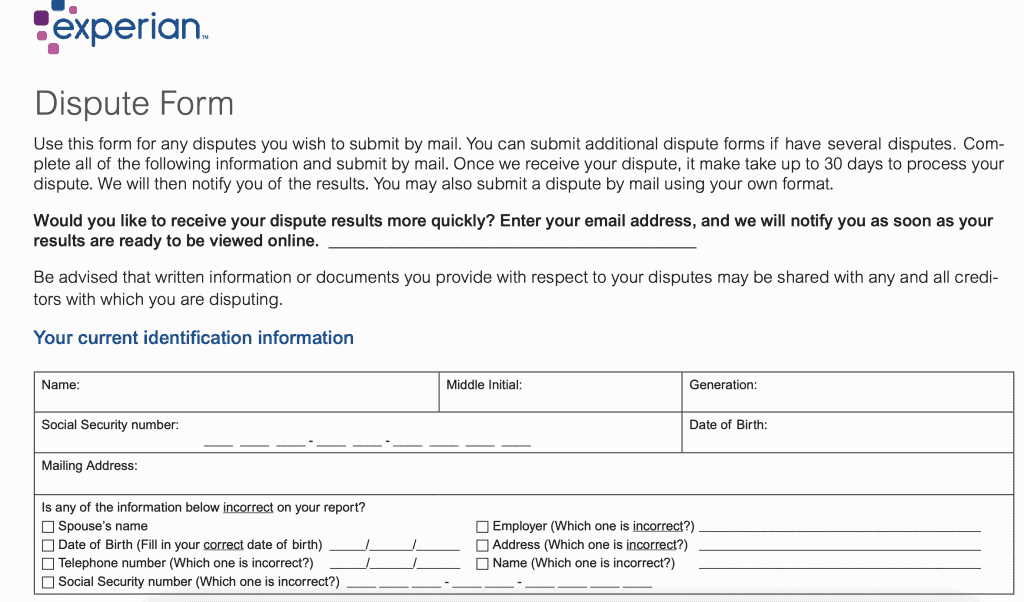

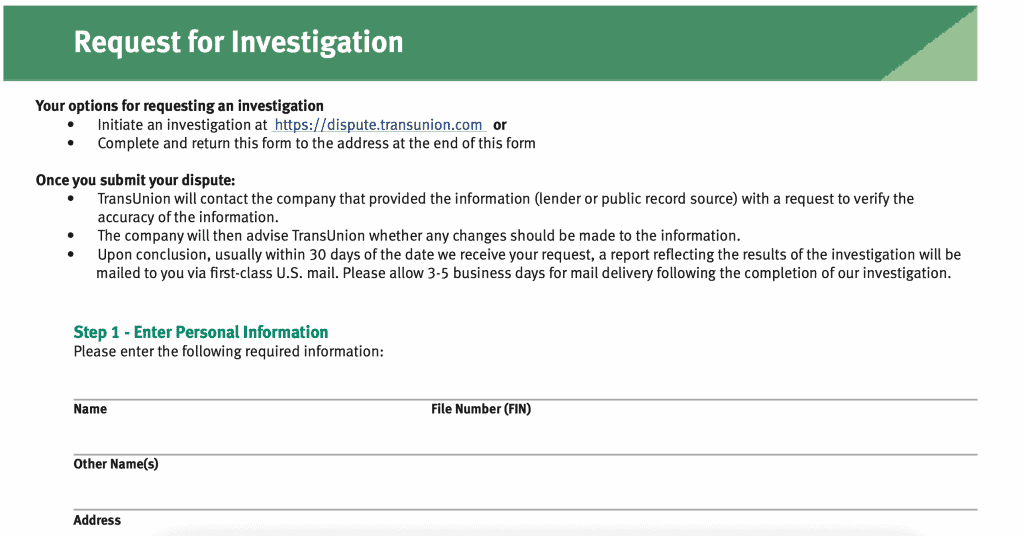

How to File a Dispute with the Credit Bureau

Is the data on your credit report not quite right? You need to get this corrected so that your credit score will show up accurately with lenders. It may take some time to get to the bottom of these errors, so start as soon as possible. Then, keep tabs on your Chase Credit Journey score to determine what impact those corrected errors made on your score.

The process for filing a dispute is relatively easy, but you will need the addresses of the three credit bureaus.

Start by writing a letter detailing the error that needs adjusted. You may also want to include their dispute form and any proof you have that supports your point. Here are the addresses and forms you will need to include based on which agency has the misinformation:

Mail your letter to Equifax at:

Equifax Information Services LLC

P.O. Box 740256

Atlanta, GA 30348

If you need to file a dispute with Experian, you will need their dispute form. Mail both the form and your letter to:

Experian

P.O. Box 4500

Allen, TX 75013

Much like Experian, you should mail your letter and dispute form to TransUnion at:

TransUnion LLC Consumer Dispute Center

P.O. Box 2000

Chester, PA 19016

When you send in this information, be sure to make a copy of it for your records. This way you have the exact information you sent in if you need to contact them about the issue again. Be sure to file it away somewhere safe.

Keep in mind that it can take some time to get these disputes updated on your credit report. It may take them thirty days or longer to review your dispute, and it may take a bit longer for any changes to be updated.

Is the Chase Credit Score Accurate?

The Chase credit score you see is based on the VantageScore 3.0 model, which is not the preferred method by most lenders. However, it is usually accurate and gives you good insight into your financial health. If you notice errors, compare them to your credit report and file a dispute if necessary. Don’t worry if you don’t see a difference in your Chase Credit Journey score right away. In most cases, the Chase credit score is accurate but it can take some time to be up to date.