Whether you are an investor or the CEO of a startup, understanding preference shares vs ordinary shares can make or break your bank. While not incredibly difficult to comprehend it’s worth taking the time to understand.

The key concept to understanding preference shares vs ordinary shares is that preference shares are usually taken on by investors. Ordinary shares are usually issued to company owners and employees. That’s because of the way the two shares liquidate differently.

Let’s give each of the shares a proper definition followed by some key similarities and differences. That way we can fully understand which does what and why.

What Are Shares?

Shares are a unit price of equity held in a company that an investor can buy. In theory, you own part of that company based on how many shares you have. If a company has success the stock will do well and the value of your shares will go up. This results in a profit on your investment.

There are two types of shares we will focus on are:

- Preference Shares

- Ordinary Shares

Preference shares:

Preferences shares are commonly referred to as preferred stock. These shares get paid out before common stock or ordinary shares. This includes if the company were to enter bankruptcy. In general, these shares are more liquid.

Ordinary shares:

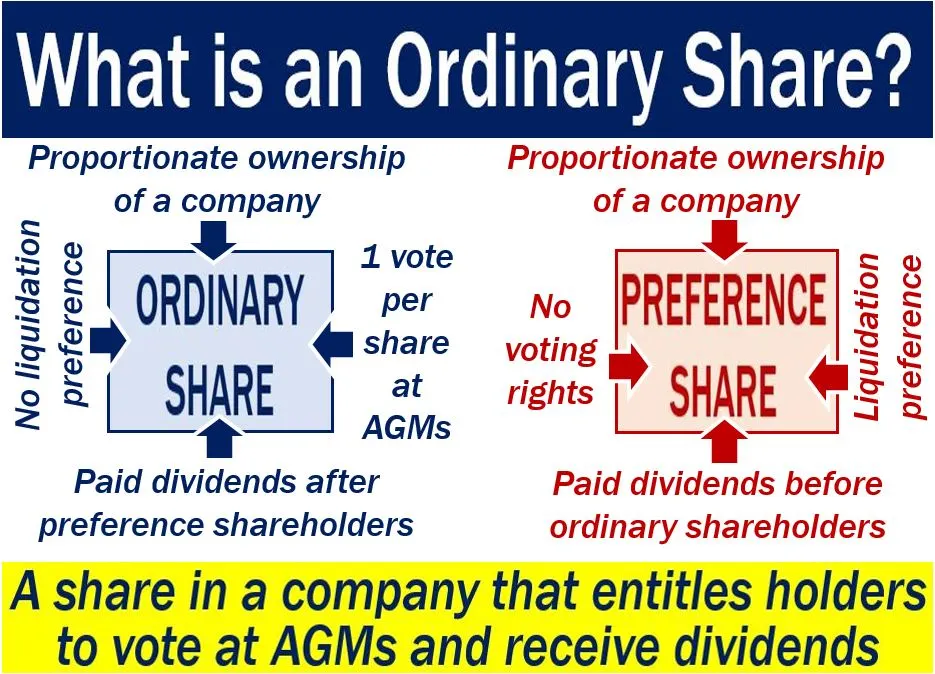

These shares are non-guaranteed dividends if the company were to go bankrupt. Often referred to as common shares, ordinary shares offer a vote in the company rather than a financial guarantee.

The definition in itself is the biggest difference between preference shares vs ordinary shares. We can break that down further.

Key Differences: Preference Shares vs Ordinary Shares

- The Ability to Vote

Preference shares do not give the shareholders the ability to vote on the companies policies or performance strategies. Ordinary shares allow for individuals to have a vote and a say in the direction that the company goes.

In short, preference shares invest in the company and will reap the benefits financially if the company does well. They also provide protection if it doesn’t. Preference shares however have no say on how the company should be run.

Ordinary shares are not protected if the company goes bankrupt with no dividends guaranteed, In turn, they have a vote and say on how the company is run. This gives them a little more insurance on performance and investment.

2) Value of the Dividends

The dividends values are significantly different between the two different types of shares. Preference shares guarantee a fixed percentage of the dividend. This is regardless of whether the company performs poorly or not. At the beginning of the investment, an agreement occurs on the rate.

Ordinary shares do not guarantee any rates and the income strictly has to do with business performance. This is why if a company outperforms and you have ordinary shares, the dividends will soar. If the company fails and goes bankrupt, you may not get anything back.

3) Share Issued Qualifications

Investors qualify for preference shares rather than employees. This allows a company to get financial backing without having to give up any of their voting. Ordinary shares are only issues to company employees/owners because it controls who has the basic voting rights.

Company members and employees also are likely to qualify for ordinary shares because it doesn’t put a cap limit on how much they can benefit from the companies success. These shares reflect the true equity of the company. When a company does well, those with ordinary shares will benefit more financially than preference shares.

The simplest way to understand who gets preference shares vs ordinary shares is more risk equals more reward.

Key Similarities: Preference Shares vs Ordinary Shares

While preference shares and ordinary shares allow a person to hold equity in a company, there aren’t many similarities. The way a shareholder benefits from one share to another is completely different as noted above.

Frustrated by your inability to transfer larger amounts of money? Check out our guide on how to increase your Zelle limits.

Differences Between Ordinary Shares and Debentures

Debentures and ordinary shares have a lot of contrasting qualities rather than similarities. Debentures like preference shares offer a fixed rate of interest.

Debenture however operates with the debt of the company rather than how a share operates on capital. For instance income on an ordinary share is are dividends. Debentures work with interest rather than dividends when it comes to income earned.

Debentures will naturally yield lower payments but have priority when it comes to liquidation. This is because corporations and governments issue these unsecured debt securities.

US Stocks

With the U.S. Stock Exchange, it is fair to say the vast majority of shares sold there are ordinary shares. This is because a preference share is a hybrid between a stock and a bond.

Regardless of whether it is a U.S. stock, a stock in the United Kingdom, or anywhere internationally, Public Limited Companies can offer a variety of stocks available for “purchase.”

This helps a company get funding for its operations to continue to grow. Outside of ordinary shares and preference shares, there are a lot of different options for employees and non-employees to look at.

Knowing Your Rights

It may not be up to you whether you obtain a preference or an ordinary share. When offered preference shares vs ordinary shares it’s important to understand the fundamental differences. That way you know what you are signing up for.

In the simplest terms, if you take on the risk of ordinary shares you stand to reap big benefits if the company does well. You also will have a say on how the company operates. If you want to go a safer route, a preference share will guarantee your dividends but yield less exciting results than ordinary shares.

Regardless, ordinary shares remain for company employees and owners. Preferred shares remain for investors. That is why knowing your role in the equation is key.