With dozens of e-Wallets that users have to manage every day, we are all scratching our heads when we try to keep track of them. If you’re looking for a way to transfer money from Venmo to Cash App, you’re not alone.

If you’re looking for a way to get your money from Venmo to Cash App, there are two ways: setting up a direct deposit for your Cash App account or using a bank account linked to both apps. Here’s a quick summary of the quickest and easiest way:

Easiest way to transfer money from Venmo to Cash App:

- Open your Cash App to get the Routing & Bank Account Numbers

Once you activate your Cash App card, you can access your routing and bank account numbers.

- Add Cash App Card As A Bank on Venmo

On Venmo, link your Cash App Card using the routing & bank account number from the Cash App.

- Send Money from Venmo to Cash App

After your Cash App Card is linked as a bank, you can transfer as normal to your Cash App card from your Venmo account.

The Two Ways to Transfer Money from Venmo to Cash App

If you are a Venmo user looking to Transfer Money to Cash App, you’re in luck. Transferring apps may seem like a hassle at first, but it’s do-able.

Option #1: Use a Bank Account That is Linked To Both Venmo & Cash App

Unlike Cash App, Venmo does not require connecting a bank account to send and receive money. You only need to be physically based in the US and have a US cellphone number. However, most people would like the option to both send and receive money from their bank account to Venmo.

If you don’t want the hassle of having to go through routing numbers and connecting another card or bank, there is another way. You can also route your money through your bank account.

1. Add A Bank Account To Your Venmo Account

If you want to avoid connecting so many apps to transfer money, you can opt to use a bank account linked to all of them. But before you can transfer to your bank account, you have to add it to your Venmo account first. Here’s how:

- Go to your Venmo App

- Tap the hamburger button “☰” on the top portion of the app to expand the menu

- Go to the “Settings” tab

- Tap “Payment Methods”

- Select “Add a Bank or Card”

- Choose “Bank”

- Type your Bank Routing & Account Numbers

- Choose your verification method

After adding your bank account, you can now proceed to transfer money to your Venmo App.

2. Transfer Your Venmo Balance To A Bank Account

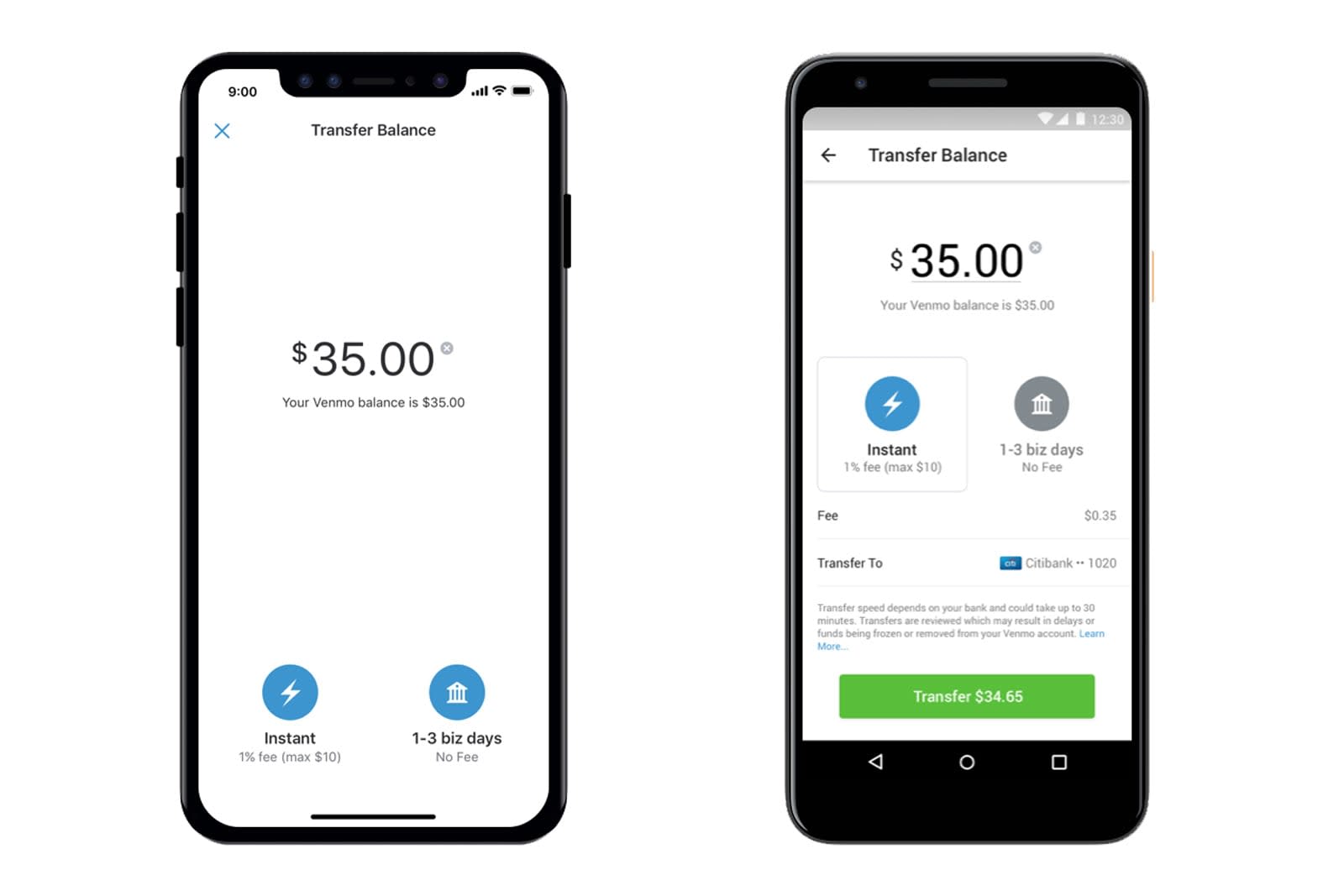

When transferring money from the Venmo account to your desired bank, you’ll have the two options. Either you pay a small fee if you want to get our money instantly, or free if you’re okay to wait.

To transfer money from Venmo to your bank account, here’s what you have to do:

- Go to your Venmo App

- Tap the hamburger button “☰” on the top portion of the app to expand the menu

- Select “Manage Balance” (some devices can skip this step)

- Tap “Transfer to Bank” or “Transfer Money”

- Key in how much you want to Transfer

- Choose whether you want the amount transferred instantly with minimal fees or wait 1-3 Business Days to transfer the money for free

- Select the bank linked to your Cash App

- Check if the transfer details shown are correct

- Press “Transfer” to confirm the transaction

Once the money from your Venmo reflects in your bank account, you can already transfer the money to your Cash App Account.

3. Optional: Add A Bank Account On Cash App

Part of the requirements to use Cash App is that users have to link their US-based bank account. Ideally, the bank account that you transfer money to from Venmo is the Cash App-linked bank account.

If you haven’t added your Cash App Bank yet, here is how to do it:

- Go to the Cash app home

- Tap on the “My Cash” tab found on the lower left-hand part of the screen

- Tap the “Add Bank” button

- Key in your bank routing and account numbers

- Validate your account

4. Transfer Money From A Bank Account to Cash App

To transfer the money from your bank to Cash App, you need to follow these easy steps:

- Go to the “My Cash” tab on your Cash App home screen

- Click “Add Cash”

- Choose the amount that you want to your Cash App Card

- Tap “Add”

- If you have more than one bank account, you may choose from which one to add cash

- Validate your transaction through Touch ID or PIN

Bear in mind that for the bank transfer method, you will have to pay additional fees to get money from your Venmo account to Cash App instantly. If not, you have to be willing to wait a couple of days. If you need to access your Venmo funds on Cash App faster with fewer transaction fees, there is another way.

Option #2: Transfer Money from Venmo to Cash App Through Direct Deposit

If you need to send money to a friend or family member who you don’t share a bank account with, there is another way. When Cash App users activate their Cash App Card, it can act like a bank account.

If you’re unsure how to get your routing numbers or set up your Venmo, then read on.

1. Find Your Cash App Account And Routing Numbers

Before you can send money to your Cash App account, you have to know your routing number.

To get your routing number, here is what you have to do:

- Go to your Cash App

- Tap on the $ sign to access the “My Cash” tab

- Select the “Cash” option with the dollar sign

- Go to the “Direct Deposit”

- Tap “Get Account Number”

- On the pop-up screen, tap “Enable Account”

- Under your account information, you will be able to see your routing number and account number.

2. Add Your Cash App Account As A Bank On Venmo

Then, you have to copy your routing and account numbers to your Venmo account. To do that, you have to do the following:

- Go to your Venmo App

- Tap the hamburger button “☰” on the top portion of the app to expand the menu

- Go to the “Settings” tab

- Tap “Payment Methods”

- Select “Add a Bank or Card”

- Choose “Bank”

- Type the Cash App Routing & Account Numbers

- Choose your verification method

3. Transfer to Cash App Card Using Venmo

If you’re in a rush and need your physical cash right away, there is another option. You can opt to withdraw your Venmo balance through your Cash App Card. Here is how to do it:

- Go to your Venmo App

- Tap the hamburger button “☰” on the top portion of the app to expand the menu

- Go to the “Settings” tab

- Select “Add a Bank or Card”

- Choose “Card”

- Key in your Cash App Card details or take a photo of your Cash App Card with your mobile phone camera

Once you have been able to add either your cash App Card or routing numbers to Venmo, you will be able to transfer money from your Venmo balance to your Cash App.

How Much Money Does Venmo Let You Transfer to Cash App?

While it’s not entirely required, it’s recommended to validate your identity on Venmo. All Venmo accounts that belong to people who do not validate their identity have a maximum transfer limit of $299.99 per week. This limit goes up to $2,999.99 per week upon validation.

4 Steps On How To Validate Your Identity On Venmo

To validate your identity, you can follow these three steps:

- Go to your Venmo App

- Tap the hamburger button “☰” on the top portion of the app to expand the menu

- Go to the “Settings” tab

- Select “Identity Verification”

The Venmo will then prompt you to provide the following information:

- Full Legal Name

- US Address

- Social Security Number

- Zip Code

- Birthday

When transferring money from Venmo to your linked back, unverified accounts have a limit of $999.99. For verified accounts, you will be allowed to transfer up to $19,999.99 per week.

Venmo Fees

Through these two methods, Venmo will not charge a fee when transferring your balance to your bank account if you opt to wait 1-3 Business Days.

Should you want to avail of the instant transfer option either towards your Bank or Cash App Account, Venmo will charge 1% per transaction with a minimum $0.25 transaction fee. The instant transfer can take up to half an hour to reflect.

Venmo Versus Cash App: What’s the Difference and why Transfer between them?

Venmo is one of the most popular peer-to-peer payment apps that leverage the social aspect of lending. By being able to share how much and for what you’re paying, Venmo helps build relationships through the process of loaning money digitally. You can also easily set up a Venmo account and transfer money even without validating your identity and linking a bank account.

In comparison, Cash App offers not only options to ways to send and receive money but also lets users buy and sell bitcoin. Cash App also requires that you link a US-based bank account before having any transaction on the app. Cash App also has a physical card that people can use to withdraw money at ATMs.

So, whether you are looking for a way to send money to friends who only have Cash App or want to withdraw physical money using your Cash App card, here is how you can do it:

Conclusion

From this, we know that transferring your money from Venmo to Cash App can either take a few minutes or a few days, depending on if you are willing to pay the instant transaction fees.