| Broker | XTB |

| Website | https://www.xtb.com/ |

| Created in | 2006 |

| Head Office | London |

| Phone number | +44 2036953085 |

| Type of support | Chat, Email, Phone |

| US customers accepted | No |

| Available instruments | Forex, Commodities, Index, Cryptos, Stocks, ETF |

| XTB Minimum deposit | $250.00 |

| Maximum leverage | 1:30 |

| Demo account | Yes |

| ECN Account | Yes |

| Deposit methods | Bank transfer, Credit card, PayPal, Skrill, WebMoney |

| XTB Regulation | FCA, CySec, KNF, IFSC |

| Mobile trading | Yes |

| Trading platforms | xStation 5, Metatrader 4 (MT4) |

| Scalping allowed | Yes |

| Hedging allowed | Yes |

Are you looking for a reliable broker to trade online safely and securely? In this article, I present you to XTB.

XTB is a Forex and CFD broker with which you can trade in Forex and other types of financial products through CFDs (equities, commodities, index, and cryptocurrencies). Founded in Poland in 2002, the broker offers its services in several countries around the world.

XTB has several branches and offices in 15 countries. They are regulated by top tiers European market regulators. The broker offers its clients access to global financial markets through their large numbers of CFDs. XTB offers training for beginners as well as a number of essential tools for technical analysis.

To trade on CFDs, XTB offers several platforms, including xStation 5, Metatrader 4 and their mobile platforms.

Is XTB regulated?

XTB is a broker regulated by several regulatory bodies, including the FCA in the United Kingdom, CySec in Cyprus, KNF in Poland and IFSC in Belize.

As you may already know, you should absolutely avoid unregulated Forex brokers. There are hundreds of them online. When you operate through an unregulated broker, you have no protection in the event of disputes.

XTB is one of the most secure CFD brokers. They are listed on the Warsaw Stock Exchange and regularly publish their income. XTB clients’ accounts are segregated, i.e. they separate their own funds from their clients’ funds. Therefore, if XTB goes bankrupt, your funds will still be available. At least, if you live in Europe.

Its European branches XTB Ltd, XTB Limited, and X-Trade Brokers Dom Maklerski SA offer protection of your funds ranging from €20,000 to €57,000 depending on the branch. However, their international branch XTB International Limited, regulated by IFSC, does not offer protection to its customers. Note, however, that there is nothing alarming, XTB remains a reliable broker for traders residing outside Europe.

Opening an XTB Account

The opening of a trading account at XTB is done through its official website. The procedure is fast and you can start trading after completing the KYC.

XTB makes it easy for you to open your account by setting up a fluid and intuitive platform. From the broker’s website, click on Create account. You will be redirected to a series of forms where you will be asked to fill in your personal data (last name, first name, emails, etc.).

While you are completing these forms, you will be asked to choose your trading platform (xStation 5 or Metatrader 4), as well as your account type.

You can mainly choose between the Pro account and the Standard account. Each one has its advantages and limitations.

- The Pro account is more suitable for active trading, so it’s the deal for scalpers and day traders.

- With its wider spreads, the Standard account is more swing trading oriented.

A free demo account will also allow you to test your strategies on the live market, with virtual funds and therefore without risk.

After checking your email, you will need to send your documents as identity verification. Like all financial institutions, XTB is required to verify your identity.

In some cases, the verification is done more quickly with the KYC software, Experian. After successful identity verification, you can fund your XTB trading account.

XTB Fees and Commissions

XTB’s fees and commissions are quite low and the broker does not charge inactivity fees. There is no withdrawal fee if you make a withdrawal request for more than $100.

On Forex, XTB has two fee models depending on your account type.

With the Standard account, the spread is rather wide, but you don’t pay any commission on your trades. For example, the EUR/USD currency pair may have a variable spread of around 1.3 pips on the standard account, while the same asset has an average spread of 0.3 pips for the Pro account.

The Pro account offers tighter spreads and therefore more advantageous. On the other hand, you pay a commission per traded lot which is €3.5. If the base currency of your account is the dollar or the pound sterling, this commission is $4 or £2.5 respectively.

If you are a professional trader with a significant monthly transaction volume, XTB offers a discount on your commissions.

The commission on equity and ETF CFDs depends on the size of your position. It is exactly 0.08%. However, the minimum commission for these assets is $8, in case your trade size is too small.

Deposit and withdrawals on XTB

The deposit methods available at XTB are bank transfers, credit or debit cards, PayPal and Skrill.

XTB does not charge deposit fees for bank transfers and card deposits. However, if you use online portfolios to fund your account, a 2% deposit fee applies to the transaction.

The minimum deposit varies depending on the country in which you reside. In the United Kingdom, it is £250, in France, there is no minimum amount required. However, in Spain, the minimum deposit is €1000. You will, therefore, need to contact XTB support to ask which minimum deposit is applicable to your country.

You can easily make the deposit from the dashboard of your XTB account.

Withdrawals can only be made by bank transfer. They are free if the amount is more than $100, €80 or £60. For smaller withdrawals, the fees are $20, €16, or £12 respectively. Bank withdrawals can take up to 3 business days.

Trading platforms

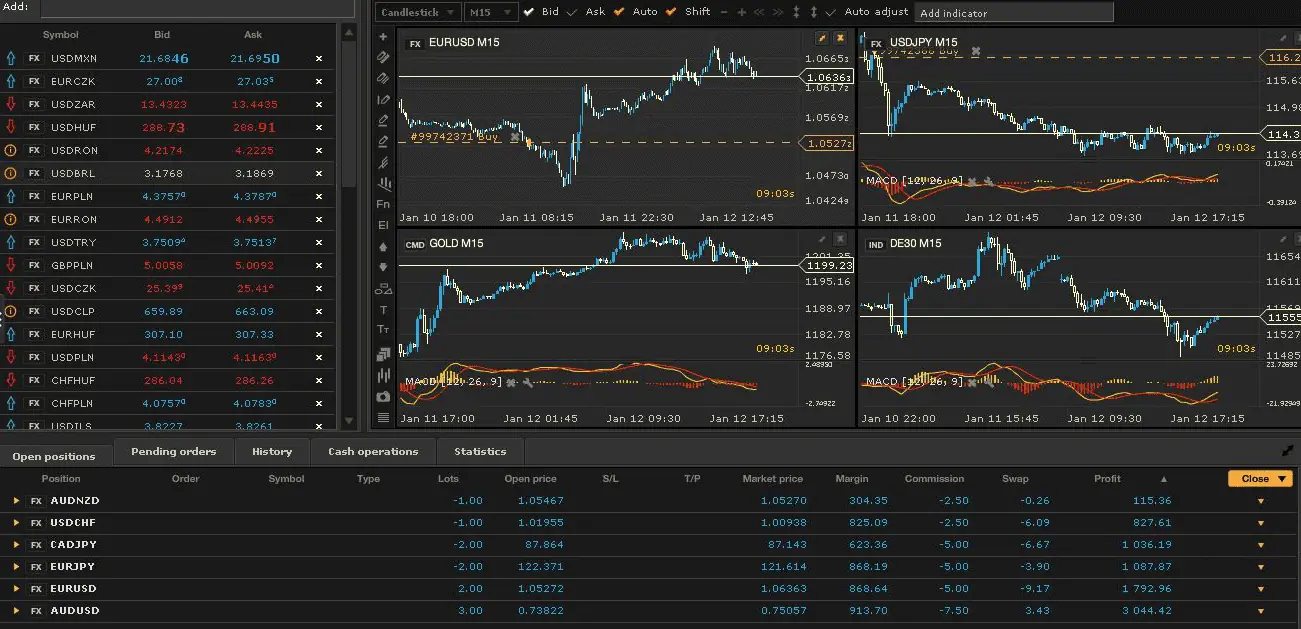

XTB has two main trading platforms: xStation 5 and Metatrader 4. xStation 5 has many practical market analysis tools. Metatrader makes it easy to automate your trading.

xStation 5 is XTB’s native platform, it is promoted by the broker and allows you to trade all the markets listed on XTB. Its main window allows you to conduct a technical analysis of the asset you are interested in.

To this end, xStation 5 integrates dozens of technical indicators as well as analysis tools such as Fibonacci lines and Gann Fan. You can also follow the financial news thanks to the platform’s news feed.

A section of xStation 5 is dedicated to the training of novice traders. You will find videos explaining the basic terms of online trading. xStation is available in more than 15 languages.

Metatrader 4 is the most popular platform in the industry. Its added value comes from the fact that it allows you to automate your trading strategies. There is indeed a large community of developers around this platform.

Available assets on XTB

Whether you are interested in cryptocurrencies, Forex, commodities or the stock market, you will always find your favorite asset on XTB.

- XTB offers the most popular cryptocurrencies through CFDs: Bitcoin, Dash, Bitcoin Cash, Cardano, Ripple, Ethereum, Stellar, Litecoin, and Ether Classic.

- There are nearly 50 Forex currency pairs on this platform: EUR/USD, GBP/USD, USD/CAD, AUD/USD, EUR/JPY, GBP/JPY, etc.

- More than 34 CFD indixes including DAX, CAC40, SP500, DOW, FTSE.

- Commodity CFDs: gold, silver, platinum, oil, gas, cotton, etc.

- CFD on shares: Facebook, Apple, Microsoft, Total, etc.

XTB now allows you to buy shares directly without going through CFDs. This offer concerns about twenty shares and is currently only available to European residents.

XTB Customer Support

The XTB support team can be reached by email, live chat, and phone support. They are available 24/7.

XTB has made the effort to translate its website into more than ten languages. Support is also available in several languages. I didn’t test the phone support. However, all my emails were answered in a few minutes.

The live chat on xStation 5 is also very responsive. Your questions will be answered in a few minutes and the agent will not hesitate to provide you with links to XTB website resources for more information.

I have noticed though that the chat on the main website is less responsive, but you still have the option to send them an email if no agent is available online. One tip: if you want a quick answer, I recommend you use the xStation 5 chat.

XTB Trading Academy

For beginners, XTB offers you a trading course. The training consists of articles and videos. At the end of each lesson, you have quizzes to evaluate your new knowledge.

The courses are structured by level and subject. Levels range from beginner to premium. However, the premium level requires you to open a live trading account. This level gives you access to more advanced resources. You will find the following topics: MT4 tutorials, xStation tutorials, introduction to CFDs, etc. Webinars are sometimes organized by XTB’s analyst team.

Conclusion

XTB has continuously improved the quality of their brokerage service. It is a broker who cares about customer satisfaction and provides them with training and a variety of market analysis tools.

With its offer of more than 1600 equity CFDs and 48 currency pairs, it is a broker that allows you to diversify widely your portfolio.

If you can’t find the information you were looking for on XTB, leave me a comment, I’ll make sure to answer you as soon as possible.