The best virtual credit cards are those that do not require a lot of effort to set up. They provide the convenience of ordering things online or in-store without having to bring your physical credit card. In this article, we’ll guide you towards the best possible virtual credit card for you in 2022.

The best virtual credit card in 2022:

- Divvy

- Netspend

- Stripe

- Revolut

- Privacy

- Citi Virtual Credit Card

- Emburse

- ePayService

- Eno Capital One Virtual Card

- Abine Blur Virtual Cards

Regardless, virtual credit cards are gaining popularity as you can use them to make payments online and in physical stores through smartphones or any device with access to the internet. They are safer than physical credit cards, and there is no need to worry about lost or stolen cards.

Certainly, the average credit card user is exposed to an increased risk of identity theft, financial fraud, or other kinds of data breaches. However, one way to protect yourself against these threats is through the use of virtual credit cards.

In contrast, virtual credit cards can be used as a replacement for physical cards, and they make it more difficult for thieves to obtain your information. A virtual credit card will look like an actual card with a 16-digit number and a 3-digit security code on the back.

What is a Virtual Credit Card?

Virtual credit cards are digitally active cards that give you all the features and accessibility as traditional credit cards do. However, with these cards, your details aren’t exposed. These cards allow you to spend money without carrying a physical credit card or cash. It is a safe and convenient way to pay for goods and services online without the need for a bank account.

Generally, many people are interested in finding the best virtual credit card with the most benefits and how to protect their identity from possible theft. For those looking to protect themselves from this risk, a virtual credit card may be a good solution.

Additionally, virtual credit cards work very similar to debit cards, meaning that you can’t use them for cash advances or balance transfers.

What are the best Virtual Credit Card Providers in 2022?

Certainly, the past few years have seen the rise of the best virtual credit card provider. These companies offer a process in which you can use them to make purchases online with a virtual credit card number, so all information stays private.

Essentially, this is an excellent way for individuals to shop without exposing their financial information or risk having their card lost or stolen at any time, but sifting through the various providers can be an exhausting process.

Our experts know that it can be challenging to decide which virtual card is right for you, so we’ve compiled a list of the best available options.

Here, we reviewed the ten best virtual credit cards. And each card has its pros and cons, but they all provide balance protection and zero liability.

1. Divvy

One of the best virtual credit cards on our list is Divvy. Undoubtedly, Divvy is a platform that helps you manage spending and expenses. Popularly known by its customers as “The spend management solution that gives you the credit you need and the software to manage it,” Divvy helps you distribute funds to multiple accounts, giving you the freedom to spend what you want at any given moment.

Unlike other apps, Divvy virtual cards come with no fees and can be created in minutes. The user-friendly interface makes it simple to organize your finances, so you know where to spend your money next.

In addition to Divvy’s great features, you can create unlimited virtual cards for an even more personalized experience, or just two for convenience. Divvy offers Virtual Credit card features, and their journey to the top of this list is hinged on a few unique features that make their virtual credit cards stand out.

Features

In today’s world of ever-increasing technology, convenience is critical. People are always looking for a way to control their lives and time without sacrificing the benefits of modern living. This is where Divvy comes into play with its free subscription virtual cards.

Pros

Cons

2. Netspend

Speaking of financial business, Netspend ranks number two on the chart. With Netspend, receiving money instantly from other sources becomes very flexible. Additionally, users get the chance to connect their accounts directly with e-commerce.

The biggest pro of Netspend is how it lets users link to Skrill and PayPal, which adds significant weight to the provider’s credibility. All you need to do is register yourself to generate your VCC, then make online/offline purchases for yourself.

Roy and Bertrand Sosa created the Netspend virtual credit card to give people a way to have a Visa-branded card without needing a physical card. Basically, Netspend works just like a regular credit card, with all the benefits of securely buying from anywhere in the world and anywhere Visa, MasterCard, American Express, or Discover are accepted.

Netspend also offers the option to load extra funds onto your virtual card if you need it for emergencies or just want additional spending power. Unfortunately, Netspend virtual credit cards are limited to USA residents alone.

Features

Pros

Cons

3. Stripe

As one of the best virtual credit card providers, Stripe has helped many companies quickly and easily establish themselves in today’s competitive market. However, as one of the big players in the industry, Stripe integrates the innovative virtual credit card feature into one of its many services.

Features include:

Stripe charges you $0.10 per virtual credit card. Which is kind of very affordable, yet most people may consider this a disadvantage.

Whether you intend to pay for a particular product or service once or multiple times, stripe offers you the opportunity to create single-use or multi-use cards.

Pros

Cons

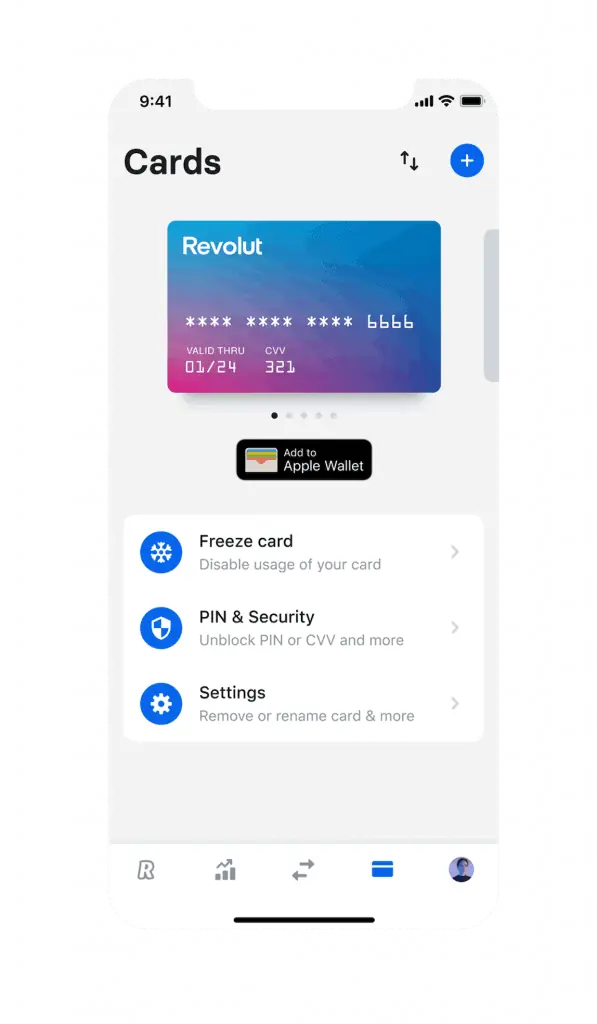

4. Revolut

Certainly, we can’t talk about the best virtual credit card providers in 2022 without Revolut making the chart. Revolut is a financial technology company that offers banking services, virtual credit cards, and Apple Pay.

Basically, they offer their customers the opportunity to convert currencies at the interbank rate, spend money abroad without paying fees or get access to their money on the go with an easy-to-use mobile app.

The company was established in the U.K. in July 2015 and now has operations in Europe, Asia, North America, and Australia. Revolut offers a virtual prepaid credit card that you can use online or in-store to make purchases.

Features include:

- Four plans for its users. Standard (Free), plus, Premium and metal.

- Access to 20 individual virtual credit cards

- Up to 200 subscription cards for paid plans

Furthermore, Revolut grants you access to generate up to 20 individual virtual cards and up to 200 subscription cards if you’re using a paid Revolut plan. Not only that, but they also offer two types of virtual credit cards for business account users;

- Personal virtual credit cards

- Subscription cards on a paid plan

However, Revolut’s pricing rates for its virtual credit card start from free to $16.99 monthly, depending on the chosen plan.

Pros

Cons

*Note: Plan pricing ranges from free to $16.99, and offers features may differ according to plan.

5. Privacy

Privacy.com made it to our list of best virtual credit cards in 2022. Ultimately, Privacy.com virtual credit cards are a new and innovative way for people to buy things online without giving their real personal information to the company they purchase from.

Though, the Privacy.com virtual credit card is a prepaid card that you can fund with any amount of money up to $5,000. Unfortunately, this service is only accessible to US residents. Even so, they still offer a lot of services and unique features on their virtual cards.

Features include:

This feature lets you set who can charge your cards, customize how much money to charge, and recurring payments.

Privacy.com offers three pricing plans that include:

- Personal (free)

- Pro (costs $10, which is billed monthly)

- Teams ($25 monthly)

Pros

Cons

6. Citi Virtual Credit Cards

Undoubtedly, our list of best virtual credit cards will not be complete without Citi virtual credit cards. Citi is one of the largest banking institutions in the United States. Citi’s virtual credit cards let customers with good credit and a checking account in the United States carry around a card on their phone rather than in their wallet.

To get a Citi virtual credit card, applicants must have a bank account with them. The application process is pretty simple, and the only significant advantage of applying for the card is that you can do it from anywhere.

*Note: This feature isn’t included across all Citi accounts.

Features

Pros

Cons

Unfortunately, Citi virtual cards’ pricing depends on the type of Citi card used; pricing may vary.

7. Emburse

Emburse is one such company that has developed e-commerce solutions for individuals and businesses by offering virtual credit cards for use on websites like iTunes, Amazon, and Walmart.

Certainly, their mission goes beyond providing customers with a means to make approved purchases with every expense syncing in real-time. Additionally, they offer a firm level of security across their entire system.

Features

Pros

Cons

8. ePayService

The ePayService made it to number eight on our list of the best virtual credit cards in 2022 overall. This provider allows you to handle automated and remote payments through its unique ePayService MasterCard.

With ePayService virtual cards, you can make quick and seamless cash transactions to anyone or any company with ease. Unlike other cards, ePayService virtual credit cards do not require credit checks or an annual fee. There are no restrictions on international transactions with the card.

However, this service is only available to residents of the United States with a valid social security number. ePayService provides two virtual credit card options for its users.

You can find more detail about the two options below;

Features

Single-use prepaid virtual credit cards

Multi-use prepaid virtual credit cards

- The daily purchase threshold is $5500

- Cards are issued for free

- ePayService multi-use prepaid virtual cards are valid for six months

Pros

Cons

9. Eno Capital One Virtual Card

The Capital One Virtual Credit Card is the perfect way for people interested in learning more about credit cards but don’t want to get one of their own. You can use the card anywhere Visa debit cards are accepted, and it is not linked to a physical card.

Even more, you can use it without worrying about where you left your card or if you’re spending too much money. Plus, the card doesn’t come with any fees as some credit cards do.

Capital One generates virtual credit card numbers through its integration of Eno service on their platform. To use the Capital One virtual card, you will have to install the Eno chrome extension to generate your desired card numbers for cash transactions.

Unfortunately, only certain users with a Capital One account can access the number generation feature.

- Stellar customization feature; lock/Unlock, or delete card numbers assigned to any vendor. Since a Capital One virtual credit is linked to your Capital One account, you are entitled to the many benefits of using a regular physical credit card.

- With the third-party Eno-Service associated with generating a virtual credit card number, your accounts are given an extra layer of protection. Every Capital One virtual card is unique to each vendor.

Features

Pros

Cons

10. Abine Blur Virtual Cards

The Blur virtual credit card service was created in 2012 by a team of Stanford students. The main goal of this project was to simplify the use of online purchasing while also preventing cyber fraud.

However, we can’t possibly end this list of best virtual credit cards without having Abine Blur on our list. This service is an example of the many apps that have emerged in recent years to help users buy products and services with increased security.

With Blur virtual cards, you can make secure everyday cash transactions. Additionally, Blur with Blur, you can quickly check out online purchases right from your phone. This feature makes data theft virtually impossible.

Features

Pros

Cons

How does a Virtual Credit Card work?

As earlier mentioned, virtual credit cards work the same way a physical debit card does. The only difference is that they’re entirely digital and temporary. A virtual credit card is an excellent option for people who want to protect their personal information and limit their credit card charges.

In fact, with a virtual credit card, you get an account number and card number that you can use without the need of linking it to your bank account or registering an actual card. Additionally, you can set up your account, so it runs each month automatically with the amount of money you want to spend and save yourself from having to keep track of balances and records.

However, most issued virtual credit cards may only be valid for a single transaction. This way, if someone were to steal your virtual card number, it would be invalid after serving its initial purpose.

What are the benefits of using Virtual Credit Cards?

Virtual credit cards can be a great way to protect your actual card and your personal information. With a virtual credit card, you can be more cautious of how you use your actual credit card.

Virtual credit cards are also beneficial because it is easy for people who are constantly traveling or forget their wallet at home to have an additional form of payment on hand.

As earlier mentioned, the benefit of having a virtual credit card cannot be overemphasized as it gives you the ability to use your actual credit cards for online transactions without sacrificing any personal information. This way, if your credit card information gets hacked or stolen, you don’t have to worry about fraudulent charges on an account that isn’t yours.

Additionally, some other benefits of a virtual credit card include:

However, it’s worthy to note that there are also monthly fees associated with some of these cards. So, it’s worth considering if they outweigh the convenience of carrying around a card in your wallet.

Of course, virtual credit cards are becoming more popular as people become more interested in using online shopping for their purchases.

FAQs

Final thoughts

As you can see, there are a lot of options for virtual credit cards. We are excited that our list has been able to help you find the best virtual credit cards for your needs. Overall, virtual credit cards can be a great way to protect your identity and credit score if you don’t want to use your actual card at some unknown website. The only downside is that many of these cards come with fees which can really add up.

However, with newer innovations bent on simplifying cash transactions, virtual credit cards are indeed the future. A close peek at the best virtual credit cards should give you an idea of what you should expect. Nevertheless, some of the most popular providers on the market are Divvy, Netspend, Stripe, Revolut, CitiBank Virtual Cards, and Privacy.com.

These cards offer different features and benefits to their consumers; however, we recommend Divvy as it has some of the best features and unlimited free access to some of its virtual cards.

Overall, there are many new and exciting ways to spend money without using your physical credit card, from paying for an Uber ride with Divvy to buying groceries on Amazon with Emburse and linking your VCC to PayPal with Netspend.