When it comes to being paid a salary in the United States, you should know a few things. The most important thing to understand is there are two ways employers can pay employees — paid hourly or salaried.

In most cases, workers will be hourly employees, meaning they get their income for the number of hours they work each week.

Salaried employees are paid a predetermined amount, regardless of their work hours. They’re usually essential personnel and make decent money. The average executive made just over $100,000 in the US in 2017.

There are some pros and cons to each method of payment, and it is important to understand the implication of each before you take a new job. Let’s get started.

What Does It Mean to Be a Salaried Employee?

A salaried employee is an individual who receives a set amount of gross pay each month, regardless of how many hours they work. Essential personnel, such as managers and executives, are usually the most likely to receive a salary.

While salaried employees may have the stability of a guaranteed income, they also typically have less flexibility than hourly workers. For instance, salaried employees can expect to work additional hours without overtime pay.

Salaried employees are entitled to the same employee benefits as other workers, such as paid vacation time, sick leave, and health insurance.

However, some employers may offer additional perks to attract and retain top talents, such as a company car or clothing allowance.

Unfortunately, many salaried managers work all of their time in the office. Those of you who enjoy working from home and collecting a paycheck while wearing pajamas, landing a salaried gig, and working from home will probably not happen.

How is Salary Paid in US – Calculated

An employee’s money is typically calculated based on several factors, including experience, education, skills, and position.

In most cases, employees receive an hourly wage or a yearly salary. Hourly wages are typically calculated based on the number of hours worked per week, while salaries are consistently paid out regularly.

Some employers may also offer bonuses or other incentives as an employee’s compensation package.

Employers usually take out the cost of benefits pre-tax, such as retirement account contributions. However, some costs, like insurance, may come out after taxes. Educating yourself is a good idea as it’ll significantly affect your take-home pay.

What’s the Difference Between Salary and Hourly Pay?

Most people are familiar with hourly pay, but salary is a different beast altogether.

For starters, salaried employees get a set amount regardless of how many hours they work, while hourly employees receive pay for the hours they work.

It can be a big advantage for salaried workers, who don’t have to worry about their income fluctuating based on the number of hours they work.

Salary also tends to be higher than hourly wages. But not always. For example, talented salespeople who receive commission can often make twice or even triple what their managers make in a year.

A Salaried Employee’s Definition and Examples

A salaried employee is paid a set amount of money each month, regardless of how many hours they work.

Salaried employees usually can’t earn overtime pay, which means they do not receive additional compensation for working more than 40 hours a week. However, some exceptions exist, such as if an employee is required to work weekends or holidays.

Example 1: You are an executive. It doesn’t matter how many hours your team has to work on a project. You will probably come in at 9 AM and leave whenever you feel like it. You take lunch at your convenience. This position pays a high salary. You are a decision-maker and a delegator.

Example 2: You’re a manager at a department store. You have several regular employees. Some are part-time, some are full-time, and some are seasonal. You’re the one ultimately responsible for the success of the store. So you work extra hours to prepare for sales and when your workforce requests off for holidays and vacations.

The regular employees take off whenever they want, but they’re probably stuck working minimum wage and have no chance for promotion.

The Benefits and Drawbacks of Working as a Salaried Employee

There are some advantages and disadvantages of being a salaried employee.

Conversely, a salaried position typically earns more money than their hourly wage counterparts. They also tend to receive more employee benefits, such as health insurance and paid time off. Salaried workers often have more job security than hourly workers. It’s pretty rare for companies to lay off executives.

On the downside, salaried employees may work longer hours than their hourly counterparts and won’t receive overtime pay. They may also have less flexibility when taking time off, even though they have more vacation time on paper.

So, is being a salaried employee right for you? That depends on your circumstances and preferences.

A salaried position may be a good fit if you value job security and a higher income. If you prefer more flexible hours and the ability to take time off when you want, then an hourly job may be a better option.

What Is a Salary Range and How Does It Work?

A salary range is a minimum and maximum amount of money a company is willing to pay an employee for their services. The salary range is typically based on the employee’s experience, skills, and education.

For example, a company may have a salary range of $50,000 to $75,000 for a particular position.

The salary range considers several factors, such as the cost of living in a particular area. For instance, a company may have a salary range of $60,000 to $80,000 for a position in New York City but a salary range of $40,000 to $60,000 for the same job in a small town.

When an employer determines the salary range for a position, they will typically look at comparable positions at other companies. They will also consider the skills and experience required for the job and the company’s budget.

Once the employer has determined the salary range for a position, they will typically advertise the job using that range. When candidates apply for the job, the hiring manager will ask the interviewee to provide their salary requirements. The employer will then decide if the candidate’s salary requirements are within the salary range for the position.

What Is the Process for Converting Annual Salary to Weekly and Monthly Pay?

Converting annual salary to weekly and monthly payments is relatively simple.

To calculate weekly pay, divide the annual salary by 52. For example, if the annual salary is $50,000, the weekly wage would be $961.54.

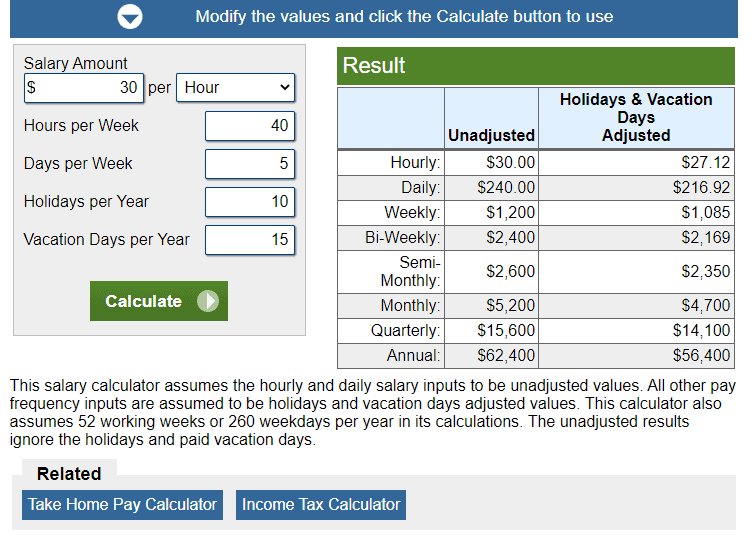

To calculate monthly pay, divide the annual salary by 12. For example, if the annual salary is $50,000, the monthly income would be $4,167. Here’s a basic salary calculator.

Retirement, taxes, and insurance will have a sizeable impact on the net pay.

Exempt vs. Non-Exempt Employees’ Income Tax

When an employer is calculating tax withholding for an employee, they will first need to determine if the employee is exempt or non-exempt.

Exempt means they are not subject to income tax withholding. The employer does not withhold any taxes from their paycheck. Non-exempt employees, on the other hand, are subject to this kind of tax withholding. The employer withholds taxes from their paycheck.

The amount of taxes withheld from a non-exempt employee’s paycheck will depend on several factors, such as their filing status and the number of allowances they claim.

The employer will use a withholding calculator to calculate income tax withholding for a non-exempt employee. The withholding calculator will consider the employee’s filing status and the number of allowances they claim.

The amount of taxes withheld from an exempt employee’s paycheck will also depend on their filing status. For example, if an exempt employee is married and files a joint return, their income tax withholding will be less than if they were single and filed a separate return.

The amount of taxes withheld from an exempt employee’s paycheck will also depend on the number of allowances they claim.

Exempt and Non-Exempt Employees’ Unemployment Benefits

Exempt employees are not eligible for unemployment benefits. They are not considered to be unemployed. Non-exempt employees, on the other hand, are eligible for unemployment benefits.

To receive unemployment benefits, a non-exempt employee must have lost their job through no fault. They must also meet the eligibility requirements of their state’s unemployment medical insurance program.

Each state has its unemployment insurance program. The eligibility requirements for each program vary.

What Factors Go Into Determining a Job’s Salary?

Many factors go into determining a job’s salary.

Some of the most important are the following:

- The type of industry

- The size of the company

- The geographic location

- The experience level of the employee

- The education level of the employee

- The skills of the employee

- The number of expected work hours

- The number of vacation days

- The type of benefits package

- The cost of living in the area

All of these factors will play a role in determining how much money an employee receives.

For example, a surgeon is likely to have higher pay than an employee who works in the retail industry. The medical industry is generally considered more demanding and requires a higher level of skill.

An employee who works for a large company is also likely to be paid more than an employee who works for a small company. Large companies can afford to pay their employees more than small companies.

Is Working as an Exempt or Non-Exempt Employee Better?

There is no right or wrong answer to this question. It depends on the individual’s preferences and needs.

Some people prefer to work as exempt employees because they like the stability of a set salary. Others prefer to work as non-exempt employees because they want the flexibility of being paid hourly.

Paying Hourly Workers: State Requirements

Some states have laws that require employers to pay their hourly employees overtime. In these states, employers must pay their hourly employees time and a half for any hours worked over 40 in a week.

Other states do not have laws requiring employers to pay their hourly employees overtime. In these states, employers only pay their hourly employees their regular rate for all hours worked.

There is also the issue of minimum wage. There is a federal standard, but states have the right to require businesses to pay a higher minimum wage. As an example, California has a minimum wage of $15 per hour.

You should take some time to educate yourself about a state’s labor laws before accepting a new position.

FAQ

The main difference between exempt and non-exempt employees is that exempt employees are not eligible for overtime pay, while non-exempt employees are. Exempt employees are also not eligible for unemployment benefits.

The best way to convert a salary to hourly pay is to divide the annual pay by the number of hours worked in a week. For example, if an employee is paid a salary of $52,000 per year and works 40 hours per week, their hourly pay would be $26 per hour.

You should not include vacation or sick time when calculating an hourly rate. Vacation and sick time are typically paid separately from regular wages.